The US Economy: All Roads Lead To Gold

Top US politicians describe the US economy as the “mightiest of all time”.

Houston, we have a problem! The next tariff tax deadline is now only about three weeks away.

While Trump’s diehard fans may want him to hike these taxes again if China doesn’t “play ball”, massive FOREX liquidity flows suggest that the world’s biggest money managers are becoming extremely concerned about the level of risk in the US economy.

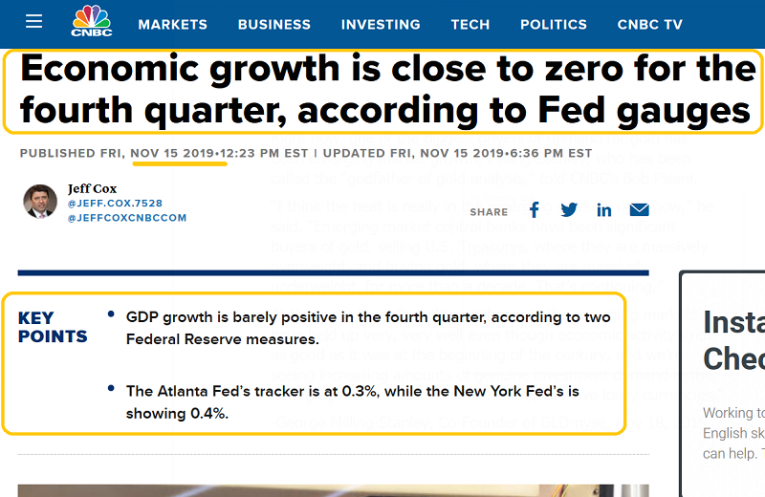

American GDP growth has literally incinerated (from what I predicted would be a 5% peak as the tariff taxes were launched), and this dollar versus yen chart shows a massive bear wedge pattern in play.

That bear wedge is ominous.It suggests giant bank FOREX traders believe something is about to go badly wrong with the US economy… more wrong than the horrific sub 1% GDP growth in play now!

Trump’s initial platform of tax cuts, law and order, and deregulation was awesome.It created surging markets (both gold and stocks), a positive vibe for citizens, and solid GDP growth.

That platform has been replaced with macabre QE and negative rates worship, turning a blind eye to a skyrocketing deficit, and a crazed attempt to boost growth with tariff taxes… and it’s all happening as the world de-dollarizes at an ever-faster rate.

Stagflation is emerging, and some economists are forecasting that in 2020 corporate earnings and revenue growth will both come in at the sub 3% marker. Debt would surge in that scenario.

While the economy wallows in a tariff tax and debt quagmire, stock market investors have been repeatedly saved by the Fed.

Top earners pay 50% capital gains tax, which arguably makes the government the main beneficiary of upside stock market action.This is, quite frankly, insane.

The alternative, a democrat administration, would be even worse news for most people with stakes in America.

It’s unknown how Jay Powell would respond to a fresh hike in tariffs in December.He might cut rates and do more “QE that is not QE”, but what if he doesn’t?

The bottom line is that it doesn’t look good for America and most of the West, and that’s why there’s a massive launch pad pattern in play on the weekly gold chart.

I’ve dubbed that pattern as “Michelangelo”, because it’s so enormous and technically aesthetic.

My base scenario for 2020 is that the US economy muddles along, Trump doesn’t launch any more significant tariff taxes, and the Fed is likely to step in and keep the stock market boats afloat if they start sinking again.

My base scenario sees gold and related items again outperform all other major asset classes in 2020, but with the bull wedge pattern on the weekly chart becoming more of a gentle reactive drift.

I give that scenario 70% odds, leaving a 30% chance that in three weeks Trump hikes tariffs, Powell does nothing, the stock market crashes, and gold stages a vertical blast towards $1900.

In that more dire scenario, there would be a breakout from the bull wedge, and gold would stun most investors with the intensity of its upside price action.

Whichever scenario prevails, gold and related assets are the most important place to be invested, for maximum upside action.

In the short-term, I’m looking for gold to stage a double bottoming event, and that could mark the end of the current reaction.

What happens with tariff taxes in the next three weeks will likely determine whether gold moves down to significant support at $1397 and bottoms there, or bottoms at current $1465 support.

A move above $1566 for bullion is probably the biggest game changer for gold and silver stocks since the 1970s.It turns many miners into cash cows and probably unleashes a frenzy of stock buybacks and takeovers.

The weekly gold bullion chart is aesthetic, but so is this short-term GDX chart.A bull wedge pattern is in play and a breakout seems imminent.The reaction has been orderly, and now there’s a buy signal in play on my 14,7,7 series Stochastics oscillator.

A breakout from the bull wedge on the GDX daily chart likely drives a breakout over $30 on the weekly chart.That opens the door to a mighty surge into my $52 target zone!

Special Offer For Gold-Eagle Readers: Please send me an Email to [email protected] and I’ll send you my free “Golden Nuggets” report. I highlight six intermediate-priced miners in the $5 to $10 sweet spot zone, poised for potential 100%+ gains when GDX stages a weekly chart breakout.

Note: We are privacy oriented. We accept cheques, credit card, and if needed, PayPal.

Written between 4am-7am. 5-6 issues per week. Emailed at aprox 9am daily.

Email:

Rate Sheet (us funds):

Lifetime: $999

2yr: $299 (over 500 issues)

1yr: $199 (over 250 issues)

6 mths: $129 (over 125 issues)

To pay by credit card/paypal, please click this link:

https://gracelandupdates.com/subscribe-pp/

To pay by cheque, make cheque payable to “Stewart Thomson”

Mail to:

Stewart Thomson / 1276 Lakeview Drive / Oakville, Ontario L6H 2M8 Canada

Stewart Thomson is a retired Merrill Lynch broker. Stewart writes the Graceland Updates daily between 4am-7am. They are sent out around 8am-9am. The newsletter is attractively priced and the format is a unique numbered point form. Giving clarity of each point and saving valuable reading time.

Risks, Disclaimers, Legal

Stewart Thomson is no longer an investment advisor. The information provided by Stewart and Graceland Updates is for general information purposes only. Before taking any action on any investment, it is imperative that you consult with multiple properly licensed, experienced and qualified investment advisors and get numerous opinions before taking any action. Your minimum risk on any investment in the world is: 100% loss of all your money. You may be taking or preparing to take leveraged positions in investments and not know it, exposing yourself to unlimited risks. This is highly concerning if you are an investor in any derivatives products. There is an approx $700 trillion OTC Derivatives Iceberg with a tiny portion written off officially. The bottom line:

Are You Prepared?

********

Stewart Thomson is president of Graceland Investment Management (Cayman) Ltd. Stewart was a very good English literature student, which helped him develop a unique way of communicating his investment ideas. He developed the “PGEN”, which is a unique capital allocation program. It is designed to allow investors of any size to mimic the action of the banks. Stewart owns GU Trader, which is a unique gold futures/ETF trading service, which closes out all trades by 5pm each day. High net worth individuals around the world follow Stewart on a daily basis. Website:

Stewart Thomson is president of Graceland Investment Management (Cayman) Ltd. Stewart was a very good English literature student, which helped him develop a unique way of communicating his investment ideas. He developed the “PGEN”, which is a unique capital allocation program. It is designed to allow investors of any size to mimic the action of the banks. Stewart owns GU Trader, which is a unique gold futures/ETF trading service, which closes out all trades by 5pm each day. High net worth individuals around the world follow Stewart on a daily basis. Website: