US Dollar Price Forecast: ECB Rate Decision Looms; Gold, GBP/USD, and EUR/USD Outlook

LONDON (October 17) The US dollar remains steady as investors anticipate key data releases today. Core retail sales are forecast at 0.1%, with the same expected for retail sales. Industrial production is forecast to rise by 0.3%, while unemployment claims are projected to hit 241K, down from the previous 258K.

The Philly Fed Manufacturing Index is expected to improve slightly to 4.2 from 1.7. Gold is trading above $2,681, with a potential boost if economic data underperforms, reinforcing expectations for rate cuts.

Investors will closely watch these figures as they could shape both the US dollar’s strength and gold’s trajectory.

US Dollar Index (DXY) – Technical Analysis

The Dollar Index (DXY) is trading at $103.610, up 0.06%, maintaining a bullish stance above the pivot point of $103.503. Immediate resistance is at $103.698, with further targets at $103.820 and $103.953 if the upward momentum continues.

On the downside, immediate support is seen at $103.382, followed by key levels at $103.190 and $103.031.

Dollar Index Price Chart – Source: TradingView

The 50-day Exponential Moving Average (EMA) at $103.227 is offering strong support, while the 200-day EMA at $102.370 reinforces a broader bullish trend.

As long as the Dollar Index stays above $103.503, the outlook remains positive, but a break below this pivot could trigger a sharp selling trend.

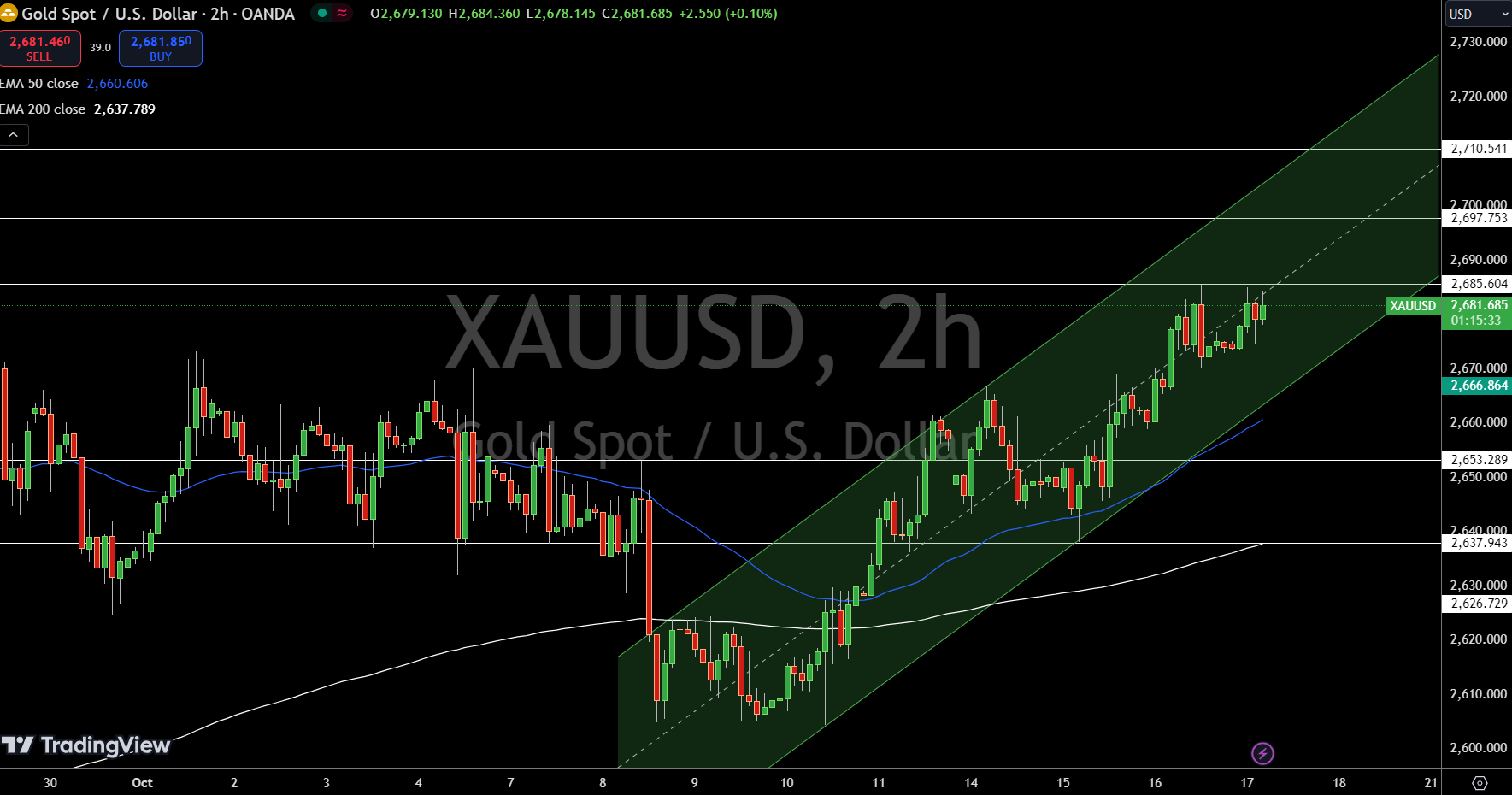

Gold – Technical Analysis

Gold (XAU/USD) is trading at $2,681.69, up 0.31% for the day, holding above the key pivot point at $2,666.86.

Gold – Chart

A break above $2,685.60 could push prices toward $2,697.75 and $2,710.54, while immediate support lies at $2,653.29. The 50-day EMA at $2,660.61 and 200-day EMA at $2,637.79 support the bullish outlook above $2,666.86.

FXEmpire