Gold: The Rally Accelerates

Gold’s impressive rally continues to accelerate. Key fundamental and technical price drivers are playing a bullish song with almost perfect harmony.

This may be the most beautiful weekly chart continuation pattern in the history of markets.

Note the awesome stance of the RSI and Stochastics oscillators as gold begins to ascend from the right shoulder low of the pattern.

If Michelangelo could be brought back to life, he would surely consider the picture being painted by the current technical action on this gold chart to be a “bull era masterpiece”.

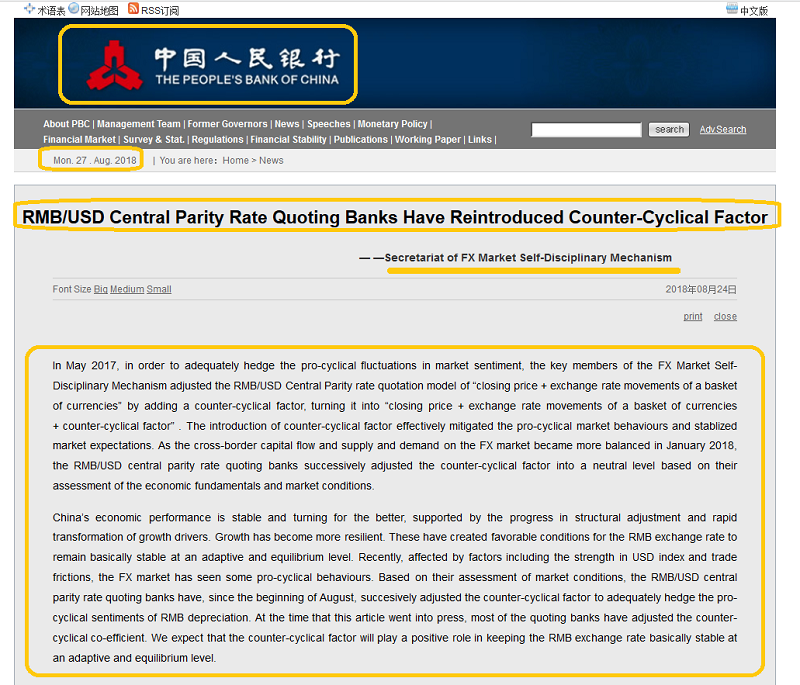

Gold’s fabulous technical posture received a solid fundamental boost from two key central banks on Friday. The PBOC just announced an important change in price discovery for the yuan versus the dollar.

The “tariffs tantrum” created a decline in the yuan versus the dollar, and that’s what created the decline in gold to the right shoulder low.

The yuan is now rallying, and the PBOC announcement should give this rally some serious legs.

If the rupee also begins a rally against the dollar as the strong demand season for gold begins in India, gold’s right shoulder rally could turn into a major barnburner!

US central bank chair Jay Powell also added more fuel to gold’s rally on Friday, when he hinted that rates could be normalized by mid 2019. This powerful central banker also suggested that US GDP growth of 3% cannot be sustained for much longer.

Many analysts hoped that the Trump administration could extend the business cycle and corporate tax cuts have certainly helped to do that.

Unfortunately, Trump has shot most of his economic booster shot bullets, and his administration brings middle of the road republicanism to the table, not libertarianism.

Given the current demographics of the United States (population age, debt, and a declining “petro-dollar”), it’s going very difficult to “make most of the citizens great” with this approach.

Trump himself is a highly skilled business builder. Individuals with his incredible skills can thrive in almost any environment. In a socialist country like China, India, or Germany, Trump would likely be just as successful as he’s been in America, and perhaps even more so due to his incredible drive to overcome adversity.

Unfortunately, the average business owner doesn’t have his skills or energy, and they need vastly more libertarian support than the US government can currently provide.

The bottom line: US population demographics are horrific. House prices in most areas are unaffordable for almost anyone who isn’t rich or hasn’t inherited money. There is no incentive for industry to produce cheap electric cars. Property taxes are outrageously high and still rising relentlessly.

To reach and sustain the kind of long term growth rates that Trump has targeted, the income tax and the capital gains tax can’t just be cut. They need to be eliminated completely.

Back in 2014 I predicted that US GDP would peak in the 4% - 5% range in a single quarter during the 2017 - 2019 time frame. It happened in 2018. I’ve further predicted that GDP begins to fade in 2019 and steadily declines to the 1%-2% range. That prediction looks to be perfectly on track, and I’m sticking with it.

Commerzbank is a member of both the LBMA and the COMEX. Their analytical work command tremendous respect in the institutional investment community.

Their top analysts now suggest that gold will reach $1300 by year-end and $1500 by 2019. I don’t use time targets, but my weekly chart bull continuation pattern for gold bullion is perfectly in sync with their scenario.

This is the Chinese stock market chart. Events in America are lining up with events in China and India to create a picture-perfect gold price surge to the $1500 area in 2019.

This Chinese stock market chart shows the FXI-NYSE ETF in a beautiful bull wedge pattern. The upside breakout that I’m forecasting would put Chinese gold buyers in a very good mood just as the strong demand season begins!

This is the key GDX chart. A Vanguard gold-oriented mutual fund is transitioning to a more “general commodity” holdings approach. That’s put pressure on gold stocks in a “one off” or “black swan” manner as the fund sells a lot of gold stocks to make the transition. The good news is that this selling seems to be largely complete now.

I realise that the gold stocks decline may have caught some investors by surprise, but those with put options for insurance easily took it in stride. This is simply a great and unique opportunity to buy GDX and quality gold stocks near the base of my $21 - $18 accumulation zone.

As the majestic rally from gold bullion’s right shoulder low accelerates, Vanguard’s selling ends, and gold stocks are poised to stage “hypersonic” outperformance against all asset classes. Key fundamental and technical price drivers will soon make all gold stock investors look and feel like they are King Kong, lording over a fabulous bull era!

Special Offer For Gold-Eagle Readers: Please send me an Email to [email protected] and I’ll send you my free “Ten Shooting Stars!” report. I highlight ten of the hottest gold stocks in the world right now, with detailed buy and sell points for each fabulous stock. Email me today, and I’ll send it today!

Stewart Thomson is president of Graceland Investment Management (Cayman) Ltd. Stewart was a very good English literature student, which helped him develop a unique way of communicating his investment ideas. He developed the “PGEN”, which is a unique capital allocation program. It is designed to allow investors of any size to mimic the action of the banks. Stewart owns GU Trader, which is a unique gold futures/ETF trading service, which closes out all trades by 5pm each day. High net worth individuals around the world follow Stewart on a daily basis. Website:

Stewart Thomson is president of Graceland Investment Management (Cayman) Ltd. Stewart was a very good English literature student, which helped him develop a unique way of communicating his investment ideas. He developed the “PGEN”, which is a unique capital allocation program. It is designed to allow investors of any size to mimic the action of the banks. Stewart owns GU Trader, which is a unique gold futures/ETF trading service, which closes out all trades by 5pm each day. High net worth individuals around the world follow Stewart on a daily basis. Website: