Gold Spikes To A 6-Year High Above $1,550

Summary

-

Gold has picked up where it left off on Friday. The safe-haven metal has spiked $20 higher above $1,550 in early Asian trading.

-

Silver is also rallying strongly, up 30 cents to $17.70. This represents a gain of 1.7% vs. gold at 1.3%.

-

These gains are being driven by a number of factors including the intensifying trade wars, growing global debt, Fed course reversal on interest rates, calls for more stimulus, Trump's tweetstorm, geopolitical tensions and an increasingly-fragile stock market.

The price of gold has picked up where it left off on Friday. The safe-haven metal has spiked $20 higher above $1,550 in early Asian trading. It is now near the top-end of the short-term trend channel and the RSI is overbought, but the fundamental drivers of the price advance appear to be accelerating.

Silver prices are also rallying strongly, up 30 cents to $17.70. This represents a gain of 1.7% vs. gold at 1.3%. The silver chart is also overbought and nearing the resistance trendline with the RSI above 70. But this breakout has a tremendous amount of volume behind it and past bull runs have seen silver become extremely overbought before correcting.

These are the highest prices for precious metals since early 2013! These gains are being driven by a number of factors including the intensifying trade wars, growing global debt, Fed course reversal on interest rates, calls for more stimulus, Trump's tweetstorm, geopolitical tensions and an increasingly-fragile stock market. This morning we are also seeing a sharp drop in the U.S. dollar, which had been holding up rather well.

According to CNN, "The US-China trade war ratcheted up yet again on Friday, with Beijing unveiling a new round of retaliatory tariffs on about $75 billion worth of US goods. China will place additional tariffs of 5% or 10% on US imports starting on September 1st, according to a statement posted by China's Finance Ministry. The Ministry also announced plans to resume tariffs on US imports of automobiles and automobile parts. The tariffs would be 25% for vehicles or 5% on parts, and would take effect on December 15th. The new tariffs will target 5,078 products, including soybeans, coffee, whiskey, seafood and crude oil."

Fed Chair Chairman Powell recently said the global economic outlook "has been deteriorating" as he vowed to "act as appropriate to sustain the expansion." This did little to soothe the nerves of investors, but it did send capital fleeing into safe-haven assets like gold.

With election season approaching, look for Trump to do everything in his power to boost the economy and prevent a recession or stock market collapse that would threaten his re-election. The President continues to pressure the Federal Reserve for even lower rates and new rounds of economic stimulus. This is all bearish for the dollar and very bullish for gold.

Given the above outlook, I am revising our 2019 gold price forecast from $1,600 to $1,750. We have positioned Gold Stock Bull subscribers in quality gold mining stocks well ahead of this latest surge higher. While gold is up an impressive 19% in the past 3 months, we have multiple mining stock positions in the GSB Portfolio up 80% or more in the same time period.

Although the technical charts suggest a near-term pullback could be in order, I believe gold and silver prices are headed much higher over the next few years. Thus, I view any pullbacks as buying opportunities and will continue to add physical metals and junior/mid-tier mining stocks on each dip.

I believe we will see capital rushing into this undervalued sector once it is realized that all the juice has been squeezed out of the stock market. Fed policy tools will have a diminishing return and there just isn't much room left to lower rates without taking them negative, an emerging trend in the bond markets.

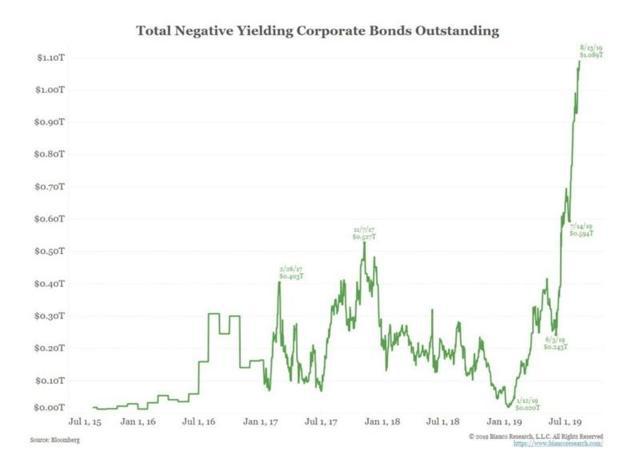

There is now more than $17 trillion in negative-yielding debt. And this is not just government debt, as the past few weeks have seen the universe of negative-yielding corporate bonds more than double to $1.2 trillion.

Imagine just how ludicrous the situation has become…

What if I said I wanted to borrow $100 from you and pay you back $99 five years later? Would you do it? Of course not. Yet, this is happening right now with nearly $17,000,000,000,000 of bonds with negative yields. It's not going to end well.

Bitcoin is also acting as a safe-haven asset or form of digital gold. The price has more than tripled in 2019 and just spiked $500 higher to $10,500 long with the price spike in gold.

Gold and bitcoin are complementary assets with more similarities than differences. Ignore those that claim it is a Ponzi scheme or attempt to pit gold and bitcoin investors against each other. We hold both and view both as important assets that are non-correlated to traditional markets.

In our view, it is wise to be positioned well ahead of the rush into gold and bitcoin from mainstream investors and institutional capital. The sheer amount of money flowing from stocks and bonds into these safe-haven assets will send prices soaring. A massive wealth transfer is unfolding and you want to be on the right side of it. The train has already started to depart the station. Will you jump on board before it is too late?

*********