AngloGold Ashanti Just Doubled Its Dividend Payout Ratio

Strengths

-

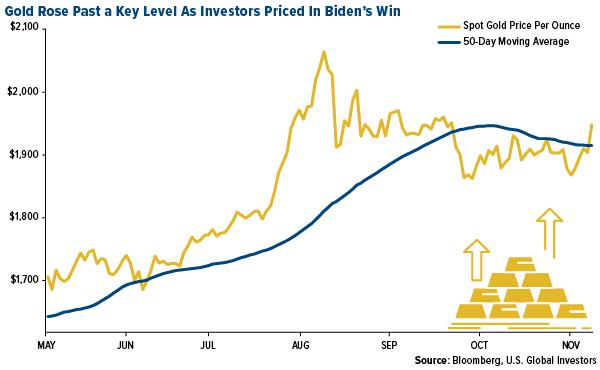

The best performing precious metal for the week was palladium, up 12.64%, despite hedge funds cutting their positioning to a 10-week low. Gold had its best weekly gain since July as Joe Biden moves closer to winning the presidential election and on prospects for further Federal Reserve stimulus. The yellow metal hit a six-week high, also boosted by the declining U.S. dollar. Velocity Trade Capital analyst Michael Siperco wrote this week that the election outcome won’t change gold’s bullish trend as the longer-term macro outlook is already well established to support the metal.

-

Barrick Gold reported its highest quarterly revenue since its 2019 merger with Randgold on stronger bullion prices. The second-largest gold producer announced $3.54 billion in revenue for the quarter ended September 30. Barrick raised its dividend by 12.5% to 9 cents a share.

-

AngloGold Ashanti also doubled its dividend payout ratio due to surging gold prices. Bloomberg notes the world’s third-largest gold producer will now return 20% of free cash flow before growth capital to shareholders. In the September quarter, AngloGold’s free cash flow rose nearly fourfold to $339 million.

Weaknesses

-

The worst performing precious metal for the week was gold, but still up 3.86%. Anglo American Platinum lowered its refined output and sales guidance after shutting its second smelting plan due to water leaks, reports Bloomberg. The company said the shutdown will cut earnings before interest, taxes, depreciation and amortization by $380 million.

-

Kinross Gold reported revenue for the third quarter of $1.13 billion, below the average estimate of $1.17 billion. Revenue was still up 29% year-over-year. Gold production was down slightly year-over-year to 603,312 ounces.

-

The President of Ghana is asking for a second parliamentary review of the country’s proposed gold royalty fund after an initial probe raised concerns, reports Bloomberg. The $500 million IPO was suspended last month after calls by opposition groups who criticized the lack of transparency in the fund.

Opportunities

-

VTB Bank PJSC, Russia’s second-biggest lender and top gold buyer, is betting on precious metals to boost profits. The bank is prioritizing physical gold trading and lending to mining companies as they are one of the few sectors to benefit from the pandemic, said First Deputy Chairman Yuri Soloview in an interview. Bloomberg reports that the bank said it plans to start the first Russian ETF backed by bullion.

-

The Reserve Bank of India said in a report that it is considering diversifying the pool of assets it invests its foreign reserves in, and may increase purchases of gold and dollars, according to Reuters. The report also noted that the bank has already gradually increased gold investments.

-

Rich Ross, CMT of Evercore ISI, noted that “We are living in a material world without inflation, which is genius!” Buy compelling breakouts in gold and silver fueled be the weaker dollar and the inevitability of more stimulus.

Threats

-

The Veladero gold operation in Argentina is selling only enough bullion to keep the mine running due to currency restrictions, said Barrick Gold CEO Mark Bristow on the third-quarter conference call. “Due to the ongoing financial crisis in Argentina, the government has maintained currency restrictions and the forced repatriation of export sales into pesos.” Veladero has had a difficult time due to the nationwide quarantine and winter weather has delayed two projects.

-

Dan Barclay, head of Bank of Montreal capital-markets division, which is the mining industry’s top dealmaker, said that few deals will get done without greater clarity on the economy and pandemic. “There’s lots of conversations going on, lots of people exploring new ways to think and new ways to operate. The probability of a lot of action is going to be conditional on that economic recovery.” According to Bloomberg data, mining companies have been involved in $52 billion worth of acquisitions in 2020, which is less than half the value of deals seen during industry consolidation in the mid-2000s.

-

Southwest Airlines warns workers of first layoffs in company history as just a slice of the estimated 174 million jobs that are expected to be lost by the World Travel & Tourism Council this year due to COVID-19 travel restrictions. With new virus cases exceeding 100,000 per day now in the U.S. it will become increasingly difficult to navigate a clear path to recovery.

Frank Holmes is the CEO and Chief Investment Officer of

Frank Holmes is the CEO and Chief Investment Officer of