Gold Forecast: Time For A Top And Then Another Drop

In this updated gold price forecast, we will look at short, intermediate and long-term gold price targets. I also have a silver price forecast explaining the possibilities of a $300 price target for silver and how I plan to turn potential profits into lasting wealth.

In this updated gold price forecast, we will look at short, intermediate and long-term gold price targets. I also have a silver price forecast explaining the possibilities of a $300 price target for silver and how I plan to turn potential profits into lasting wealth.

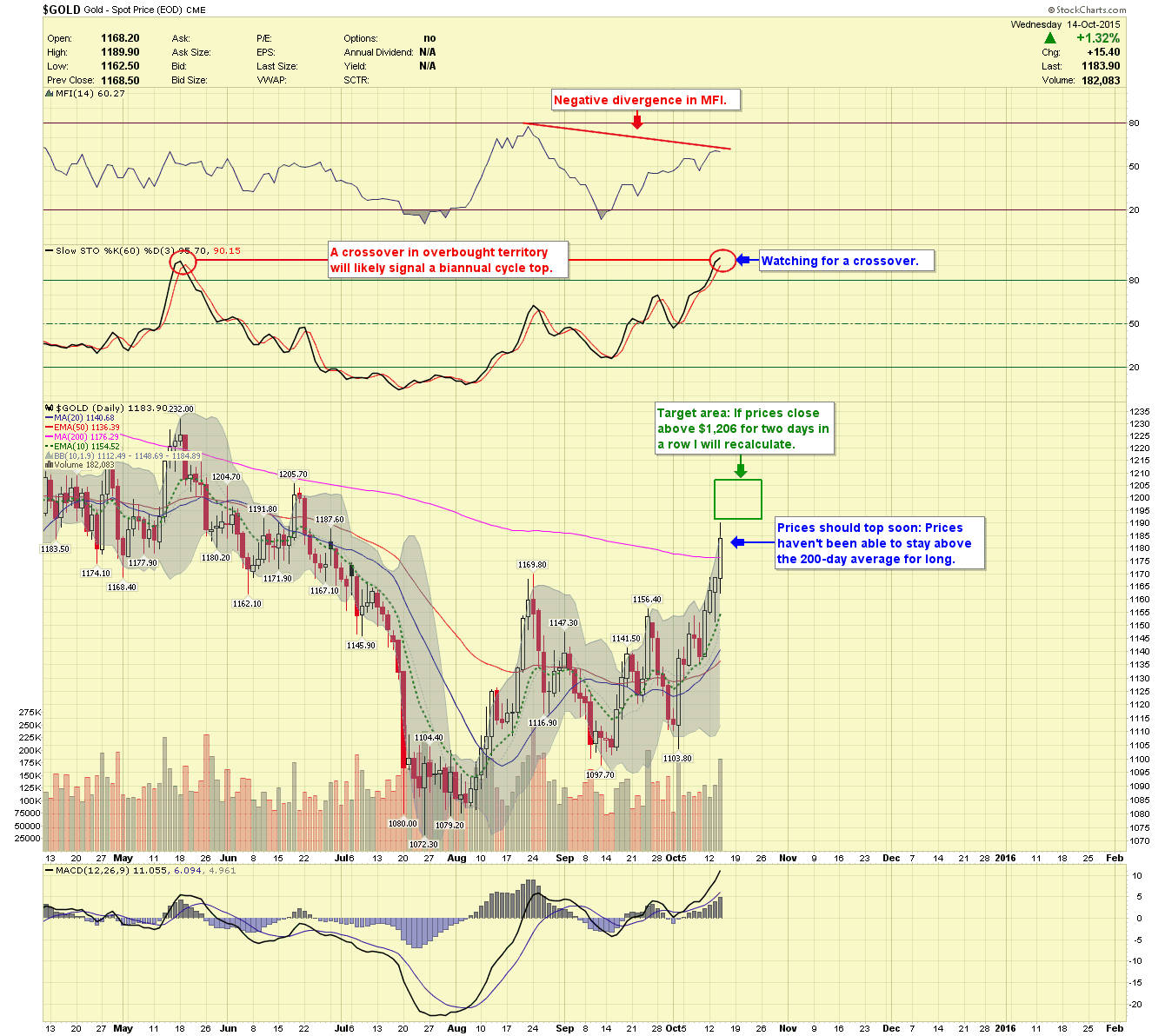

Our unique approach combines cycles work with technical analysis to give estimated market timing and potential target areas. Current indicators suggest the gold price is close to forming a top and once formed prices should head lower into a biannual cycle low by year end. In the remainder of this exclusive gold forecast we will focus on various gold price charts and give brief summaries of the present technical environment.

Since this correction began in 2011, prices have stayed in somewhat of a predictable pattern. This pattern includes gold prices forming biannual cycle tops within certain time parameters and prices holding to specific moving averages. The daily chart pictured below shows prices are now attacking the downward sloping 200-day moving average (pink line at $1,176.29). Gold prices have struggled with the 200-day moving average and therefore, this seems like a potential termination area. If prices close above $1,206 for more than two days in a row, I will be forced recalculate the target area. Our premium newsletter is focused on identifying topping patterns and we will alert subscribers once confirmed. Note: The slow stochastics indicator (shown above the price) is in overbought territory, a crossover from this area has often signaled the biannual cycle top.

When considering market tops and bottoms, it's critical to look at the weekly gold chart. Here you will see that biannual cycles have lasted in duration anywhere from 18-27 weeks (blue numbers). The current biannual cycle is in its 12th week from the $1,072.30 low, and cycles have been topping on or before the 13th week. Note: The 50-week moving average has been containing, and in the chart below you’ll see tops have formed within 3% of that moving average, which currently sits at $1,181.58.

Now that we have an idea of where gold prices may be headed between now and year end let’s tackle the more difficult long-term gold chart. To serve as a disclaimer, ALL material distributed by www.buygoldprice.com and or www.chartseek.com are for educational and informational purposes only. We nor our affiliates are financial advisors, and we recommend that readers seek the advice of certified financial professionals before making any investing decisions.

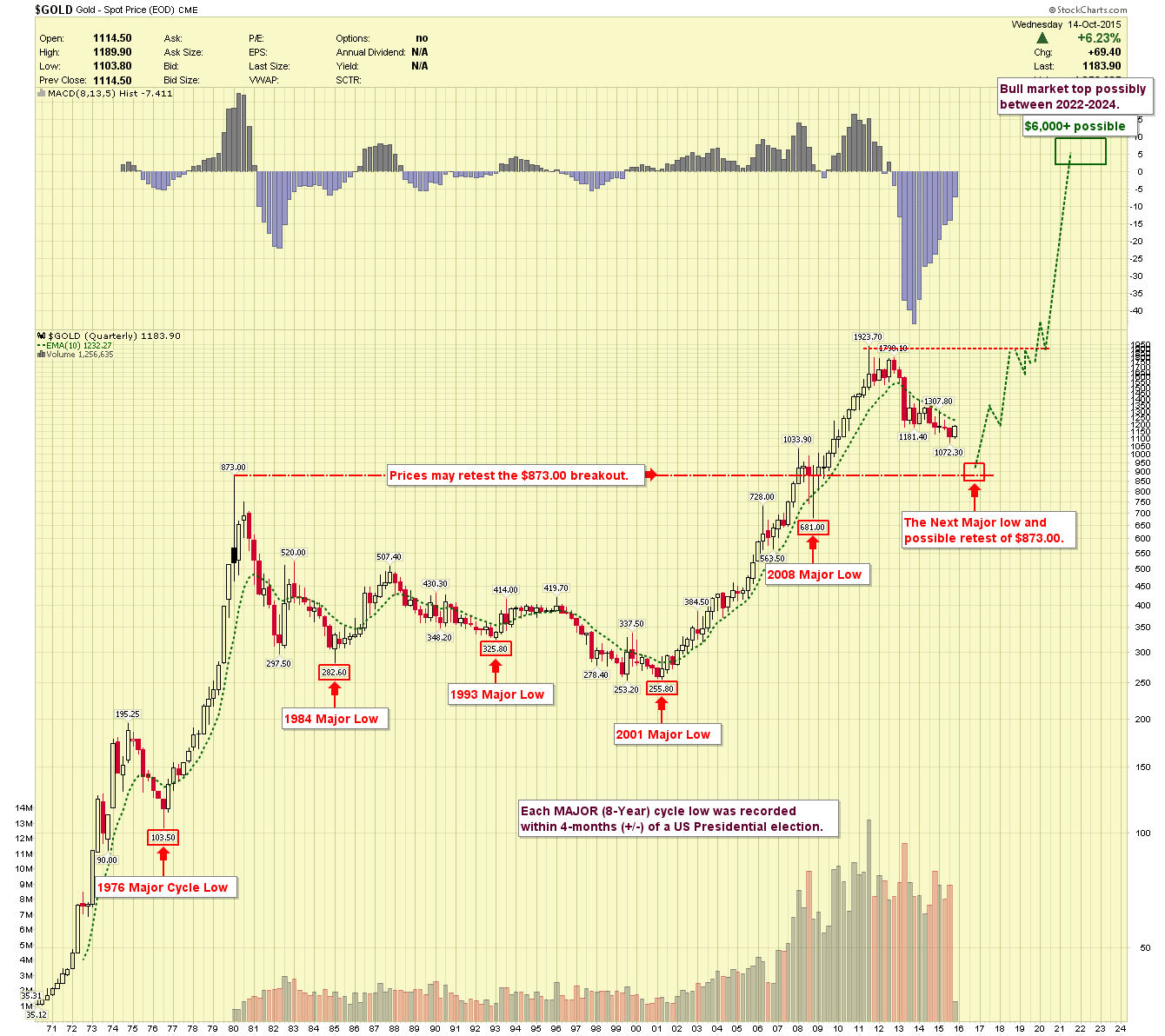

The quarterly chart below expands all the way back to 1970. After forming a bull market top in 1980, the gold sector entered a multi-decade consolidation until it finally sustained a breakout above the $873.00 level in 2008. It’s common for prices to retest a major breakout level once defeated, and that may be what’s taking place now. If prices continue lower into a 2016 major low as predicted, it’s imperative for the $873.00 level to remain whole (close above). Note: Each major cycle in the chart below formed within 4-months, either before or after a US Presidential election.

If things go well and as expected prices could climb higher and higher into a parabolic gold bull market top sometime between 2022 and 2024. These are unpolished estimates, and timing/targets will be adjusted as data and the price structure develop.

Please visit us at http://www.buygoldprice.com for all your gold and silver forecasting needs, click on services for affordable weekly reports starting from just $29.95 for 1-Year.