Gold SWOT: Gold Has Surged This Year, but Is It Overdone? Not According to One Goldman Analyst

Strengths

- The best-performing precious metal for the past week was silver, up 6.29%. Silver remains firmly higher on the week, still showing double-digit gains, but is now cooling from the speculative frenzy that pushed it into overbought territory. The healthy pullback reflects profit-taking and easing delivery concerns, suggesting the rally is maturing rather than reversing, with strong underlying momentum still intact after its 12% weekly surge.

- Orla Mining reported third-quarter production of 79.6 thousand ounces, beating its 71.7 thousand-ounce estimate. That brings year-to-date production to 205.2 thousand ounces, or 75% of the midpoint of its revised 265-285 thousand-ounce 2025 guidance range. The beat was largely driven by the Musselwhite mine, where throughput and head grade exceeded Scotia’s expectations by 8% and 4%, respectively.

- According to the World Gold Council (WGC), net global ETF gold purchases hit a record 146 tons in September 2025, more than double the 54 tons added in August. Total global ETF gold holdings rose to 3,838 tons at month-end, up 31% from the five-year low of 2,938 tons in January 2020, but still 2% below the October 2020 all-time high of 3,915 tons.

Weaknesses

- The weakest-performing precious metal for the past week was platinum, still up 0.55%. The Japanese exchange warned that the Japan Physical Platinum ETF has been trading at a sustained premium to its NAV, raising concerns about speculative excess. Weaker fundamentals added pressure, as Jubilee Metals Group reported lower first-quarter PGM output, 8,382 ounces versus 9,328 a year earlier, highlighting softness in underlying supply growth despite lofty prices.

- RBC reports that Evolution Mining is tracking below FY26 guidance in what could be a front-loaded production year. Annualized from first-quarter output of 174 thousand ounces, production equates to 696 thousand ounces, below its 710,000-780,000-ounce guidance range.

- Silver has soared 79% this year, outpacing gold’s 61% gain. But the surge may be on shaky ground, according to Goldman Sachs, which warns that the rally is being fueled by Fed rate cuts and speculative inflows. With no central-bank safety net and a smaller market, silver remains far more volatile than gold.

Opportunities

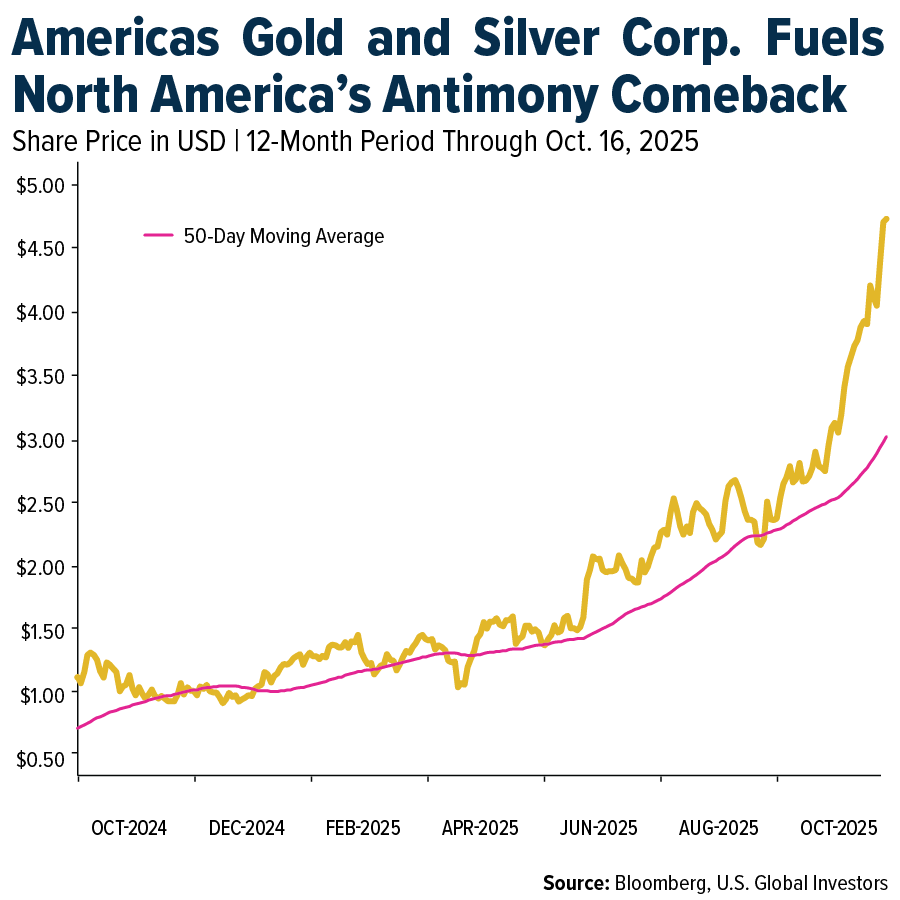

- Americas Gold and Silver’s strong antimony intercepts at its Galena Mine position the company as a dual precious- and critical-minerals producer aligned with U.S. strategic priorities to secure domestic supply chains. Combined with Canada’s welcoming stance toward U.S. investment in critical minerals, this cross-border cooperation could help North America onshore processing, reduce reliance on China, and build a resilient antimony-and-silver supply network.

- Gold has surged this year, but is it overdone? Not according to Goldman Sachs analyst Lina Thomas, who says the rally “remains rooted in strong real demand, not hype.” With gold up 61% this year, she argues we’re seeing a normalization of the gold trade after years of underinvestment. Central banks continue buying record amounts of gold, and private investors are simply catching up as the Fed cuts rates.

- RBC notes that as $3,000-per-ounce gold becomes viewed as the “new normal,” investors see room for the sector to re-rate from trough EV/EBITDA multiples toward mid-cycle averages—still about 10% below historical levels. Regionally, Australian mid-caps have seen premiums soften relative to global majors, while U.S. and Canadian names have re-rated and Chinese miners remain at historic premiums.

Threats

- Bank of America is watching three key downside risks: (1) the Supreme Court’s ruling on President Trump’s tariffs, (2) a possible hawkish pivot by the Fed if economic data improves, and (3) the U.S. midterm elections, which could affect the administration’s economic agenda.

- The investment flows that drove silver to record highs are starting to stall, suggesting a bumpier ride ahead. Silver ETF holdings have risen 117 million ounces this year to about 833 million, but momentum has faded. Inflows totaled 9 million ounces on October 14—the biggest in weeks—only to see small outflows the next day, leaving total holdings flat for the month, according to Bloomberg.

- Bank of America’s October global fund manager survey shows that long gold is now the most crowded trade. About 43% of investors ranked it as such, surpassing the “Magnificent 7” tech stocks at 39%.

*******

Frank Holmes is the CEO and Chief Investment Officer of

Frank Holmes is the CEO and Chief Investment Officer of