Goldman Says Gold Is A Better Hedge Than Oil

Strengths

-

The best performing metal this week was palladium, up 6.48 percent, notching its best weekly advance since June. While global car sales are weak, loadings for their catalytic converters are going up with regulatory requirements. Gold traders and analysts were spilt on their outlook for the yellow metal next week after this week saw big price swings due to U.S.-Iran tensions escalating then subsiding. Gold futures swung between gains and losses on Friday as traders assessed slower-than-expected hiring and wage growth against low unemployment. Bloomberg reports that nonfarm payrolls rose 145,000, below expectations of 256,000, and average hourly earnings climbed 2.9 percent – the first below 3 percent reading since July 2018.

-

The Perth Mint reported that gold coin and minted bar sales in December totaled 78,912 ounces – a big jump from November’s 54,261 ounces. BullionVault said the number of first-time precious metals investors using the service grew 25 percent to a two-year high in 2019. The growth was led by clients in the Eurozone. The Royal Mint announced that its bullion division saw a 572 percent boost in sales revenue and a fivefold increase in the average order value over the past weekend compared with the prior weekend, reports Bloomberg. Turkey’s gold reserves rose $2.4 billion from the previous week to bring the central bank’s holdings to $27.5 billion as of January 3.

-

Newmont Goldcorp announced on Monday that it is streamlining its name after last year’s megamerger with Goldcorp. The company will now go by simply Newmont, and has promised shareholders a 79 percent increase in its quarterly dividend. Centamin reported that its fourth quarter gold output at the Sukari mine was up 51 percent from the same period last year for a total of 158,387 ounces. The company said its 2019 total gold production was up 2 percent from the previous year. Bloomberg reports that Sibanye Gold Ltd has exercised its option to buy an additional 168 million shares in DRDGold to take controlling shareholding interest in the surface-tailings producer.

Weaknesses

-

The worst performing metal this week was platinum, down just 0.28 percent on somewhat of a choppy trading week for the metal. Spot gold surged as much as 2.4 percent on Tuesday to cross the $1,600 an ounce mark for the first time since 2013 after news of the U.S. killing a top Iranian general spurred a retaliatory strike on U.S. interests. Geopolitical tensions are historically positive for the yellow metal as it is seen as a perceived safe haven asset. Relations between the U.S. and Iran cooled later in the week and gold subsequently fell back toward $1,540 an ounce. David Govett, head of precious metals trading at Marex Spectron Group, says the “focus will now return to economic drivers as opposed to conflict worries.”

-

The All India Gems and Jewellery Domestic Council said this week that the total business volume of gems and jewellery industry has posted a 30 percent decline in terms of demand over the last six months. Chairman Anantha Padmanabhan claims that due to the increase in customs duty, goods and services tax there was an increase in gold smuggling and customers are opting to purchase gold instead from neighboring countries.

-

Evolution Mining forecasts that its gold production for the full year will be at the low end of 725,000 to 775,000 ounces. The miner reported second quarter all in sustaining costs rose 9.9 percent year-over-year to A$1,069.

Opportunities

-

Goldman Sachs Group Inc. said in a note this week that gold is a better hedge than oil in the Iranian crisis. “History shows that under most outcomes gold will likely rally to well beyond current levels. This is consistent with our previous research which shows that being long gold is a better hedge to such geopolitical risks.” The bank added that “additional escalation in U.S.-Iranian tensions could further boost gold prices.” According to Citigroup, spot gold prices might breach $1,625 an ounce this quarter due to elevated geopolitical risks sending investors to seek tail risk hedges.

-

Brazil plans to allow mining in Amazonian indigenous reserves. Bento Albuquerque, a Navy admiral, told Bloomberg News in an interview that “a majority of the 600 indigenous communities want this” and “nothing is more damaging to the environment than illegal activity.” Although a negative step toward protecting Amazonian lands, the new bill aims to reduce illegal mining, which is more harmful than legal mining operations. The Amazon Geo-Referenced Socio-Environmental Information Network estimates that there are 453 wildcat mines in the Amazon already.

-

Scottie Resources Corp. announced positive drill results this week at its Bow Property in British Columbia. Highlights include a drill hole with 73.32 grams per ton of gold and 71.01 grams per ton of silver over a 4.38 meter length. Just days after the results were released, Scottie announced a $2 million private placement financing with Eric Sprott.

Threats

-

2019 was a great year for jobs, but it was also the worst since 2011. Friday data was released showing that employers added 145,000 jobs in December, down from 266,000 in November. Bloomberg’s Reade Pickert writes “the broader picture of a slowdown is in line with what many economists expected in the 11th year of the record-long U.S. expansion, with fading stimulus from tax cuts and headwinds from tariff uncertainty also weighing on hiring.” Pickert adds that a slowdown in jobs growth could weigh on President Trump’s re-election chances.

-

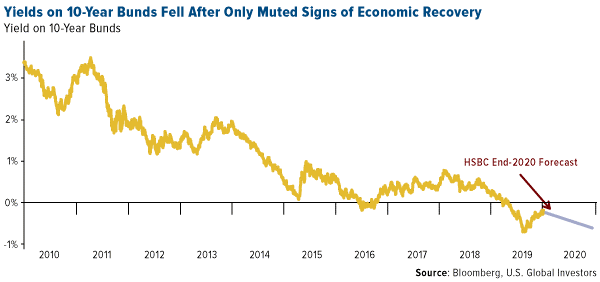

According to HSBC Holdings, there will be more joy for bond bulls in 2020 as sovereign bonds have smashed expectations in the last ten years. Steven Major, global head of fixed income research, says “low-for-longer interest rates are a reality, no longer a forecast.” In a Bloomberg Opinion piece, Brian Chappatta writes that the bond market looks incredibly expensive as the 30-year Treasury yield is just a few months removed from its all-time low of 1.9 percent. Chappatta cites the “Sherman Ratio”, which shows the amount of yield investors receive for each unit of duration, and it is close to the lowest level ever. This means it would take a smaller move higher in interest rates to wipe out the income return on a fund tracking the Bloomberg Barclays U.S. Aggregate Bond Index. Chappatta says the corporate bond market is “truly frightening” as the Bloomberg Barclays U.S. Corporate Bond Index hit a record-low yield-to-duration ratio that week after a relentless decline in 2019.

Tax shield investors are piling into funds that plan to take advantage of “opportunity zone” tax incentives that were introduced in the late-2017 tax overhaul signed by President Trump. Investors added $2.26 billion into funds, a 51 percent jump from December, reports Bloomberg. Noah Buhayar writes that opportunity zones were once heralded as a novel way to help distressed parts of the U.S., but they are now being slammed as a “government boondoggle.” The perks of such investing are being used to “juice potential investment returns in luxury developments” and “reports have shown that politically connected investors influenced the selection of zones to benefit themselves.” Meanwhile, an increasing number of hospital bankruptcies have left sick and injured with nowhere to go for treatment. According to data compiled by Bloomberg, at least 30 hospitals entered bankruptcy in 2019 as Americans are leaving rural areas in favor of urban centers. The American Hospital Association calculated that payments from Medicare and Medicaid lagged costs by $76.6 billion in 2018, leaving hospitals struggling to make up for the difference in government reimbursements.

*********

Frank Holmes is the CEO and Chief Investment Officer of

Frank Holmes is the CEO and Chief Investment Officer of