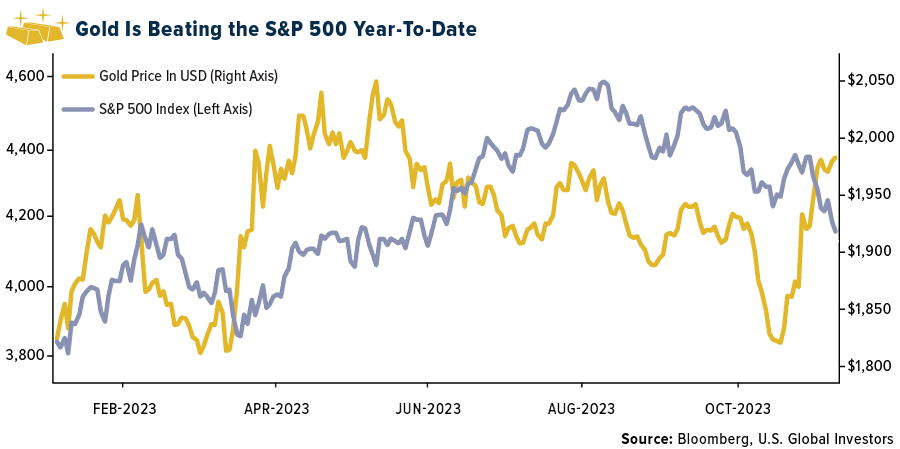

Gold SWOT: Year-To-Date, Gold Is Beating the S&P 500 Index

Strengths

- The best performing precious metal for the week was palladium, up 1.78%. U.S. stocks are in their third monthly decline while underwhelming corporate earnings and yields climbing above 5% have investors pondering their choices. When other assets don’t look so safe, gold may find a more welcome buyer. As of Friday afternoon, gold is up more than 10% year-to-date and the S&P 500 is now up only 7%. Russia saw gold production drop 9.2% year-on-year and 4.1% month-on-month in September 2023, the Federal State Statistics Service (Rosstat) said in a statement. Despite the declining monthly data, the overall volume of domestic gold production rose 1.7% for the first nine months of this year.

- Eldorado Gold reported earnings per share (EPS) of $0.17, well above consensus of $0.04, partially driven by better-than-expected costs across the portfolio. Third quarter production of 121,000 ounces gold was pre-released, with higher quarter-over-quarter production, while consolidated AISC of $1,177 per ounce was 21% below consensus AISC of $1,486 per ounce.

- Alamos reported third quarter adjusted EPS of $0.14, above the consensus of $0.12. Production of 135,400 ounces at total cash costs of $835 per ounce and AISC (all-in sustaining costs) of $1,121 per ounce beat consensus by 12%, 4%, and 7% respectively, driven by continued outperformance at Mulatos. The company has increased its fiscal year 2023 production guidance from 480-520,000 ounces gold to 515-530,000 ounces gold and reiterated its cost guidance with AISC of $1,125-$1,175 per ounce.

Weaknesses

- The worst performing precious metal for the week was silver, down 1.34%. According to Morgan Stanley, gold ETF holdings are now at the lowest level since early 2020 with nearly continuous outflows since April 2022. This shows the challenge of gold as an investment when bond yields are rising, as it struggles to compete in portfolios as a non-yielding asset.

- Gold edged lower as benchmark Treasury yields hit the highest since 2007 while fears of a spiraling conflict in the Middle East receded. The yield on 10-year U.S. bonds topped 5% on Monday for the first time in 16 years, driven by expectations the Federal Reserve will keep monetary policy tight for a long period. That is typically negative for bullion, which bears no interest.

- OceanaGold reported third quarter production of 99.0 k ounces gold, below the 104.1 k ounce consensus and AISC of $1,911 per ounce gold above the $1,757 per ounce consensus. Adjusted EPS for the quarter was $0.00, missing the consensus estimate of $0.03. Concurrently, OceanaGold updated its fiscal year 2023 cost guidance, increasing forecasted cash cost by $50 per ounce to a range of $850 – $950 per ounce, while AISC by $125 per ounce to a range of $1,550 – $1,650 per ounce, reflecting the impact of lower production from Haile.

Opportunities

- Gold priced in Swiss francs shows that the precious metal could sustain its upward momentum should geopolitical tensions persist. The Swiss franc and gold have seen a surge in demand as haven assets amid the turmoil in the Middle East. Gold has gained more than 8% against the dollar so far in 2023, while the Swiss franc has appreciated by more than 3%, solidifying its position as the leading performer among G-10 currencies.

- According to recent data from the U.S. Treasury, Chinese investors sold $21.2

billion of U.S. assets in the month of August. Chinese investors may be among the first to direct their funds to gold markets. There are two main theories about the reasons of China’s rapid selling of U.S. assets. First, the Asian nation needs to support the local currency. The second potential reason for China’s activity lies in the realm of geopolitics. - Wheaton Precious Metals has entered into a definitive Precious Metal Purchase Agreement with Waterton Copper Corp. on its 100% owned Mineral Park Mine located in Arizona, USA. Wheaton will pay Waterton total upfront cash consideration of $115M in four payments during construction (three installments of $25M and a final installment of $40M) with construction to be completed by the end of the first quarter of 2025. Under the stream, Wheaton will purchase 100% of the payable silver from the project for the life of the mine.

Threats

- Bitcoin continues to gain ground, taking bullish cues from traditional

rate-sensitive assets like gold. Prices are up 14% for the month, with gold registering a much lesser 6.7% gain. Gold, however, picked up a bid a week before Bitcoin, as the outbreak of tensions between Israel and Hamas, alongside continued speculation about the end of the Fed tightening cycle, signaled an inflationary regime ahead. - Panama’s labor unrest surrounding First Quantum’s new contract to operate its copper and gold mine is still facing challenges. Protests have broken out and now Panama’s Supreme Court noted it will consider a lawsuit which alleges the nation’s contract violates their constitution. Frano-Nevada Corp. has the most exposure to First Quantum through its royalty on the gold production. Regardless of the outcome, Panama makes itself look unsuitable for new mining investment currently.

- Sibanye Stillwater Ltd. said it will enter talks with labor unions over the possible restructuring at some of its South African platinum group mines that could affect more than 4,000 workers. The consultations will concern four shafts – two of which have reached the end of their producing lives – at the company’s Rustenburg, Marikana and Kroondal projects, the Johannesburg- based firm said in a statement.

*********

Frank Holmes is the CEO and Chief Investment Officer of

Frank Holmes is the CEO and Chief Investment Officer of