Gold And Silver Prices Major Breakout Alert As Dollar Crumbles

This past week has been momentous because the dollar has finally broken down from its giant 3-year long Broadening Top pattern, and fundamental developments suggest that it will continue to weaken, and since it has now broken down decisively, the rate is decline is likely to accelerate. These fundamental developments include the imposition of tariffs, long proven to be self-defeating and economically destructive, which invite retaliation and will slow the global economy, and the administration stating that it wants to see a weaker dollar as a means of increasing competitive advantage, which again will invite a "beggar thy neighbor" response from other powers.

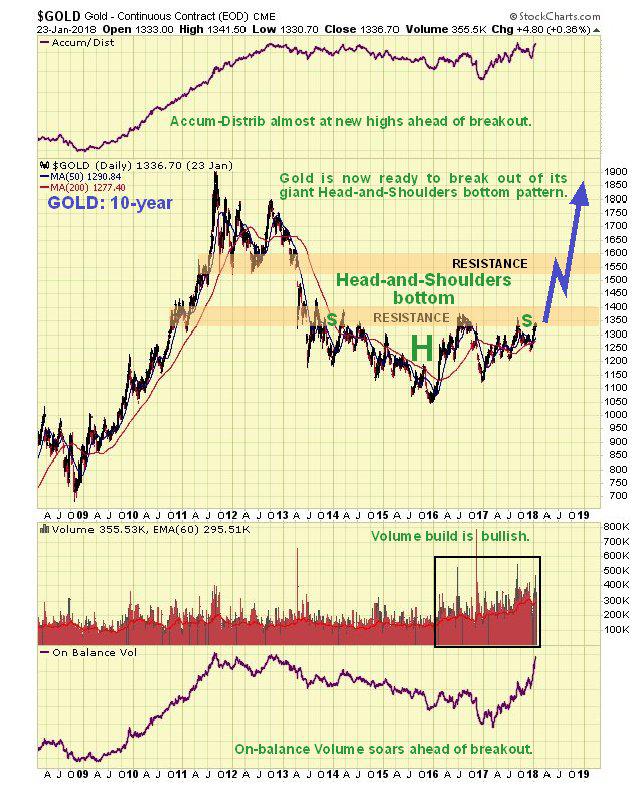

Thus the underpinnings of the stock market rally are being kicked away. The outlook for the dollar is now grim, but on the other hand the outlook for gold and silver could not be better, and they are now limbering up to break out of their giant Head-and-Shoulders patterns, and once they do will enter a vigorous bull market. Gold and silver stocks will soar when that happens, because after years of tough conditions, producing mining companies are slimmed down and efficient and rises in metal prices will go straight down to their bottom lines.

For my subscribers, on Jan. 13, I presented 49 of the best gold and silver stocks for the imminent precious metals sector bull market. In the environment that we will soon be moving into you will basically be able to "throw darts" and pick winners in this sector, while most of the rest of the stock market goes into meltdown.

As we can see below, gold is now in position to break out of its giant base pattern that has taken almost five years to build out. The talk about it being suppressed by manipulation is largely "sour grapes"—the plain fact of the matter is that versatile investors were partying elsewhere, in the broad market, the FANGS, Bitcoin and Cryptos, etc., most of which will soon hit a wall.

Ditto silver, which will take a lot of investors by surprise because it has been more depressed, but has the capacity to rally more strongly.

*********

Clive Maund has been president of www.clivemaund.com, a successful resource sector website, since its inception in 2003. He has 30 years' experience in technical analysis and has worked for banks, commodity brokers and stockbrokers in the City of London. He holds a Diploma in Technical Analysis from the UK Society of Technical Analysts.

Top of Form

Bottom of Form

Disclosure:

1) Statements and opinions expressed are the opinions of Clive Maund and not of Streetwise Reports or its officers. Clive Maund is wholly responsible for the validity of the statements. Streetwise Reports was not involved in the content preparation. Clive Maund was not paid by Streetwise Reports LLC for this article. Streetwise Reports was not paid by the author to publish or syndicate this article.

2) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

Charts provided by the author.

CliveMaund.com Disclosure:

The above represents the opinion and analysis of Mr Maund, based on data available to him, at the time of writing. Mr. Maund's opinions are his own, and are not a recommendation or an offer to buy or sell securities. Mr. Maund is an independent analyst who receives no compensation of any kind from any groups, individuals or corporations mentioned in his reports. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stockmarket analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund's opinions on the market and stocks can only be construed as a solicitation to buy and sell securities when they are subject to the prior approval and endorsement of a Registered Securities Advisor operating in accordance with the appropriate regulations in your area of jurisdiction.