The Fed pivot will be good for gold in 2023, says Bank of America

NEW YORK (Dec 2) It’s jobs Friday again. Equity bulls will be hoping for a nonfarm payrolls report that is sufficiently cool that it allows for the narrative of a less aggressive Federal Reserve to be sustained.

Confirmation from Fed chair Jay Powell this week that the central bank will slow its pace of rate hikes has helped push the S&P 500 SPX, -0.09% firmly back above 4,000, and crucially for those of a more technical bent, the benchmark sits north of its 200-day moving average.

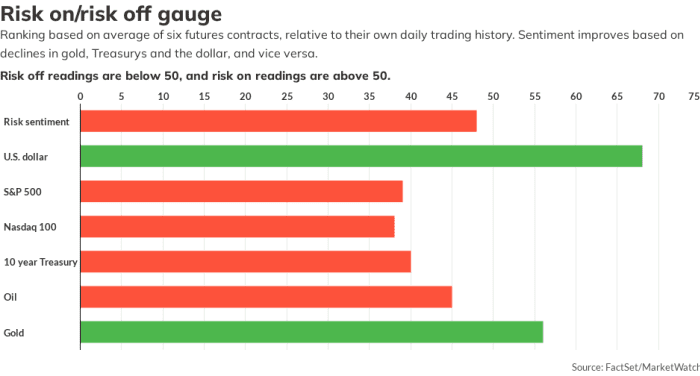

Underpinning the S&P 500’s 14% bounce from its mid-October trough are the recent retreats in bond yields and the dollar, moves that are evidently linked to Fed expectations. The dollar index DXY, -0.17% has broken below its 200-day moving average, while the 10-year Treasury yield TMUBMUSD10Y, 3.510% is threatening to fall through the floor of a year-long uptrend channel.

But this shift in the buck and bonds is also good for another asset: gold GC00, -0.21%.

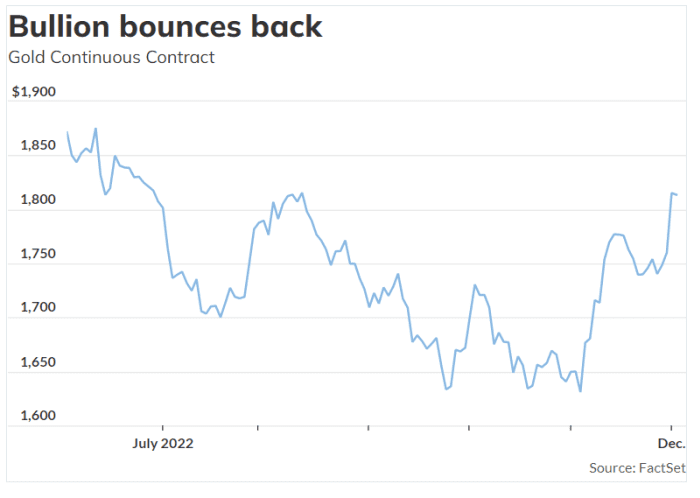

The yellow metal on Thursday, as measured by the COMEX front month futures contract, jumped 3.1% to recover the $1,800 an ounce level. That was the biggest daily gain since April 2020 and took bullion to its most expensive since August.

The commodity strategy team at Bank of America, led by Francisco Blanch, thinks gold has further to go. In a comprehensive 2023 commodity outlook note recently released, BofA says the price could exceed $2,000 an ounce next year as of all the precious metals “gold has the most to gain…on a Fed pivot”.

“With relatively limited commercial uses, gold has always been driven by investor demand,” says BofA. And that demand in turn tends to be impacted by borrowing costs and the dollar, in which gold is denominated.

Thus: “A pivot away from the aggressive rate hikes through 2023 should bring new buyers back into the market.”

And some weighty buyers have been showing their hand. Central bank purchases have rebounded in 2022, with monetary authorities in Turkey, Egypt, Iraq, India and Ireland all adding to their holdings, BofA observes.

The latest survey by the World Gold Council suggests this trend is unlikely to change, with 25% of central banks expecting to increase their exposure to the precious metals further, compared with 21% last year.

However central banks make up only about 20% of what BoFA terms “total implied investment” for gold, and so their interest is not sufficient to really get a rally going. For that, gold needs increased demand for “bar hoarding, physically backed ETFs, OTC net-investment and official sector purchases”.

“Annualized gold purchases year-to-date place the gold market squarely into the $1,500/oz and $2,000/oz range. Encouragingly, for gold to fall to the lower end of the range, recent investor liquidations, and outflows from ETFs would have to accelerate, which is not our base case, because we expect a bottoming out in USD and less upside to 10-year rates,” says BofA.

“While the U.S. central bank will in all likelihood keep tightening monetary policy, the pace of rate hikes should start to slow. This pivot will likely bring new investors into the market. As such, with physical demand already strong in some pockets, we believe gold prices should rally into 2H23,” BofA concludes.

Finally, here’s another factor BofA doesn’t mention. Some market observers have speculated that one reason gold did not rally as much as expected during recent years was that a significant sized cohort of potential investors were attracted to crypto instead. With anxiety over crypto assets building may bullion now attract some of those players?

MarketsS&P 500 futures ES00, -0.09% were barely changed at 4081 and the Nasdaq 100 futures NQ00, -0.15% were down just 7 points at 12056. The benchmark 10-year Treasury yield was up 1 basis point to 3.520%.

For more market updates plus actionable trade ideas for stocks, options and crypto, subscribe to MarketDiem by Investor’s Business Daily.

The buzzThe big data point on Friday is the monthly nonfarm payrolls report. Will it show signs that the labor market is wilting in the face of the Federal Reserve’s rate hikes?Economists forecast that a net 200,000 jobs were added in November, down from the 261,000 in October. The unemployment rate is expected to be steady at 3.7% and average hourly earnings growth is reckoned to have been 0.3% month-on-month, compared with 0.4%.

Credit Suisse CSGN, 9.15% stock bounced 8% off record lows after chairman Axel Lehmann said outflows from the bank “have basically stopped”.

Blackstone stock BX, -7.09% is trading down 2%, after falling 7% on Thursday, as investors absorb news that the investment group was limiting redemptions from its $69 billion Real Estate Income Trust fund .

Oil prices were relatively steady, with U.S. crude futures CL.1, 0.64% down less than 0.1% at $81.20 a barrel ahead of the OPEC+ meeting this weekend. The discussion comes as oil sits only several bucks above 11-month lows hit last week amid concerns a slowing global economy will crimp demand. Meanwhile, the EU is trying to agree a price cap on Russian oil.

Shares in Marvel Technology MRVL, -2.41% are down 7% in premarket trading after the semiconductor maker’s earnings and outlook disappointed investors following the closing bell on Thursday.

MarketWatch