Gold Prices Up 5% Over The Past Month

Strengths

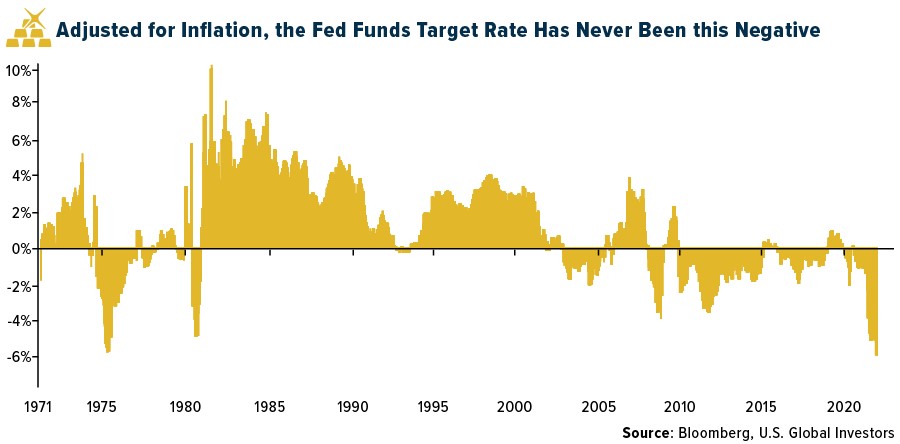

- The best performing precious metal for the week was silver, up 4.79% on a broad-based rally across the precious metals space. The latest U.S. producer and consumer price data this week will offer fresh insight on the likely course of Federal Reserve policy. Fed Chair Jerome Powell last week stressed that the start of monetary tapering didn’t mean rate hikes were coming any time soon. “The Fed is behind the curve on inflation as far as the markets are concerned,” refiner Heraeus Metals Germany GmbH & Co. KG. wrote in a note. “Should inflationary pressures remain high, gold could return to favor but, as stock markets keep hitting record highs, it is stuck in its trading range.”

- Newcrest Mining agreed to buy Pretium Resources in a cash and shares deal valuing the Canadian gold producer at about $2.8 billion, adding to a wave of consolidation in the sector. Melbourne-based Newcrest will offer Pretium holders C$18.50 ($14.87) a share, a 23% premium to the target’s closing price Monday in Toronto.

- Shares in Chalice Mining soared 44% this week on the initial release of its maiden resource statement for its nickel, copper, cobalt and platinum deposit at its Gonneville discovery. The resources were found undercover just 70 kilometers from Perth, so there is excellent access to infrastructure. This discovery represents the largest find of nickel sulfide in 21-years according to the Australian Financial Review.

Weaknesses

- The worst performing precious metal for the week was gold, up 2.56%. Jaguar Mining operating production costs of $19.4 million in the third quarter as compared to $14.1 million last year. The increase in operating cost is primarily due to local inflationary pressure on wages, mining materials and plant consumables, higher tons processed and higher secondary development. Cash operating costs increased 36% to $833 per ounce of gold sold as a result of reduced ounces sold and increased production costs.

- The last 12 months have seen a steady rise in inflation, yet gold has largely traded sideways as stock markets make new highs. The precious metal has long been regarded, correctly, as a hedge against inflation and monetary debasement but have only recently responded to the higher-than-expected inflation numbers. However, the gold miners have been in the company worst-performing sectors in the S&P 500.

- Pan American 2021 gold and silver production guidance was reduced by 9% and 8%, respectively, with silver cash cost guidance 14% higher and gold costs unchanged. The revised outlook implies a strong 4Q production rebound (+10% during the quarter).

Opportunities

- Nano One Materials share price sold off 26% this week on news that Johnson Matthey was abandoning its push into battery metals and announced a new chief executive officer. Only back in June Nano One and Johnson Matthey announced a development agreement to help bring down their costs at Johnson Matthey and the share price really didn’t acknowledge much for the deal. For Johnson Matthey to exit battery materials doesn’t really affect Nano One and it is a good entry point to add the stock on the overreaction. The other news was that Nano One was pulling back joint development of a LFP (Lithium Iron Phosphorus) with Pulead in China to bring that technology to a North American production line that is free from China and lowers the carbon footprint. Tesla’s is also focusing on LFP batteries as they are cheaper and safer, but don’t have the acceleration of a lithium-nickel-cobalt battery, likely to still have a roll where that kind of power output is needed.

- The developer of the world’s first standard diamond-investment product is launching a $50 million investment trust to make trading the precious stones more accessible to professional investors, the company said. Diamond Standard Co., a startup working to enable investors to hold diamonds in their portfolios, plans to create the Diamond Standard Trust in January.

- With global inflation pressures rising, the short-term “transitory” outlook for rising cost pressures is giving way to a longer-term, structural increase. As expected, investors are therefore once again looking for ways to diversify their investments and find a hedge against inflation, with gold the traditional beneficiary. Gold prices have started to respond, with the price of the precious metal up 5% since over the past month, and equity valuations outpacing gold’s performance, rising generally 15-20% over the same period.

Threats

- Exchange-traded funds continued to sell, bringing this year’s net sales to 9.11 million ounces, according to data compiled by Bloomberg. Total gold held by ETFs fell 8.5 percent this year to 98 million ounces, the lowest level since May 13, 2020.

- Greenland’s parliament has passed legislation that will ban uranium mining and cease development of the Kuannersuit mine, one of the biggest rare-earth deposits in the world. Kuannersuit, owned by Australian mining firm Greenland Minerals and located near the southern town of Narsaq, contains a large deposit of rare earth metals, used to make consumer electronics and weapons, but also radioactive uranium. The law, passed by parliament late on Tuesday, was put forward by the Inuit Ataqatigiit party that came to power in April after campaigning to ban uranium mining and halt the Kuannersuit project, also known as Kvanefjeld..

- Impala Platinum Holdings’s decade-long quest to buy a smaller rival that owns assets key to prolonging the life of its own mines in South Africa came to a shuddering halt on Tuesday. Chief Executive Officer Nico Muller thought he finally had a deal to acquire 100% of Royal Bafokeng Platinum, after gaining the backing of the company’s management and board. Implats, as the miner is known, was preparing to make an offer this week after announcing it was in talks on Oct. 27, according to people familiar with the matter. The company’s fears were realized on Tuesday morning, when Northam Platinum Holdings said it was buying a 32.8% stake in RBPlat, potentially blocking Implats’ at least sixth attempt to acquire the company. RBPlat’s biggest shareholder Royal Bafokeng Holdings — the investment arm of the Bafokeng nation that’s led by King Kgosi Leruo Molotlegi and his advisers — switched sides at the last minute to back a bid for its stake from Northam.

*********

Frank Holmes is the CEO and Chief Investment Officer of

Frank Holmes is the CEO and Chief Investment Officer of