US Mint Reports Astounding Gold And Silver Demand

Strengths

- In a down week for most markets, silver fared the best, falling only 0.11 percent. There was no particular story supporting the move, but note that silver really didn’t fully participate in the precious metal rally last week and perhaps had less to lose.

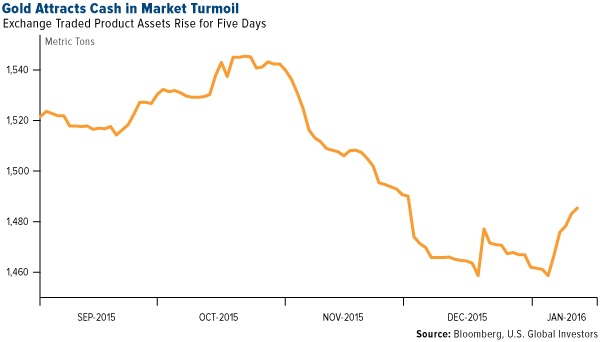

- Over the past five days investors bought 26.8 metric tonnes of bullion through exchange-traded products backed by the metal, according to Bloomberg, the most since January 2015 as seen in the chart below. In addition, Reuters says gold and silver demand is off the charts; the U.S. Mint sold nearly as much gold on the first day of 2016 as in all of January 2015, with silver sales equally as astounding.

- HSBC believes that gold has “shrugged off” two bearish developments, a strong dollar and weaker commodity prices, announcing that they remain bullish on the precious metal. The group sees good emerging market demand, eventual dollar declines and central bank accumulation helping gold this year. As reported by Bloomberg, the FTSE/JSE Africa Gold Mining Index, which rallied 20 percent this year, has had the best start since 1995.

Weaknesses

- Platinum faced the worst losses this week with a 5.75 percent price decline. Price action seemed to track the falling equity markets but in countries like South Africa and Russia, which have had falling local currencies, the incentive to continue producing remains attractive.

- Rubicon Minerals is having a rough start to the year, tumbling nearly 80 percent for the week, after a revised new resource estimate showed a significant decrease in metric tons and ounces compared to a 2013 report. Similarly, Royal Gold extended its drop (24.5 percent for the week) after an update on its Phoenix Gold Project, and Eldorado Gold tumbled 29.85 percent due to “Greek mining woes,” as reported by Bloomberg.

- The controversial Pebble Mine project, a proposed gold mine near Alaska’s Bristol Bay, was deemed an environmental risk by the Environmental Protection Agency which is moving toward a formal decision to bar mining operations there. The EPA, however, was questioned on its “misuse of authority,” according to the Washington Post, and now the group’s internal watchdog has announced there is “no evidence of bias in the agency’s efforts.” Critics who have followed the EPA’s review process noted that the EPA investigator did not consider a significant body of publically available information brought to light by the Congressional Science Committee that demonstrates clear instances of bias and predetermination.

Opportunities

- Evercore ISI took a look at sectors they believe are candidates for being “exalted” in 2016, meaning those that have underperformed over the past several years, but could now perform in excess of their index. Of these “exalted” industries, gold makes the list. Jeremy Wrathall of Investec is quoted this week in Mineweb reinforcing ISI’s annual rotation picks, stating “we will see a very different mining industry in 12 months’ time…those who haven’t got debt will reshape the industry.”

- In its Technical Outlook 2016, UBS writes that the seven-year cycle in equities is rolling over and now it’s time to “buy gold.” The group warns investors not to be surprised by “record spikes in volatility over the next 12 to 17 months.” Adding to UBS’ rhetoric, U.S. Treasury Secretary Lawrence Summers is quoted in Bloomberg this week saying that “risks are substantially tilted to the downside,” when it comes to global commodity and stock markets.

- Jeffrey Gundlach, CEO of DoubleLine Capital and one of the first to predict the oil price crash in 2014, thinks that gold could surge this year. Gundlach believes that as investors look for safe haven assets in a volatile market, the precious metal could “soon climb” 30 percent higher from its current price, according to an article on StreetTalk.

Threats

- Gold demand in India could take a hit this year as farmers are likely to reduce buying on account of a poor crop production this season, according to a CommodityOnline article. This could also mean that gold demand will see a dent during wedding season. Experts predict a 10 to 15 percent dip in purchases this year.

- According to Pranabesh Ray of the Xavier School of Management (during a conference on e-waste this week), 50 pounds of gold and 20,000 pounds of copper could be extracted from one million discarded cell phones if processed properly. “E-waste,” which comprises precious metals like gold and silver, can produce more gold than what is obtained through mining, according to a Bloomberg article recapping the conference.

- Bullion may drop to around $995 per ounce in the fourth quarter, according to Societe General’s Asia Head of Commodities Research Mark Keenan. During a Bloomberg TV interview this week Keenan reminded viewers that SoGen has been bearish on gold for some time.

Frank Holmes is the CEO and Chief Investment Officer of

Frank Holmes is the CEO and Chief Investment Officer of