Gold And Fiat Dependence Day

Should American Independence Day be renamed Fiat Dependence Day?

The United States is no longer united. Arguably, the only unifying force that remains amongst races and political parties… is worship of the fiat money voodoo doll.

In 2019 I warned that in 2020-2021, a vicious virus cycle would shock the world.

In the ghoulish Corona wake, I have suggested that in 2021-2025, an even more ominous “dual war cycle” (both civil and global) could follow.

The ill-preparedness of citizens for germ and physical warfare almost certainly relates to their lackadaisical endorsement of government fiat money.

A debt mentality allows citizens to engage in “woke joke” debates, flag fights, etc. The main problem, fiat money, is never addressed, so it gets worse. The US nation stays relatively intact only so long as the lifeblood fiat being printed and borrowed does not create hyperinflation.

I urge the gold community to consider using national government holidays to embrace their own independence from fiat, debt, and government. The bottom line:

Not only do gold bugs need to be their own central bank; they may need to be their own nation too!

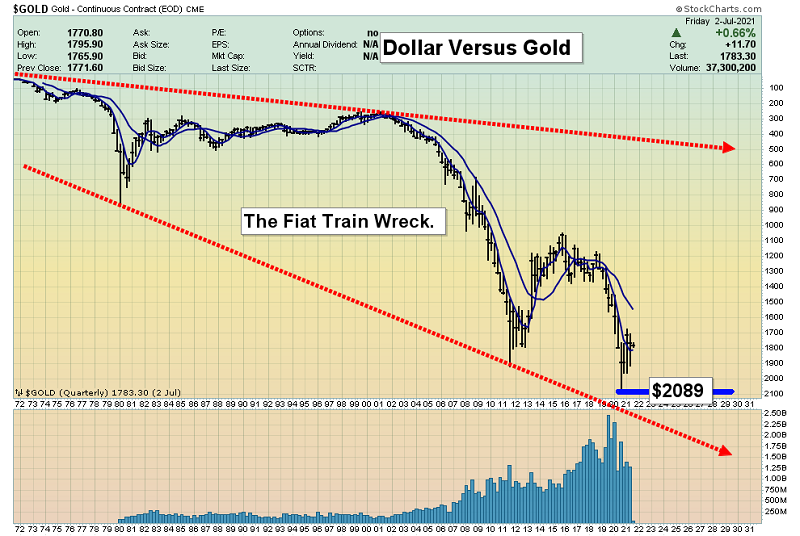

The horrifying big picture chart of US fiat versus gold. My suggestion is to view it regularly.

The Nasdaq stock market signals chart.

It is very important to systematically buy core positions (in any major asset class) during significant price weakness and sell some of them into significant strength.

I bought core positions in the US stock market in 2008, 2011, and in 2020.

Significant stock market strength is here now. My chosen path is to gradually sell about 35% of my stock market holdings in July and August, and then move the proceeds into crypto and gold (private money).

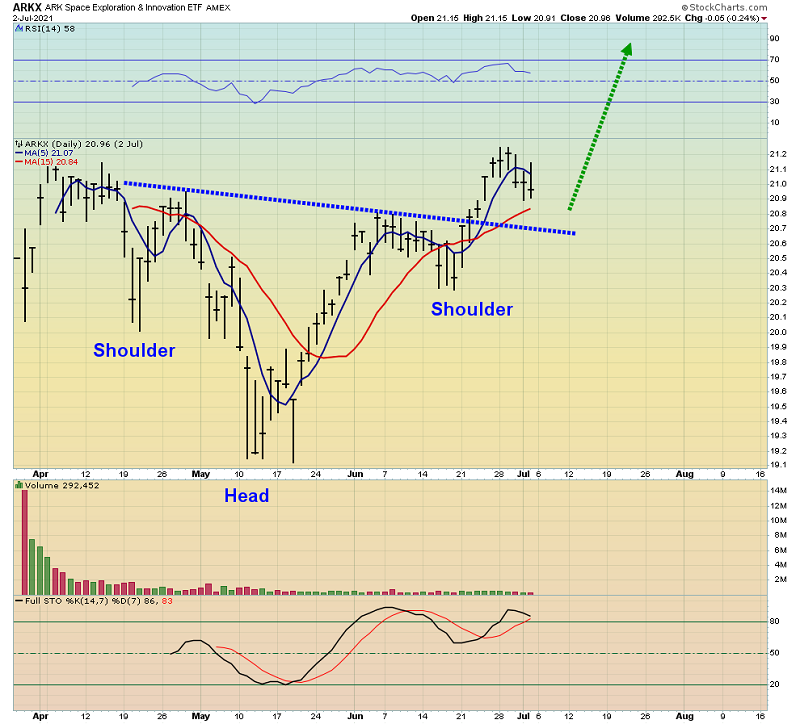

The fabulous space ETF chart. I plan to focus on the space industry with a third of my remaining stock market holdings and trade the short-term moving average signals on the Nasdaq “Q’s” with the rest.

