Gold price slumps as traders eye US CPI, Trump–Putin summit

NEW YORK (August 11) Gold price dives during the North American session as traders waited for the White House resolution on duties over physical Bullion bars, which triggered a downturn last Friday in the futures market. Traders awaiting the release of inflation data in the United States (US) pushed spot prices down. At the time of writing, XAU/USD trades at around $3,360, down over 1.20%.

Demand for Gold took a hit due to speculation that the meeting between US President Donald Trump and his Russian counterpart, Vladimir Putin, on Friday could unveil a truce plan in Ukraine. The recovery of the US Dollar amid falling US Treasury yields drove Bullion prices below the $3,400 mark.

On Tuesday, the US Bureau of Labor Statistics (BLS) is expected to release the Consumer Price Index (CPI) for July. Estimates suggest that headline inflation would be at around 2.8% YoY, up from June’s 2.7%. Core CPI is projected to rise above the 3% threshold for the first time since February 2025.

US President Donald Trump posted on his social network that Gold will not be tariffed.

Ahead this week, the US economic calendar will feature the release of inflation on the producer front, jobless claims, Industrial Production data, Retail Sales and the University of Michigan Consumer Sentiment for August. Alongside this, speeches by Federal Reserve (Fed) officials will be scrutinized.

Daily digest market movers: Busy US economic docket to drive Gold prices

- The current week’s economic data will be eyed following the latest jobs data, which has shown signs of cracking. However, if the July CPI rises, Fed officials' reaction to the data will be crucial. If they stress that price stability would be the priority, this could drive Gold prices lower. Otherwise, if the disinflation process progresses, then Bullion might be headed higher as US yields are expected to drop.

- Following CPI, traders will also eye the evolution of the labor market and consumer spending via Retail Sales, which are expected to dip from 0.6% to 0.5% MoM in July. The week will end with the release of US Consumer Sentiment, which is projected to improve from 61.7 to 62 in August’s preliminary reading.

- The US Dollar Index (DXY), which tracks the performance of the buck’s value against a basket of its peers, is up 0.26% at 98.52. The US Dollar’s recovery capped Gold’s advance toward $3,400.

- The US 10-year Treasury note yield is down two basis points, sitting at 4.265%.

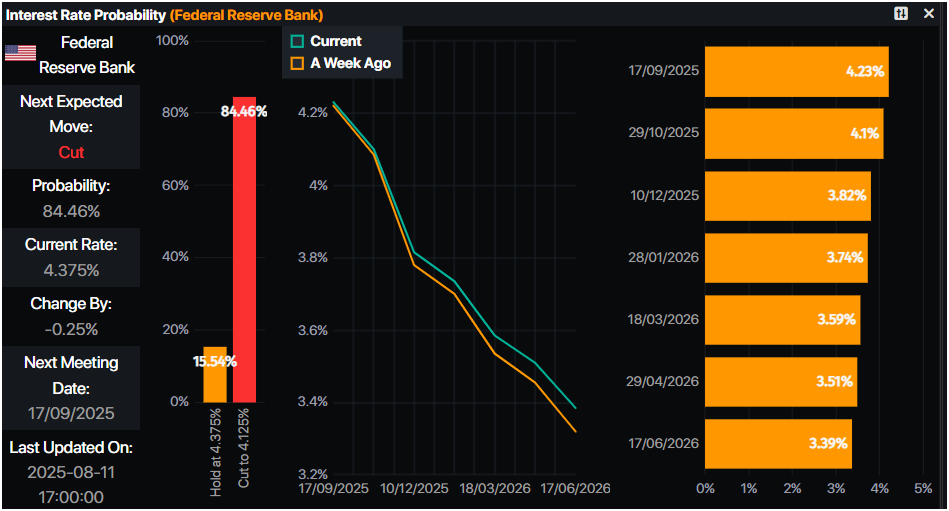

- Fed Interest Rate Probabilities show that traders have priced in an 84% chance of a 25 bps rate cut at the September meeting, according to Prime Market Terminal data.

FXStreet