Central Banks Record Gold Buying

Central Banks Record Gold Purchases [Infographic]

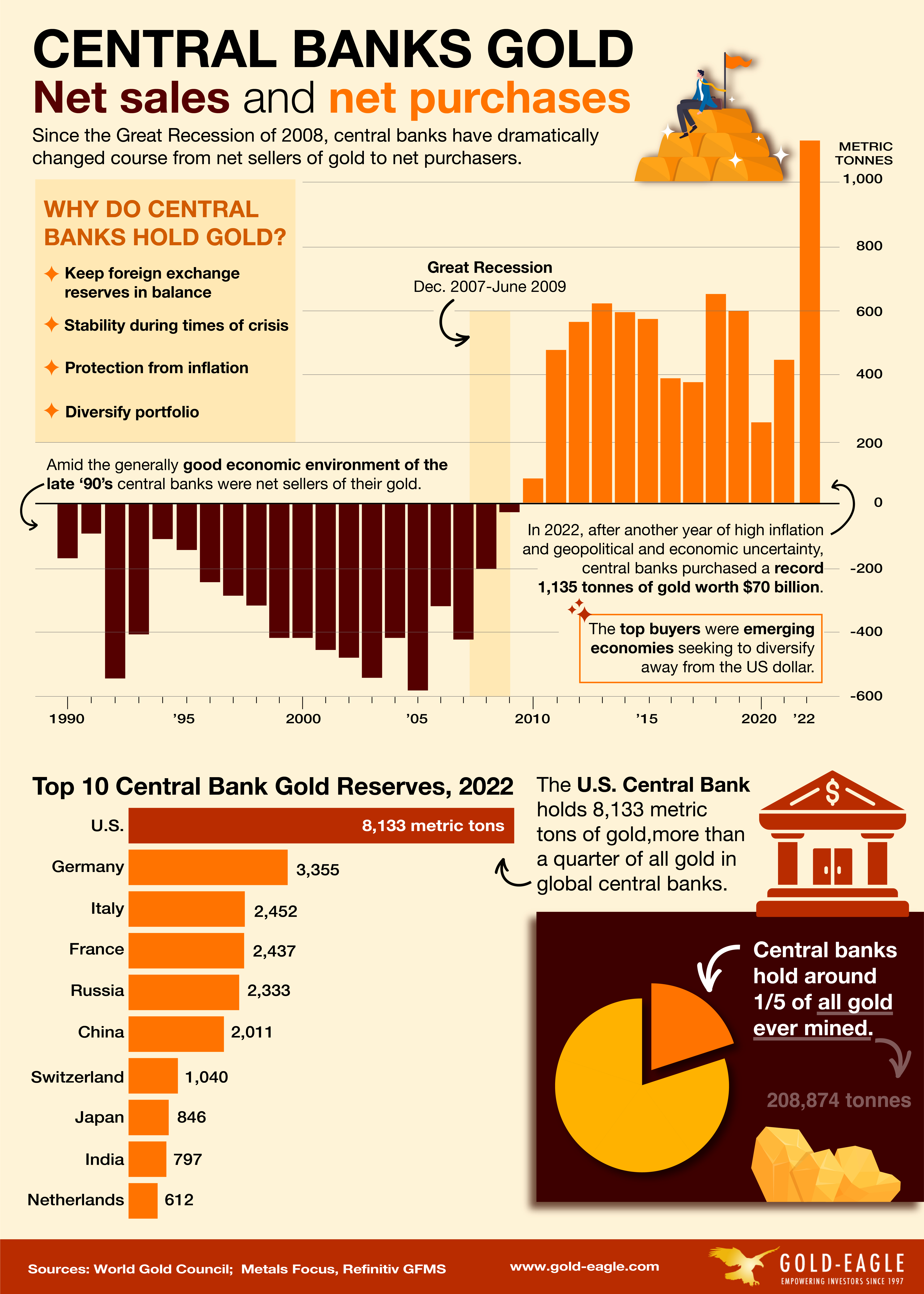

Since the Great Recession of 2008, central banks have dramatically changed course from net sellers of gold to net purchasers. In 2022, the amount purchased by central banks rose an astounding 152 percent to 1,136 tonnes of gold worth $70 billion.

What caused the switch in global central banks’ sentiment towards gold? Do these actions have implications for the individual investor?

The infographic above shows central bank gold demand since 1990 using data from the World Gold Council. As depicted, central banks were net sellers of gold during the 1990’s through the early 2000’s. This was a period characterized by generally good macroeconomic conditions especially in the 90’s: strong job growth, increasing productivity, low inflation, low oil prices, and a soaring stock market.

When the economy and markets are strong, gold is a less attractive asset. During the 90’s to the early 2000’s there was less urgency for a “safe-haven” asset in central bank portfolios.

Central banks began rethinking their position on holding gold in their reserves during the turmoil of the 1997 Asian Financial Crisis. However, it was the Great Recession of 2008 that was the primary catalyst of their dramatic shift. For additional context, the stock market crash that preceded the recession was the worst decline of the past 50 years. Looking at the decade leading up to 2022 we see rising inflation, increasing oil prices, a global pandemic, worsening geopolitical tensions, and declining US dominance over the world economy.

Top Reasons Why Central Banks Purchase Gold

According to the 2023 Central Bank Gold Reserves Survey, the following are the top 4 reasons why central banks hold gold in their country’s reserves:

- Keep foreign exchange reserves in balance

Central banks seek to rebalance their gold holdings to their desired strategic level in line with their geopolitical and economic concerns.

- Stability during times of crisis

Gold has historically proven itself to be a stable “safe-haven” asset during times of economic and geopolitical crises.

- Protection from inflation / long-term store of value

Inflation pushes down the value of currencies. Gold isn’t impacted, negatively, by this downward pressure. In fact, the demand for gold tends to increase with inflation.

- Diversify Portfolio

Gold is a highly liquid and stable asset that is an attractive alternative to volatile fiat reserve currencies. Gold also has an inverse correlation with the US dollar.

Which Central Banks Have the Most Gold?

One fifth of all the gold ever mined is currently held by global central banks. Which central bank holds the most gold in their reserves?

The US Central Bank holds significantly more gold than other global central banks at 8,133 metric tons which is more than double the gold reserves of the #2 central bank of Germany.

Emerging Economies Purchased the Most Gold in 2022

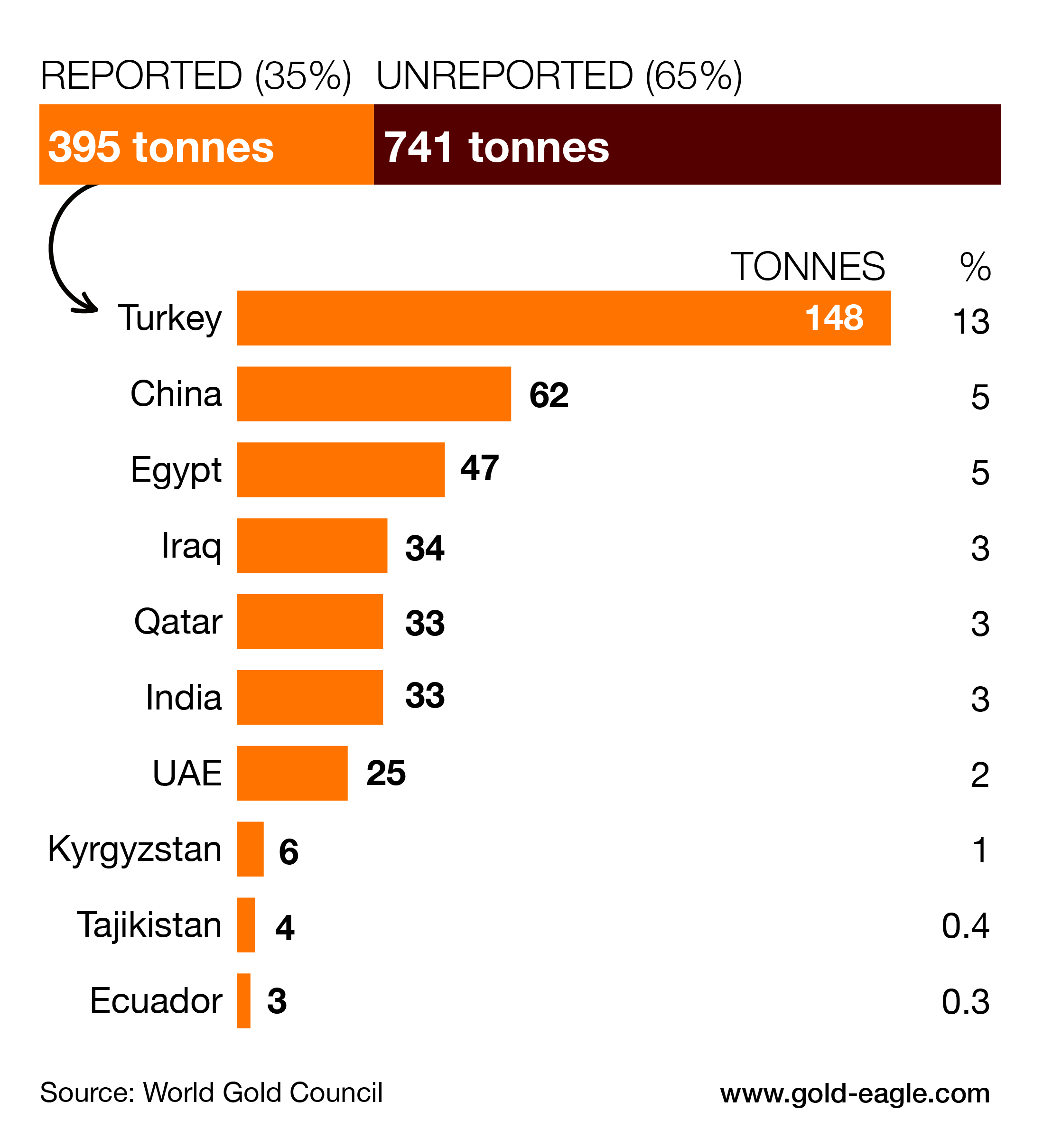

Which central banks purchased the most gold in 2022? The central banks of emerging economies were responsible for most of the central bank gold purchases in 2022.

According to reported gold purchases, Turkey was far and away the largest central bank buyer of gold in 2022 - purchasing 148 tonnes. This was in response to the country’s runaway inflation (72%) and their depreciating currency.

China was the second highest reported buyer of gold at 62 tonnes which was likely sparked by geopolitical events and tensions with the US.

The emerging nations of Egypt, Iraq, Qatar, India and UAE also significantly added to their gold reserves in 2022.

There is a considerable blind spot, however, to central bank gold purchases. According to the World Gold Council, an estimated 65% of the gold buying in 2022 went unreported due to many central banks not sharing their data regularly. China and Russia, some analysts say, are likely the top unreported purchasers.

De-Dollarization of Central Banks

The US dollar has been the primary reserve currency and means of conducting international trade since the end of World War II. But now its continued dominance is in question. There is a strong drive by many emerging economies, Russia and China chief among them, to de-dollarize reserve holdings and set up trade channels using a currency other than the US dollar. Gold is attractive to emerging nations as it can be swapped into any currency for global trade and can skirt western sanctions. If the US dollar were to lose its reserve status, analysts say, it would likely result in a significant depreciation of its value.

Implications for the Individual Investor

Does the record buying of gold by Central Banks have implications for the individual investor?

Central banks have responded to current geopolitical and economic threats by adding physical gold to their reserves. Their concerns about inflation, impending recession, geopolitical tensions, and the decline of the US dollar, are all concerns shared by many individual investors as well. If the world’s central banks turn to gold as a protective measure during these times, should you?

For those considering how best to add gold to their portfolios, there are a number of options to explore. An increasingly popular option is to open a Gold IRA. Gold IRA’s offer similar tax advantages as regular IRA’s but you hold physical gold in a secure depository that is FDIC insured. Physical gold is less susceptible to market risk than paper gold. There are quite a few companies offering Gold IRA’s. This list of the Top 5 Best Gold IRA’s is a good place to start.

Other ways to invest in gold include gold futures and stocks, gold ETF’s (exchange traded funds) and gold mining stocks. To better understand all of these options download this FREE 36 page Gold Investing Guide.