The colonization of the Moon and Mars, and the monetization of space itself, will likely be done with private money (gold and crypto). It will happen much faster than most investors realize.

I will talk more about both the space industry and gold-oriented space money soon.

Gold looks fabulous this morning, and the breakout over $1800 that I have urged investors to cheer for… is here!

Gold looks good and the miners look better. It’s only a matter of time before gold and silver stocks begin to trade more like oil stocks.

Meaning, when there is a swoon in the bullion price, the miners can keep rising so long as they remain cash cows.

The daily GOAU chart. I’m not overly concerned about the sell signal on the key 20,50 moving averages. Here’s why:

The sell signal comes during the formation of a right shoulder of an inverse H&S pattern. Also, moving averages are not lead indicators. They lag.

Note the buy signal on the 14,7,7 Stochastics series. That’s a lead indicator and it looks great!

From a fundamental perspective, what would produce a surge in GOAU over the neckline of the H&S patten?

One answer is almost certainly the return of Indian demand, which is likely in August.

Another would involve the US inflation that money managers thought wouldn’t happen and is now viewed as “transitory”. Some analysts are concerned that the inflation is here to stay. If that concern spreads, gold stocks will surge!

Special Offer For Gold-Eagle Readers: Please send me an Email to [email protected] and I’ll send you my free “GOAU On Steroids!” report. I highlight top GOAU component stocks that investors can own to build their own high-performance version of the ETF, with key tactics to manage risk and enhance performance!

Note: We are privacy oriented. We accept cheques, credit card, and if needed, PayPal.

Written between 4am-7am. 5-6 issues per week. Emailed at aprox 9am daily

Email:

Rate Sheet (us funds):

Lifetime: $1299

2yr: $299 (over 500 issues)

1yr: $199 (over 250 issues)

6 mths: $129 (over 125 issues)

To pay by credit card/paypal, please click this link:

https://gracelandupdates.com/subscribe-pp/

To pay by cheque, make cheque payable to “Stewart Thomson”

Mail to:

Stewart Thomson / 1276 Lakeview Drive / Oakville, Ontario L6H 2M8 Canada

Stewart Thomson is a retired Merrill Lynch broker. Stewart writes the Graceland Updates daily between 4am-7am. They are sent out around 8am-9am. The newsletter is attractively priced and the format is a unique numbered point form. Giving clarity of each point and saving valuable reading time.

Risks, Disclaimers, Legal

Stewart Thomson is no longer an investment advisor. The information provided by Stewart and Graceland Updates is for general information purposes only. Before taking any action on any investment, it is imperative that you consult with multiple properly licensed, experienced and qualified investment advisors and get numerous opinions before taking any action. Your minimum risk on any investment in the world is: 100% loss of all your money. You may be taking or preparing to take leveraged positions in investments and not know it, exposing yourself to unlimited risks. This is highly concerning if you are an investor in any derivatives products. There is an approx $700 trillion OTC Derivatives Iceberg with a tiny portion written off officially. The bottom line:

Are You Prepared?

*********

Stewart Thomson is president of Graceland Investment Management (Cayman) Ltd. Stewart was a very good English literature student, which helped him develop a unique way of communicating his investment ideas. He developed the “PGEN”, which is a unique capital allocation program. It is designed to allow investors of any size to mimic the action of the banks. Stewart owns GU Trader, which is a unique gold futures/ETF trading service, which closes out all trades by 5pm each day. High net worth individuals around the world follow Stewart on a daily basis. Website:

Stewart Thomson is president of Graceland Investment Management (Cayman) Ltd. Stewart was a very good English literature student, which helped him develop a unique way of communicating his investment ideas. He developed the “PGEN”, which is a unique capital allocation program. It is designed to allow investors of any size to mimic the action of the banks. Stewart owns GU Trader, which is a unique gold futures/ETF trading service, which closes out all trades by 5pm each day. High net worth individuals around the world follow Stewart on a daily basis. Website: