Gold Stocks Are Extremely Oversold

Gold stocks have broken down technically, but they are extremely oversold.

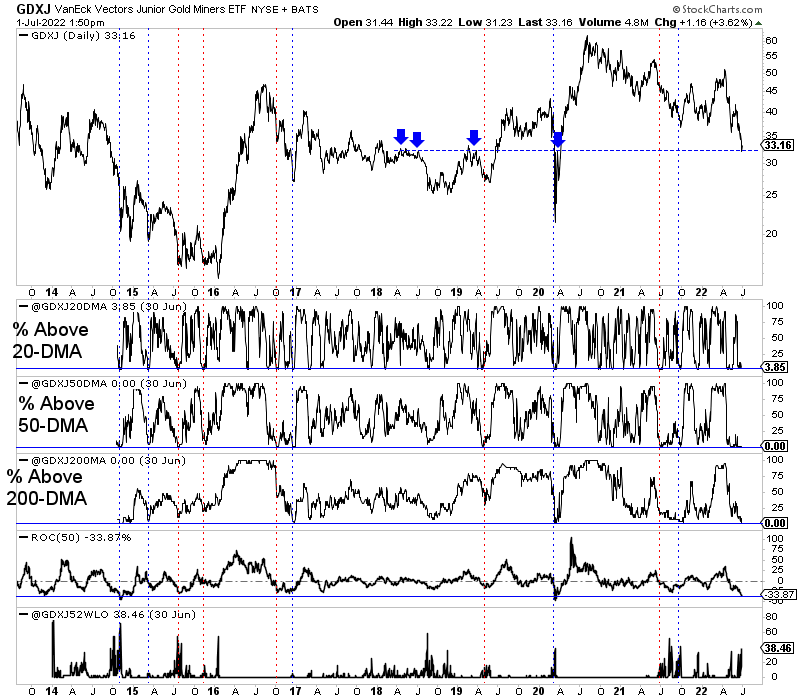

Let’s start with GDXJ, which is rebounding today after testing support at $32.

The chart below plots GDXJ along with four breadth indicators, including new 52-week lows and a 50-day rate of change. The blue lines mark where the percentage of GDXJ stocks above all the moving averages is similar, and the red lines mark where the percentage of GDXJ stocks above only the 20-day and 50-day moving averages are identical.

GDXJ is arguably the most oversold or the second most oversold (Covid crash) in the last six years. When the market is this oversold, it typically enjoys, at worst, a decent rebound.

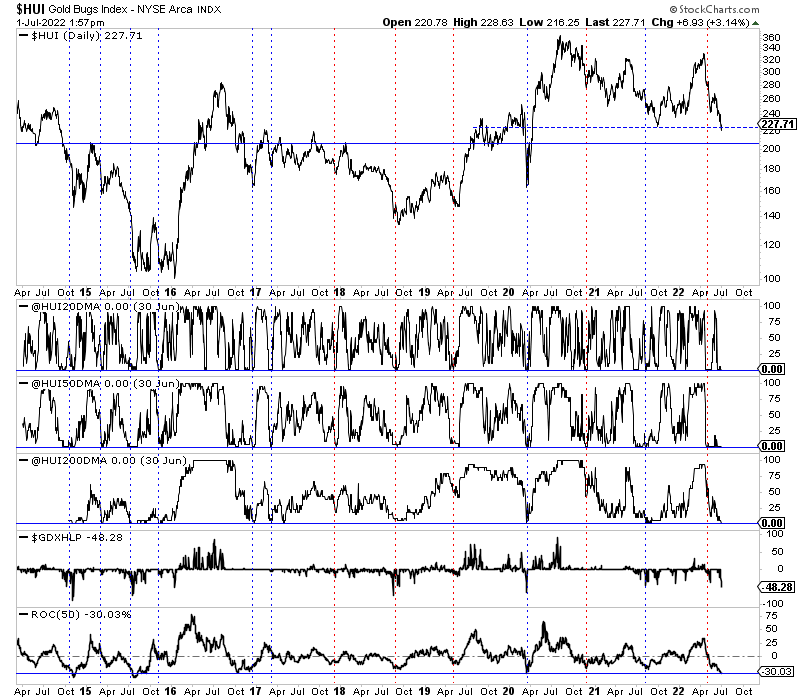

Meanwhile, the HUI Gold Bugs Index looks similar. It traded as low as 216 Friday, which is less than 5% from strong support.

No HUI stocks are trading above the 20-day, 50-day, and 200-day moving averages, and yesterday 48% of GDX stocks (all HUI stocks are in GDX) made a new 52-week low. In the last six years, the only time new 52-week lows spiked that high were at the 2018 and 2020 (Covid crash) bottoms.

The macro is also lining up in Gold’s favor as the 2-year yield plunged to as low as 2.72% this morning, inflation expectations have rolled over, and the Atlanta Fed model shows we are in a recession. The market is now aggressively pricing in rate cuts in 2023.

Later this month, the Fed will likely take rates up to 2.50% to 2.75%. Should the 2-year yield and inflation expectations continue to fall, this will certainly be the Fed’s final rate hike. It makes sense that precious metals would bottom right before the last rate hike.

Now is the time to be a buyer of weakness.

I continue to focus on finding high-quality juniors with at least 5 to 7 bagger potential over the next few years.

Periodically I will publish and update a list for subscribers of my favorite stocks with at least 10-bagger potential. To learn the stocks we own and intend to buy, with at least 5x upside potential after this correction, consider learning more about our premium service.

********