Gold $2800…Fiction Or Fact

In the gold market, there may be a “perfect storm” of bullish fundamental forces converging now. First, gold jewellery companies in China are reporting phenomenal increases of 15% - 50% in sales, for the Chinese New Year buying season.

Late in 2013, many bank economists lined up to claim that the 1000 tons of gold demand that occurred in China in 2013 was a onetime event, unlikely to be repeated in 2014. It’s still early in the year, but there’s no question that Chinese citizens are buying gold jewellery aggressively. Do the bank “econs” now have a little egg on their faces? I think so, and that egg is golden.

For gold investors and gold dealers alike, the 2014 calendar year is clearly off to a fabulous start.

Janet Yellen, who I’ve labelled a “gold bull shark”, makes a key speech before congress today, and again on Thursday. Dr. Yellen is rumoured to be seriously concerned about the low official inflation rate.

If she raises those concerns in her speech to congress, it could cause an institutional stampede into gold stocks.

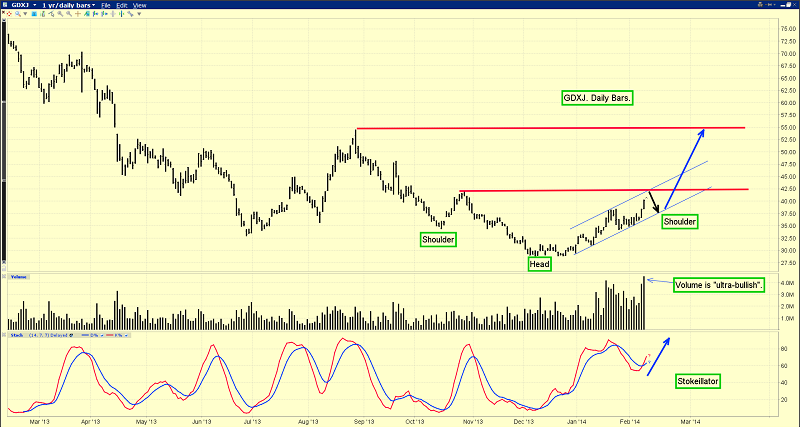

Arguably, that stampede is already underway. The huge volume on this key daily GDXJ chart is what I would call “ultra-bullish”.

Note the position of my stokeillator (14,7,7 Stochastics series), at the bottom of the chart. Buy signals that occur near the 50 or 60 area tend to be momentum-oriented. Powerful moves to the upside often follow these types of buy signals.

There is also a bullish inverse head and shoulders bottom pattern in play, with a $55 upside target.

Since the year started, junior gold stocks have outperformed all market sectors. They have risen on days when bullion has fallen, and when the Dow has fallen.

Volume must be respected, and no other market shows the bullish volume that is clearly apparent on a myriad of junior gold stock charts.

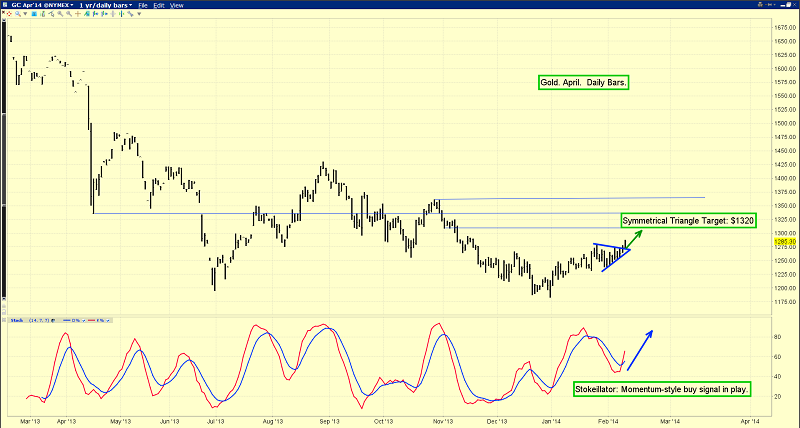

That’s the hourly bars gold chart. There’s a bullish symmetrical triangle breakout in play, with an upside target of about $1320.

The daily chart looks equally bullish. Note the beautiful stokeillator buy signal in play.

