Gold Price And Silver Price Updates

Gold sector cycle is down again.

Gold Sector

$HUI is on a long-term buy signal.

Long-term signals can last for months and years and are more suitable for the long-term investors.

$HUI is on a short-term sell signal.

Short-term signals can last for days and weeks and are more suitable for traders.

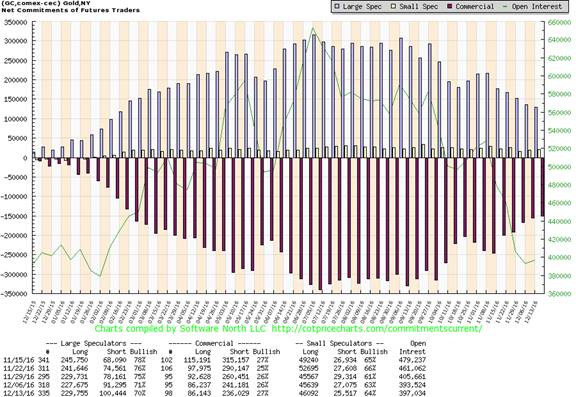

Speculation has dropped below level of previous bottom.

USD – is in a bull market and has been since our major buy signal in 2011. A strong dollar is not friendly to the precious metals.

Summary

Gold sector is on a major buy signal and short-term is on sell signal.

Cycle is down.

Trend is down.

Correction continues.

Caution is advised.

Silver Sector

Silver is on a on a long-term buy signal.

Long term signals can last for months and years and are more suitable for long-term investors.

SLV – short-term is on sell signal.

Short term signals can last for days and weeks and are more suitable for traders.

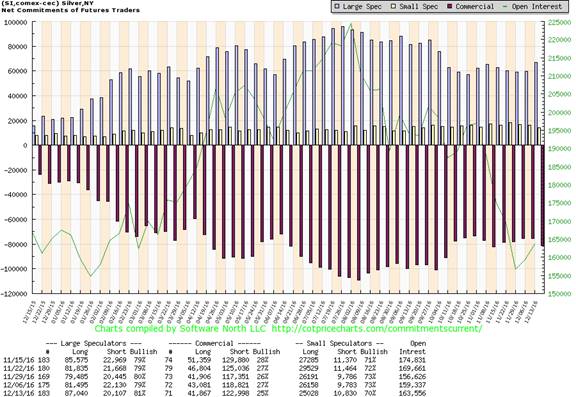

Speculation is now at level of previous bottom.

Summary

Silver is on a long-term buy signal.

Short-term is on sell signal.

Correction continues.

Silver is more volatile than gold, manage your risk.

Courtesy of www.simplyprofits.org