Bullion And ETFs See Inflows

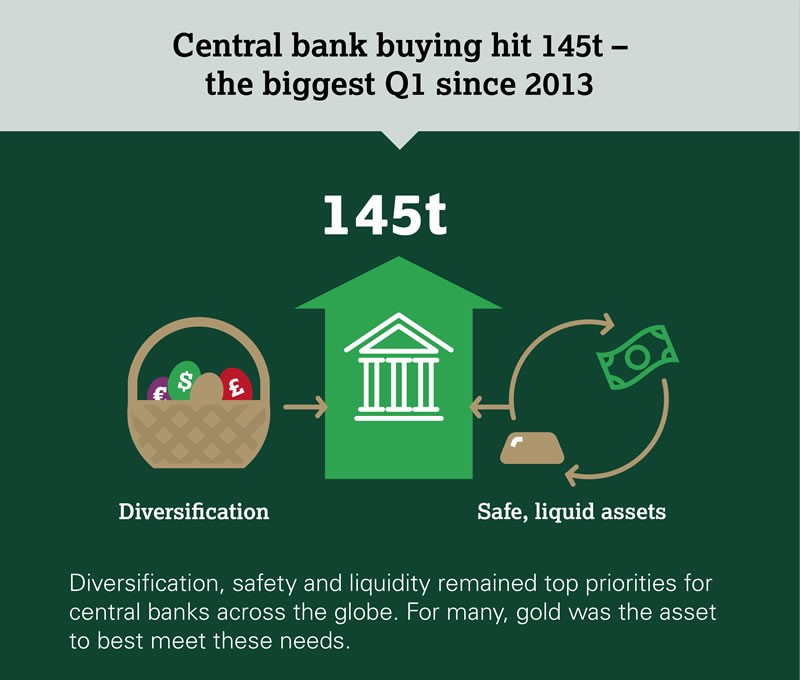

Diversification, safety and liquidity remained top priorities for central banks across the globe.

For many, gold was the asset to best meet these needs.

Global Gold Demand Trends Q1 2019: Global gold demand lifted by central banks and ETFs

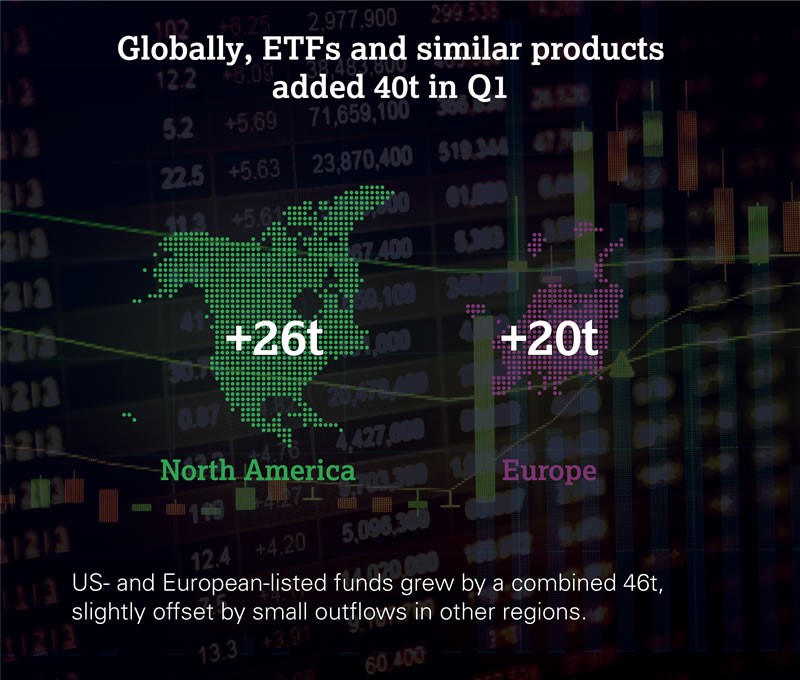

This compares with a relatively weak Q1 2018, when demand sank to a three-year low of just 984.2t. Central bank buying continued apace: global gold reserves grew by 145.5t. Gold-backed ETFs also saw growth: quarterly inflows into those products grew by 49% to 40.3t. Total bar and coin investment weakened a fraction to 257.8t (-1%), due to a fall in demand for gold bars; official gold coin buying grew 12% to 56.1t. Jewellery demand was a touch stronger y-o-y at 530.3t, chiefly due to improvement in India’s market. The volume of gold used in technology dipped to a two-year low of 79.3t, hit by slower economic growth. The supply of gold in Q1 was virtually unchanged, just 3t lower y-o-y at 1,150t.

Highlights

Central banks bought 145.5t of gold, the largest Q1 increase in global reserves since 2013. Diversification and a desire for safe, liquid assets were the main drivers of buying here. On a rolling four-quarter basis, gold buying reached a record high for our data series of 715.7t.

Q1 jewellery demand up 1%, boosted by India. A lower rupee gold price in late February/early March coincided with the traditional gold-buying wedding season, lifting jewellery demand in India to 125.4t (+5% y-o-y) – the highest Q1 since 2015.

ETFs and similar products added 40.3t in Q1. Funds listed in the US and Europe benefitted from inflows, although the former were relatively erratic, while the latter were underpinned by continued geopolitical instability.

Bar and coin investment softened a touch – 1% down to 257.8t. China and Japan were the main contributors to the decline. Japan saw net disinvestment, driven by profit-taking as the local price surged in February.

Gold used in applications such as electronics, wireless and LED lighting fell 3% to 79.3t. Trade frictions, sluggish sales of consumer electronics and global economic headwinds hit the technology sector.

Full Report From The World Gold Council – Download Here

********

Mark O'Byrne is executive and research director of

Mark O'Byrne is executive and research director of