Buckle Up: Inflation At 58-Month High

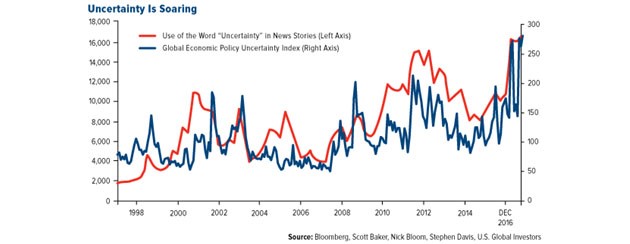

The stage has been set for high levels of uncertainly…and with uncertainty comes opportunities in commodities.

Your Investment Portfolio Must Be Supercharged by March—mine is.

This has been the most important week of 2017.

The trends that are now in motion will set the tone for the entire year, and there are critical statistics to align with.

Back in 2012, when Obama was in office, inflation rates were at 2.5%, precious metals stocks were extremely overvalued, gold was priced at $1,800 per ounce, and Europe and China were slowing down.

Today, after a five-year downtrend, gold has begun moving higher since 2016.

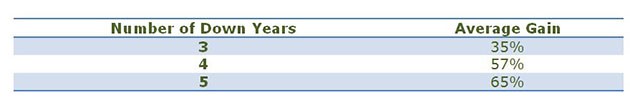

Four consecutive down years in a sector has only occurred 1% of the time since the 1920s, and five down years has almost never occurred.

Uranium and coal are also up substantially after five and six years of downtrends.

Going back to the 1920s, here's the data Wealth Research Group found on fortunes earned for investors on down year trends:

Today presents a rare opportunity in commodities.

What is truly a fundamentally essential key to understand is that today's investing environment is unique. On one end, inflation is rising in the U.S. while interest rates are rising, which means that lending is going to pick up steam. This is all while the new president, who is pro-business, is creating uncertainty in foreign relations.

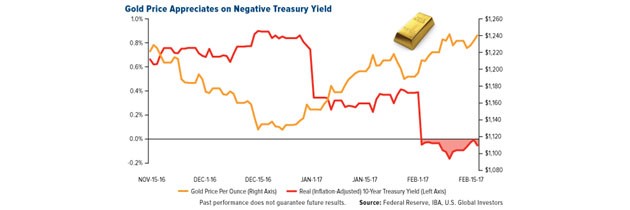

This is a genuinely useful chart, as it points out loud and clear all the fundamental reasons for which gold and silver prices will continue higher.

Uncertainty, coupled with the rising inflation that keeps real rates negative, is the ultimate environment for gold—Fed tightening periods have been wealth-generating moments in the past and are going to be so once more.

This week, Germany has finished repatriation of 300 tons of gold bars from the United States.

Germany's central bank has established the return of its gold reserves to domestic vaults by the end of 2017, three years ahead of schedule.

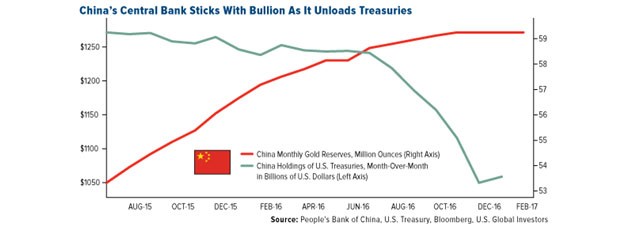

Not only Germany (the only European superpower) left, taking drastic political measures with its reserves, but China, the new global force, is also dumping treasuries at an alarming speed.

No financial analysts from global hedge funds to private equity are noticing an unprecedented phenomenon—Wealth Research Group is the only financial newsletter pointing out this divergence. Governments are now exhibiting high uncertainty, while the business sector is astonishingly optimistic.

There's a record-breaking amount of cash waiting to be invested today, and the biggest buyers with the deepest pockets are large financial institutions and big pharma.

The majority of my contacts in the pharmaceutical industry have told me that managements now have an "open checkbook" and should be looking at two types of companies:

1. Patent-Based Disruptive Technologies: A company that displaces an established technology and shakes up the industry or a groundbreaking product that creates a completely new industry.

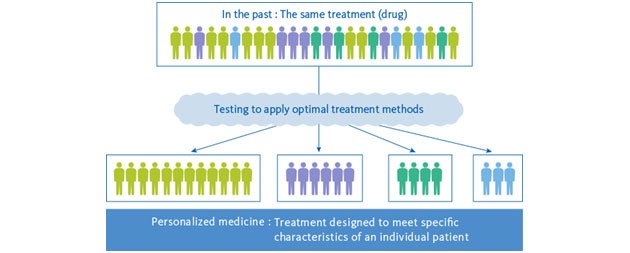

2. Personalized Medicine: Tailoring of medical treatment to the individual characteristics of each patient. The approach relies on scientific breakthroughs in the understanding of how a person's unique molecular and genetic profile makes them susceptible to certain diseases.

This same research is increasing our ability to predict which medical treatments will be safe and effective for each patient and which ones will not be.

The baby boomers are indeed approaching their 60s, but they are spending a fortune on making sure they stay young and vital physically.

Personalized medicine small-cap companies are exactly what cash-rich big pharma wants because these are high-margin businesses with patented intellectual property, which gives them a competitive advantage.

2017 is a unique year to invest. Commodities have turned higher for the first time in five years, and cutting-edge technologies are hunted for by mega-wealthy multinational corporations.

Trump's administration is going to continue to make it easier for deals to materialize.

Investing in the future by positioning now is the formula for investing in disruptive technologies in the medical arena, and companies that sincerely strive to improve lives will flourish.

********

Lior Gantz, an editor of Wealth Research Group, has built and runs numerous successful businesses and has traveled to over 30 countries in the past decade in pursuit of thrills and opportunities, gaining valuable knowledge and experience. He is an advocate of meticulous risk management, balanced asset allocation and proper position sizing. As a deep-value investor, Gantz loves researching businesses that are off the radar and completely unknown to most financial publications.

Want to read more Gold Report articles like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see a list of recent articles and interviews with industry analysts and commentators, visit our Streetwise Interviews page.

Disclosures:

1) Statements and opinions expressed are the opinions of Lior Gantz and not of Streetwise Reports or its officers. Lior Gantz is wholly responsible for the validity of the statements. Streetwise Reports was not involved in the content preparation. Lior Gantz was not paid by Streetwise Reports LLC for this article. Streetwise Reports was not paid by the author to publish or syndicate this article.

2) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

3) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their families are prohibited from making purchases and/or sales of those securities in the open market or otherwise during the up-to-four-week interval from the time of the interview or article until after it publishes.