Gold Prices During Recessions

Do Gold Prices Increase During US Recessions? [Infographic]

Gold has a long held reputation as a hedge against an uncertain or failing economy. However, some question whether this view of gold as a safe-haven asset still applies today. We decided to dig into the data for a definitive answer.

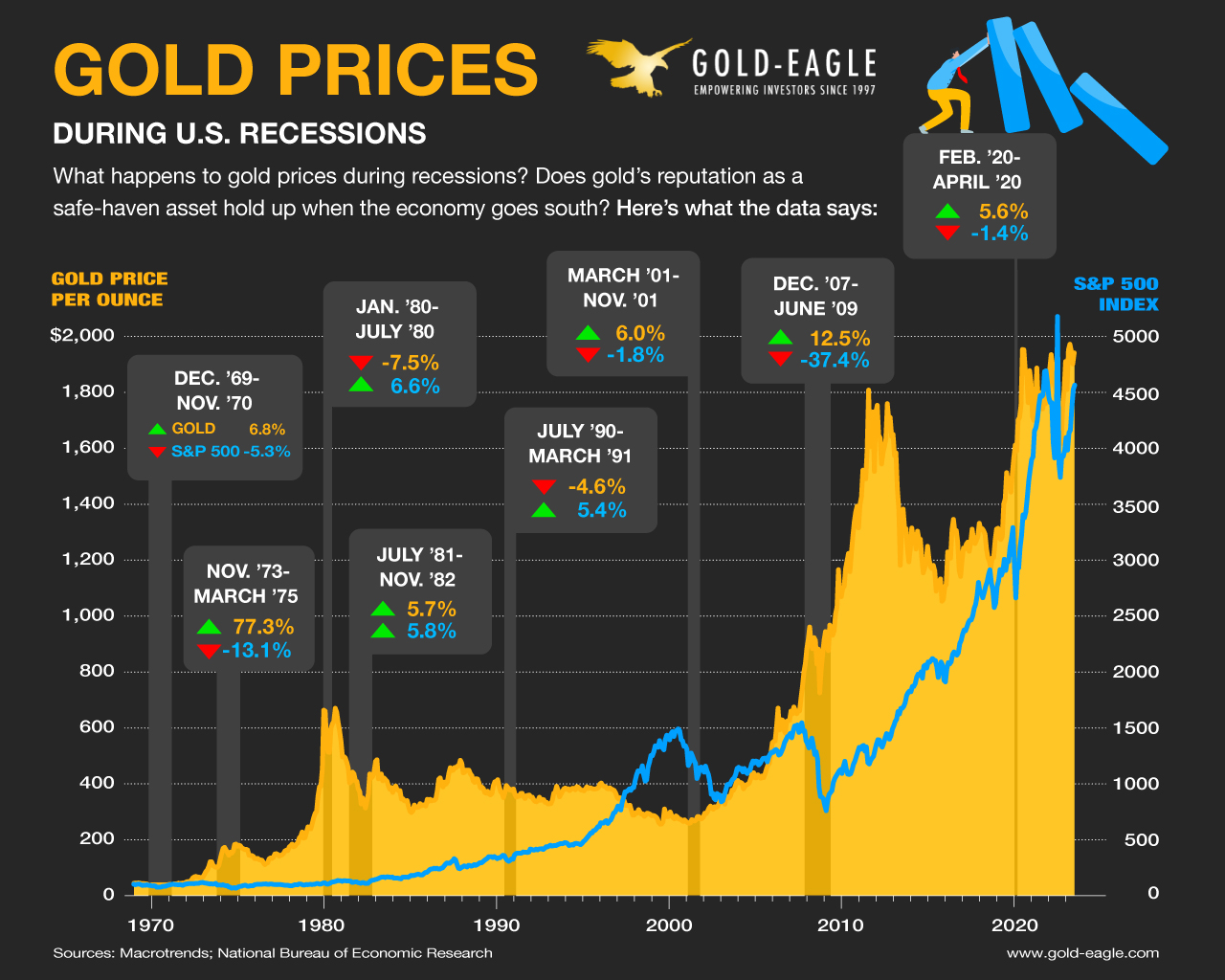

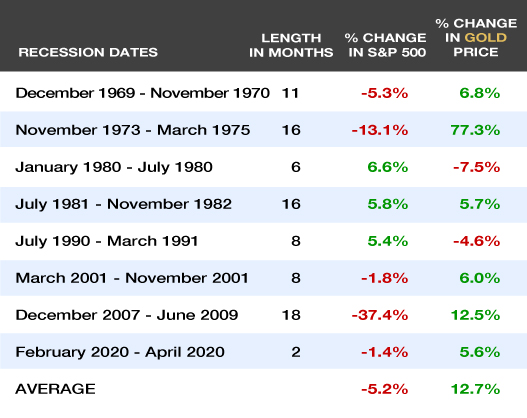

The infographic above shows the eight US recessions since 1970 along with S&P 500 data and gold prices. We used nominal S&P 500 and gold price data from Macrotrends, and the official recession dates from the National Bureau of Economic Research (NBER).

Recessions are about the economy, not the stock market

Before diving into the data, it’s important to keep in mind that the stock market is not the economy but more of an indicator of sentiment in the economy. A recession is a significant and prolonged downturn in the economy as determined by the NBER. Among the factors used in their analysis are: GDP, employment, personal income and spending, industrial production, and retail sales.

Given how recessions are determined, they are a lagging indicator. In other words, by the time the government officially declares a recession has begun, we’ve already been experiencing it - sometimes for many months. And, conversely, by the time a recession is declared “over”, the stock market has often already begun recovering.

Also see “Gold Prices During Stock Market Crashes”.

Price of Gold vs. US Recessions Since 1970

Does having gold in your investment portfolio provide meaningful protection during a recession?

The above comparison of the S&P 500, a proxy for the stock market, with the performance of gold prices provides a clear answer. The analysis reveals that gold outperformed the S&P 500 in 5 out of the 8 US recessions since 1970. In addition, of the 3 recessions where the S&P 500 performed better than gold, one of them was basically a draw. During the sixteen month recession that began in July 1981, the S&P 500 outperformed gold by only .1%.

