Buy Signal for Gold Investors

This week, both the $HUI and $XAU's weekly charts have confirmed a major buy signal. In consideration of investors both sides of the border within our membership who are committed in mutual funds within their pension plans, IRAs and RRSPs, these major buy signals provide ideal timing to switch some or all of your funds to the precious metals sector, or adding new money to these funds for the 2006 taxation year.

The indices

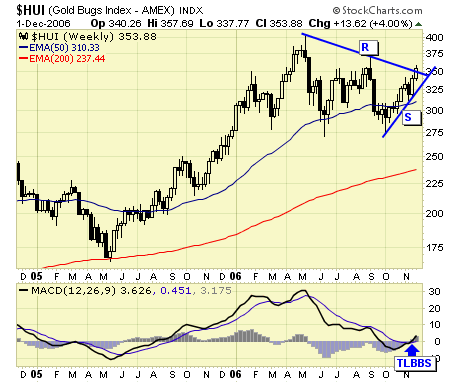

$HUI - a weekly TLBBS is confirmed this week.

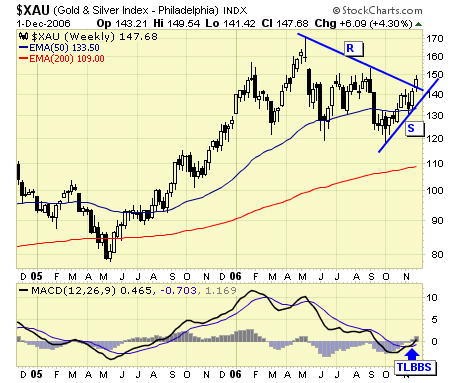

$XAU - a weekly TLBBS is also confirmed this week.

Funds we are familiar with

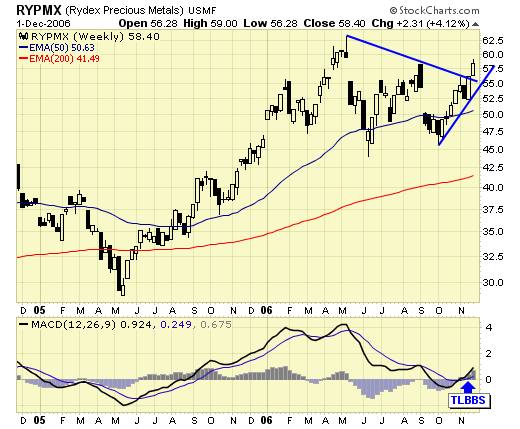

RYPMX - Rydex precious metals has a confirmed weekly TLBBS. TL support is at 55, buying at current price is risking 6%, acceptable for long term investors.

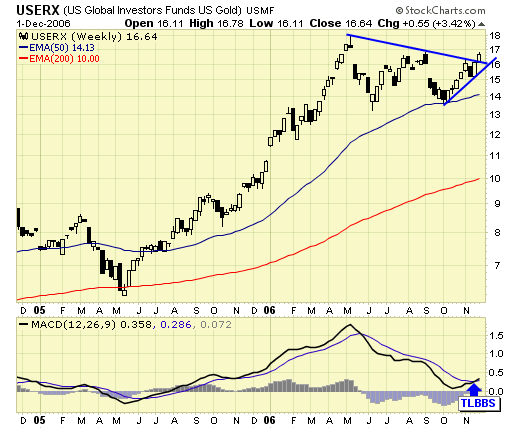

USERX - confirmed weekly TLBBS this week also. TL support is just below 16, buying at current price is risking under 6%, acceptable for long term investors.

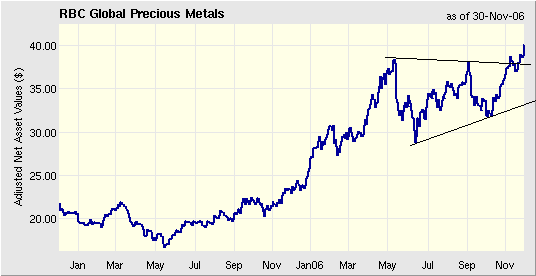

RBF468 - It has broken out from the six month consolidation with no overhead resistance. Investors can use a 6% stop to buy this fund.

The RBC precious metals is probably the best performing fund in Canada, period. Despite its awesome performance, this public bank fund is little known to the average Canadian investor, simply because it is a no load, public bank fund which brokers do not recommend for obvious reasons. John Embry was at the helm before leaving for Sprott asset management, but the legacy lives on and so is the performance.

Summary

For the benefits of our loyal subscribers, we will track the progress of these major buy signals and the funds' performance in our weekend updates. Traders are currently 70% invested and perhaps should consider allocating some or all of the remaining 30% cash into these long term positions. A detailed buy program and recommendation is in this weekend's gold update, and in our "trader's log" at member's website.

********

Disclaimer: I am not a certified investment advisor, and I have no affiliations with any of the mentioned investment funds. Investing has risks and you should seek professional advice before buying or selling anything.