Inflation: 18% And Sticky?

What will the Fed meet bring for the major markets?

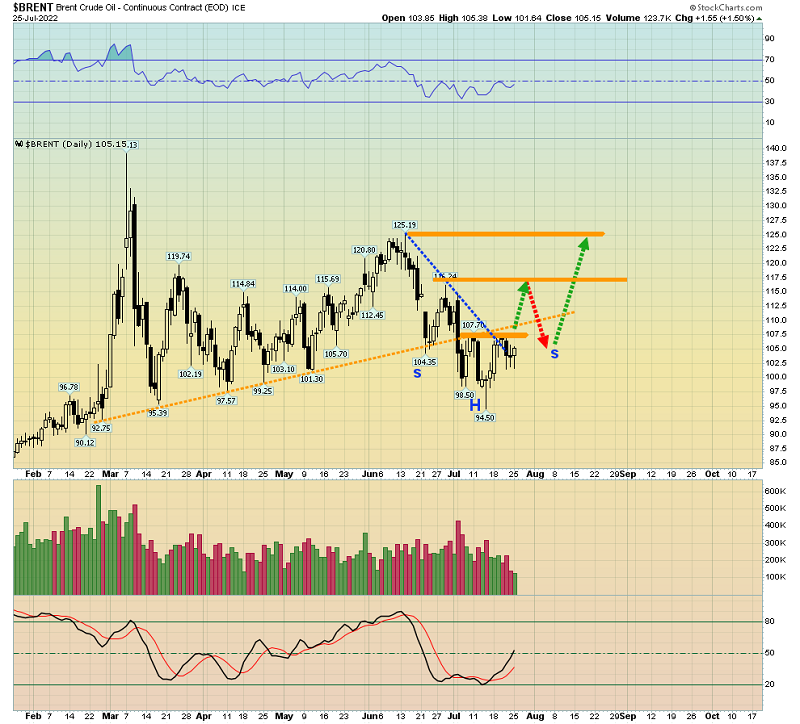

The Brent crude oil chart. There’s an inverse H&S bottom in play and Brent may be leading the price of Texas crude because of the Ukraine war.

If major commodities like oil (and gold!) are bottoming, the Fed may be more aggressive than stock market investors would like… even with growth fading and America already in a de facto recession.

Also, the Fed’s QT program is set to accelerate in September. This is going to put more pressure on the government to reign in its vast array of ludicrous global meddling and regime change schemes.

The US government is unlikely to reduce spending at all. Sadly, US homeowners carrying million-dollar mortgages don’t have the luxury of making laws for themselves. Nor can they order the Fed to buy their debt with printed money. The bottom line:

Stagflation may be here to stay… for the next 30 years.

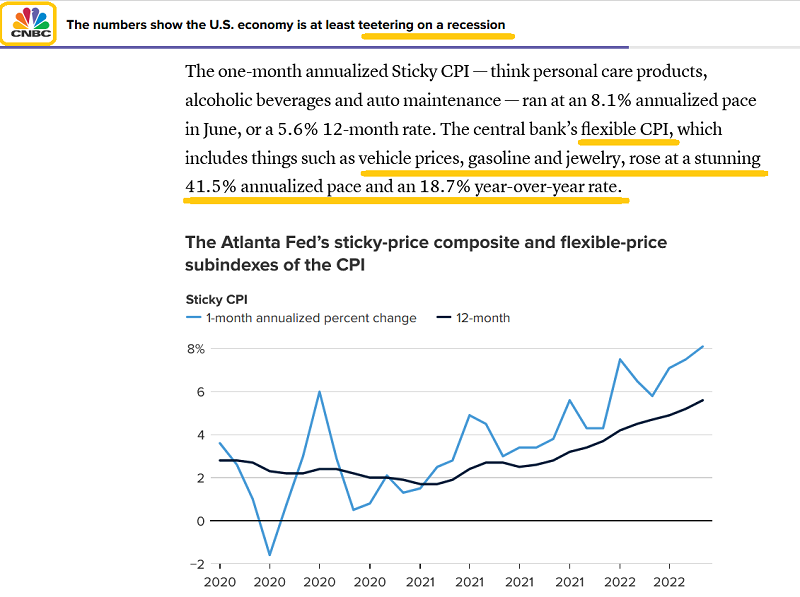

A number of gold bugs have tried to create “real inflation” indexes, but the Fed’s Sticky CPI already does that.

Real US inflation is likely in the 18% range that is indicated by the Sticky index, and topped 40% in June! https://galacticupdates.com/wp-content/uploads/2022/07/2022jul26oil1.png

The current inflation is related to Corona and the Ukraine war. Fed man Jay may be gazing beyond the current price drivers and into a future where energy transition (dirty to clean) and empire transition (West to East) dominate the economic landscape. Both are highly inflationary.

While there will be lulls in inflation (there just was one with commodity prices), Jay may see decades of inflation ahead. Horrifically, the problem is compounded by the US government’s refusal to cut spending at all, let alone in a serious way.