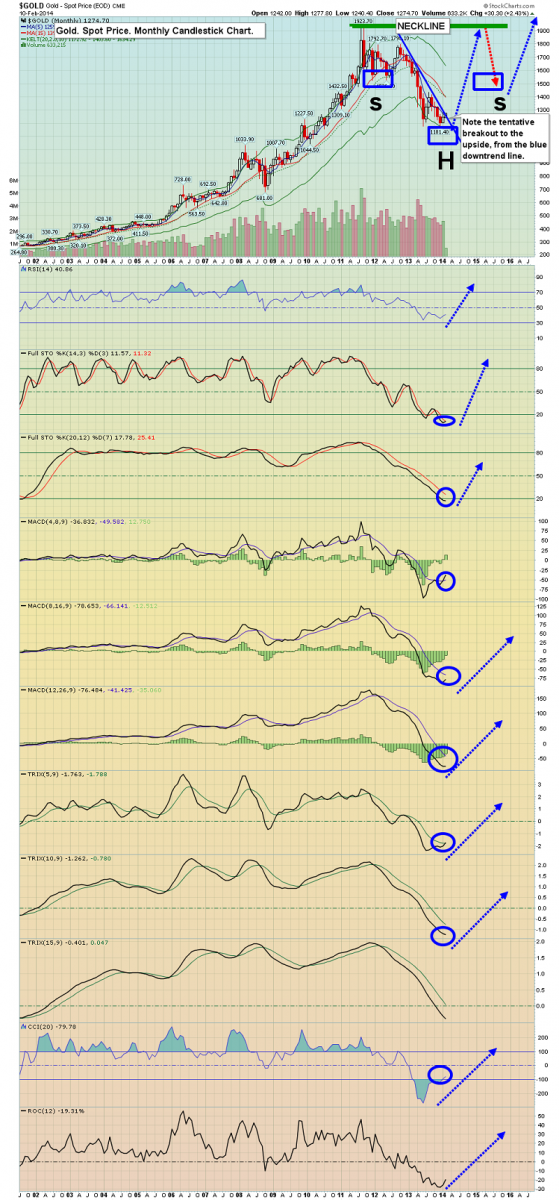

The monthly chart suggests that the current rally in gold may be just starting. If you look closely, you can see that gold has staged a tentative breakout to the upside, from the thin blue downtrend line that I’ve marked on the chart.

Many senior bank technicians have stated they would turn bullish on gold if it rose above that line to trade above $1278, and it just did that.

While most of the indicators and oscillators look good, I’m particularly impressed with the action of the 4,8,9 series MACD.

Also, there’s a potentially enormous head and shoulders bull continuation pattern forming on that monthly chart. The technical target is about $2800.

While a move to $2800 may seem unlikely, more fiction than fact, fundamentally-oriented investors should remember that the entire nation of India is essentially in “handcuffs”. Narendra Modi is the front runner in national election polls. This man has been weighed in silver, a ceremony reserved for Hindu priests. He’s publically stated that he doesn’t want to stifle the goldsmith industry. He wants to develop it.

If Modi gets elected, pent-up Indian demand could swamp supply, and create a temporary “super-spike” in the gold price. Smuggling is also beginning to rise there, and if Modi doesn’t win the election, the amount of smuggled gold going into India could increase dramatically. I feel it could rise by hundreds of percent above the (estimated) 15 tons a month being smuggled into India now. That’s because most Indian gold demand is based on religion, making it essentially inelastic.

Also, Shinzo Abe and Haruhiko Kuroda are promoting a QE program in Japan that dwarfs American QE, and Japanese inflation has already started to rise because of it. Japan is the world’s third largest economy. Inflation there will be exported around the world, probably fuelling significant institutional buying of gold and gold stocks.

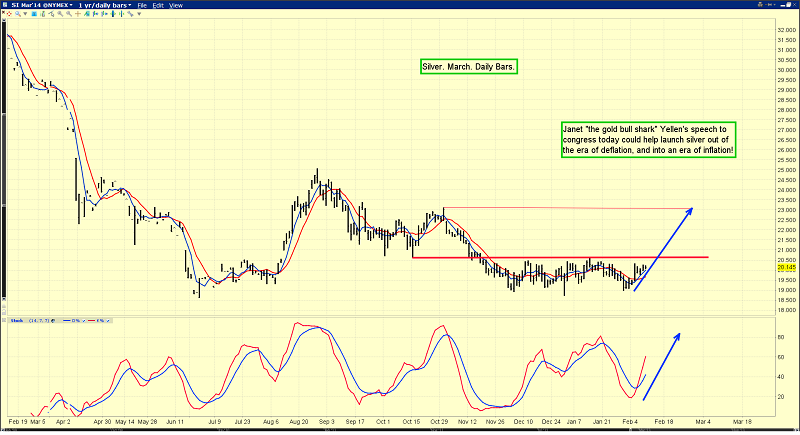

I know that many investors in the Western gold community also love silver. It hasn’t really shown much upside action in 2014, but I think that’s about to change.

The $20.60 area has limited the upside action recently, but a move above there is likely to attract significant hedge fund buying. Also, Janet Yellen’s speech could be a “game changer”.