The Great Recession (December 2007 - June 2009) provides perhaps the best example of gold’s power as a safe haven asset when the country is in a severe economic contraction. During the 18 months of this recession, the longest and deepest since World War II, the S&P 500 tanked -37% while gold prices increased 12.5%.

Gold’s best performance occurred during the sixteen month Oil Shock Recession (November 1973 - March 1975). Oil prices quadrupled, inflation rose to double digits, and growth stagnated ie stagflation. The S&P 500 dropped 13% during this time but gold prices soared over 77%!

Gold’s worst performance was during the six month Energy Crisis recession of 1980 where it experienced a 7.5% decrease. This recession was triggered by record energy prices and huge interest rate hikes by Fed Chairman Volcker to tame inflation. Gold prices often have an inverse relationship with interest rates and this was a prime example. To put more context into this time period, just prior to the beginning of the 1980 recession gold experienced its largest bull market where it soared an astonishing 2,300 percent from its 1970 low.

Looking at the average percent change of all 8 US recessions the value of having gold in your investment portfolio as a hedge against a troubled economy becomes clear. While the S&P 500 declined an average of 5.2%, gold increased an average of 12.7%.

Safe Haven Asset In Your Investment Portfolio

For those considering how best to add gold to their investment portfolios, there are a number of options to explore.

A convenient and increasingly popular option is to open a Gold IRA. Gold IRA’s offer similar tax advantages as regular IRA’s but you hold physical gold in a secure depository that is FDIC insured. Physical gold is less susceptible to market risk than paper gold. There are quite a few companies offering Gold IRA’s. This list of the Top 5 Best Gold IRA’s is a good place to start.

Other ways to invest in gold include gold futures and stocks, gold ETF’s (exchange traded funds) and gold mining stocks. To better understand all of these options download this FREE 36 page Gold Investing Guide.