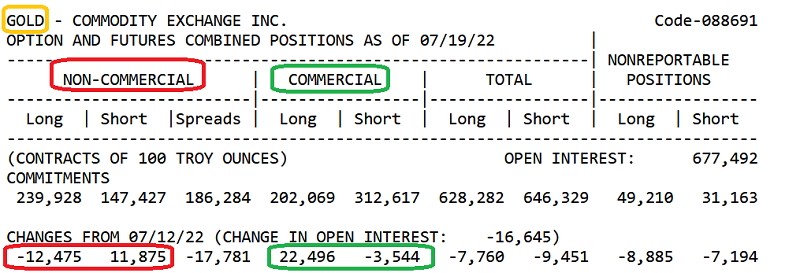

Tactics? Smart money is moving into gold (and I would hope that includes most small investors in the Western gold community).

The weekly gold chart. The price and oscillator action at $1675 is impressive.

A look at the daily chart. A big engulfing bull candlestick appeared at the $1675 support zone. It suggests that whatever the Fed does tomorrow, gold is in good shape.

What about the miners? The important XME versus GDX chart.

XME gives gold bugs exposure to both base and precious metals stocks. At one point, the two biggest holdings in the XME ETF were the silver companies Coeur d’Alene and Hecla. That can happen again.

It’s an ideal holding that can help investors manage both the growth of post-Corona China and the danger of economic collapse in America.

I cover key XME holdings like Freeport, Vale, and BHP in my dividends newsletter as well as NYSE-traded investments that pay substantial interest on gold and silver. Most investors should have some dividend-oriented holdings in their portfolio, especially those with time-tested monthly payouts. At $189/year the newsletter is solid value and this week I have a special $159/15mths offer! Send me an email if you are interested and I’ll send you the details and payment link. Thanks!

The copper price chart. Months ago, I laid out $3.20 as a key buy zone. A rally looks imminent.

Nancy Pelosi seems eager to ramp up tension between China and America and she’s likely to succeed if she makes her upcoming trip to Taiwan. That could create severe supply chain issues for metals like copper.

Economists refer to Copper as “Doctor Copper”, because it tends to indicate economic strength when the price rallies, and economic weakness when it declines.

That changed in early 2022 when stagflation appeared.

Doctor Copper may soon become better known as Doctor Stagflation.

What about the silver miners? The SIL chart. There’s a rough inverse H&S bottom in play. These patterns indicate a low is either here or very near.

Given that the Fed’s “Sticky” inflation index shows inflation is 18% and commodity prices may be set to rally, once the Fed meeting is over, SIL is likely to offer investors an ideal entry point on Thursday morning!

Special Offer For Gold-Eagle Readers: Please send me an Email to [email protected] and I’ll send you my free “Under The Golden CDNX Radar” report. I highlight ten CDNX gold and oil stocks that are in rally mode now, and set to surge even higher! Key buy and sell tactics are included in the report.

Thanks!

Cheers

St

Stewart Thomson

Graceland Updates

Note: We are privacy oriented. We accept cheques, credit card, and if needed, PayPal.

Written between 4am-7am. 5-6 issues per week. Emailed at aprox 9am dailyhttps://www.gracelandupdates.com/

Email:

Rate Sheet (us funds):

Lifetime: $1299

2yr: $299 (over 500 issues)

1yr: $199 (over 250 issues)

6 mths: $129 (over 125 issues)

To pay by credit card/paypal, please click this link:

https://gracelandupdates.com/subscribe-pp/

To pay by cheque, make cheque payable to “Stewart Thomson”

Mail to:

Stewart Thomson / 1276 Lakeview Drive / Oakville, Ontario L6H 2M8 Canada

Stewart Thomson is a retired Merrill Lynch broker. Stewart writes the Graceland Updates daily between 4am-7am. They are sent out around 8am-9am. The newsletter is attractively priced and the format is a unique numbered point form. Giving clarity of each point and saving valuable reading time.

Risks, Disclaimers, Legal

Stewart Thomson is no longer an investment advisor. The information provided by Stewart and Graceland Updates is for general information purposes only. Before taking any action on any investment, it is imperative that you consult with multiple properly licensed, experienced and qualified investment advisors and get numerous opinions before taking any action. Your minimum risk on any investment in the world is: 100% loss of all your money. You may be taking or preparing to take leveraged positions in investments and not know it, exposing yourself to unlimited risks. This is highly concerning if you are an investor in any derivatives products. There is an approx $700 trillion OTC Derivatives Iceberg with a tiny portion written off officially. The bottom line:

Are You Prepared?

*******

Stewart Thomson is president of Graceland Investment Management (Cayman) Ltd. Stewart was a very good English literature student, which helped him develop a unique way of communicating his investment ideas. He developed the “PGEN”, which is a unique capital allocation program. It is designed to allow investors of any size to mimic the action of the banks. Stewart owns GU Trader, which is a unique gold futures/ETF trading service, which closes out all trades by 5pm each day. High net worth individuals around the world follow Stewart on a daily basis. Website:

Stewart Thomson is president of Graceland Investment Management (Cayman) Ltd. Stewart was a very good English literature student, which helped him develop a unique way of communicating his investment ideas. He developed the “PGEN”, which is a unique capital allocation program. It is designed to allow investors of any size to mimic the action of the banks. Stewart owns GU Trader, which is a unique gold futures/ETF trading service, which closes out all trades by 5pm each day. High net worth individuals around the world follow Stewart on a daily basis. Website: