Gold Price Forecast: April Peak Occurred Right on Cycle Schedule

Gold surged above the upper band of its 10-month EMA envelope in April, signaling the potential start of a multi-month consolidation phase.

Gold surged above the upper band of its 10-month EMA envelope in April, signaling the potential start of a multi-month consolidation phase.

Our cycle timing tool forecasted a blow off top into a cycle peak around April 21st. True to form, gold reversed the following day after briefly touching $3,500 overnight.

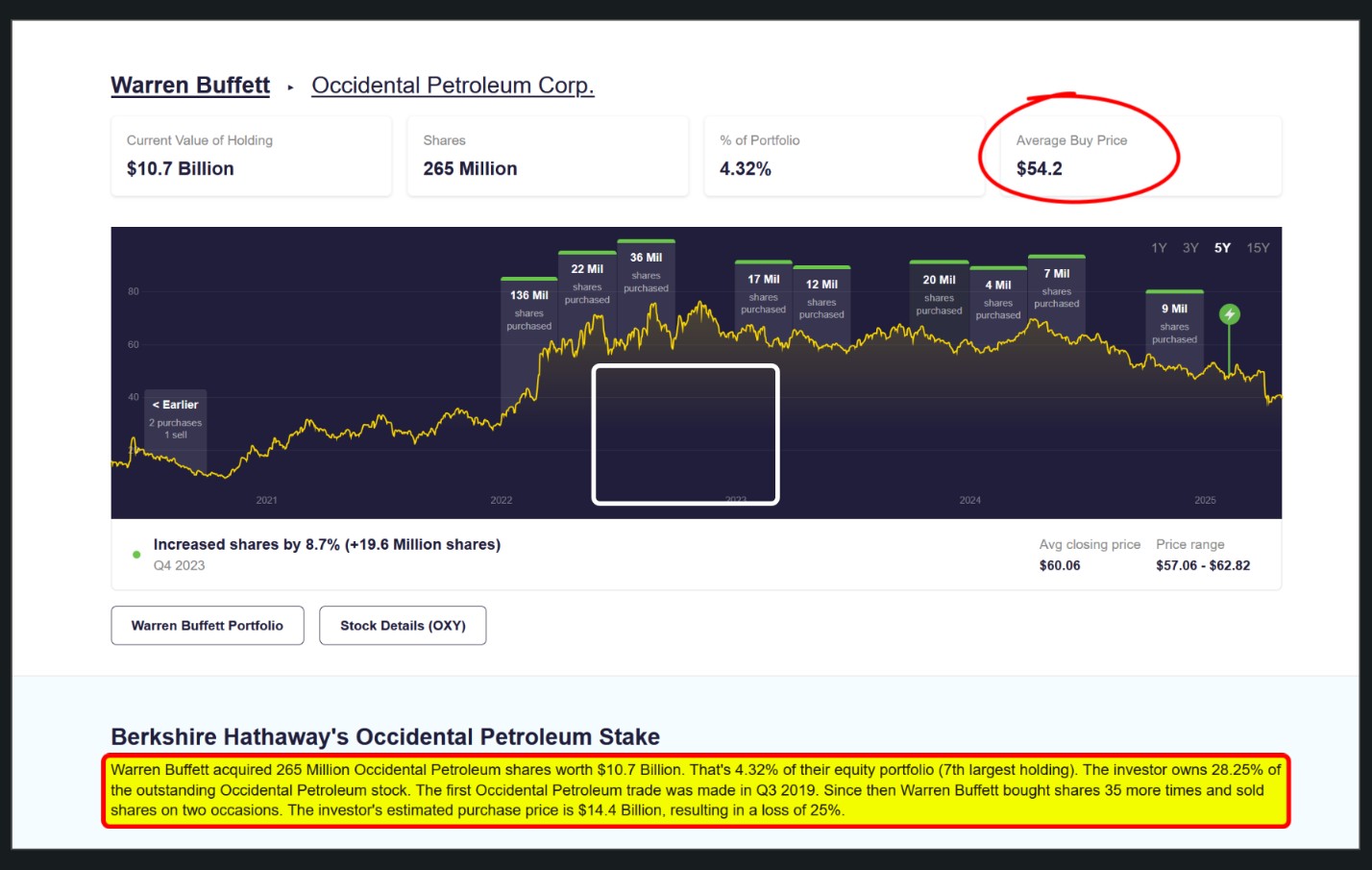

The recent pullback in crude oil prices is creating attractive opportunities in the energy sector. Notably, Warren Buffett has built a 28% position in Occidental Petroleum (OXY) at an average cost of $54.20, while shares are now trading around $40.00.

GOLD MONTHLY

The monthly price of gold spiked above the upper boundary of the 10-month EMA envelope in April, marking the fourth occurrence in three decades. These events are rare and support a significant pullback or consolidation phase.

Our Gold Cycle Indicator is at 333 after maxing out in mid-April. Overall, we expect a pullback towards $2,800 over the coming months.

GOLD: Our cycle analysis indicated that market highs tend to form approximately every 115 trading days, indicating a potential peak around April 21st (± a few days). On April 22nd, gold posted an outside reversal day after hitting $3,500, reinforcing the likelihood of an imminent cycle top. Additionally, our gold cycle indicator reached its maximum topping level, suggesting a multi-month correction of around 20%, with prices possibly retracing toward the $2,800 level.

SILVER: Silver dipped below $32.00 intraday but rallied into the close. Overall, I think the prices are headed lower with gold over the coming months and could revisit support near $26.00 before the next significant bottom.

PLATINUM: Platinum peaked in February, and I'm looking for prices to slip back towards $800 before the next significant bottom.

GDX: Miners are testing critical support near $47.00. The downtrend is picking up steam, and we see the potential for a decline back to the price gap near $38.00 before the next significant bottom.

GDXJ: We warned investors not to chase the post-tariff breakout in miners as it had the hallmarks of a bull trap. Gold juniors could shave off another $10.00 once prices slip below support at $58.00.

SILJ: Silver juniors will likely drop below $10.00 during this intermediate decline. The next level of support arrives at $11.60.

CRUDE OIL UPDATE

Historically, oil prices often spike ahead of equity market downturns. For example, oil hit $126 in March 2022, just before the onset of the bear market. In contrast, in 2025, prices peaked at just $79 before reversing. This divergence suggests one of two scenarios: the typical pre-bear market oil surge didn’t occur, or a broader equity downturn may not materialize as widely anticipated. With economic growth slowing, oil could dip below $50 in the coming months, creating potential opportunities to invest in high-quality energy names selectively. Major support at $40 should hold.

OXY WEEKLY

Prices broke support at $53.00, supporting a cyclical bear phase. In the near term, I see the potential for a bear flag that could take prices below $30.00 in the coming months. I'd consider aggressive accumulation below $27,00, which is 50% below Buffet's average price of $54.20.

BUFFET OXY HOLDINGS

Warren Buffett has accumulated 265 million shares of Occidental Petroleum, valued at approximately $10.7 billion, representing about 28.25% of the company's outstanding shares. His most recent purchase was on February 7, 2025, when he acquired 763,000 shares at a price of $46.79.

Source: https://stockcircle.com/portfolio/warren-buffett/oxy/transactions

Conclusion

Following a strong rally, gold appears poised for a multi-month consolidation and could retrace toward the $2,800 level.

As the next major bottom forms, I expect silver and gold miners to lead the next leg higher, finally aligning with the broader bull market.

Looking ahead, with global growth expected to decelerate, I'm turning my attention to value opportunities in the energy sector—names like Warren Buffett's Occidental Petroleum (OXY) and other high-quality plays stand out.

AG Thorson is a registered CMT and an expert in technical analysis. For more price predictions and daily market commentary, consider subscribing at www.GoldPredict.com.

********