Ever since the Western super-crisis began in the year 2000, American citizens have been living under a cloud of almost perpetual asset destruction. Late in the fall of 2013, I forecast that a “QE taper caper” would occur, and it would shock the gold community by being bullish for gold stocks. Now I’m forecasting that the era of deflation is going to be officially ended by Dr. Yellen’s speeches.

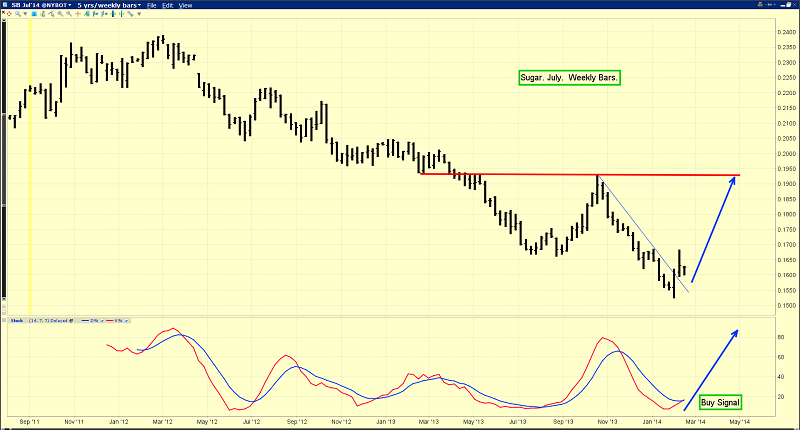

Along with the yen, I use sugar as a key leading indicator for silver prices. Look at the buy signal being flashed by my stokeillator now, on this key weekly sugar chart.

Institutional money managers who can flock to gold stocks are far more interested in the inflation rate than they are in the size of the money supply. A significant rise in food price inflation is being forecast by that sugar chart right now. Is the Western gold community ready, for Dr. Yellen to potentially usher in the return of inflation, and a new gold bull era? I hope so!

********

Special Offer For Gold-Eagle Readers: Please send me an Email to [email protected] and I’ll send you my free “Junior Silver Monsters!” report. I’ll highlight three silver stocks that have monster-size NI 43-101 proven and probable reserves. If Dr. Yellen really ushers in a new gold bull era, these stocks could experience phenomenal capital gains. I’ll show you where to buy and sell, to maximize those gains!

Stewart Thomson

Graceland Updates

Note: We are privacy oriented. We accept cheques. And credit cards thru PayPal only on our website. For your protection. We don’t see your credit card information. Only PayPal does. They pay us. Minus their fee. PayPal is a highly reputable company. Owned by Ebay. With about 160 million accounts worldwide.

Email: [email protected]

Rate Sheet (us funds):

Lifetime: $799

2yr: $269 (over 500 issues)

1yr: $169 (over 250 issues)

6 mths: $99 (over 125 issues)

To pay by cheque, make cheque payable to “Stewart Thomson”

Mail to:

Stewart Thomson / 1276 Lakeview Drive / Oakville, Ontario L6H 2M8 Canada

Stewart Thomson is a retired Merrill Lynch broker. Stewart writes the Graceland Updates daily between 4am-7am. They are sent out around 8am-9am. The newsletter is attractively priced and the format is a unique numbered point form. Giving clarity of each point and saving valuable reading time.

Risks, Disclaimers, Legal

Stewart Thomson is no longer an investment advisor. The information provided by Stewart and Graceland Updates is for general information purposes only. Before taking any action on any investment, it is imperative that you consult with multiple properly licensed, experienced and qualified investment advisors and get numerous opinions before taking any action. Your minimum risk on any investment in the world is: 100% loss of all your money. You may be taking or preparing to take leveraged positions in investments and not know it, exposing yourself to unlimited risks. This is highly concerning if you are an investor in any derivatives products. There is an approx $700 trillion OTC Derivatives Iceberg with a tiny portion written off officially. The bottom line:

Are You Prepared?

Stewart Thomson is president of Graceland Investment Management (Cayman) Ltd. Stewart was a very good English literature student, which helped him develop a unique way of communicating his investment ideas. He developed the “PGEN”, which is a unique capital allocation program. It is designed to allow investors of any size to mimic the action of the banks. Stewart owns GU Trader, which is a unique gold futures/ETF trading service, which closes out all trades by 5pm each day. High net worth individuals around the world follow Stewart on a daily basis. Website:

Stewart Thomson is president of Graceland Investment Management (Cayman) Ltd. Stewart was a very good English literature student, which helped him develop a unique way of communicating his investment ideas. He developed the “PGEN”, which is a unique capital allocation program. It is designed to allow investors of any size to mimic the action of the banks. Stewart owns GU Trader, which is a unique gold futures/ETF trading service, which closes out all trades by 5pm each day. High net worth individuals around the world follow Stewart on a daily basis. Website: