US should brace for a 30% recession in stock market, legendary forecaster says

NEW YORK (May 15) Seasoned forecaster Gary Shilling raises a red flag for investors, warning of a potential recession that could have severe implications for the stock market this year.

He predicts a downturn due to weakening job market indicators and investor overconfidence, which could lead to a 30% drop in stock prices.

Shilling highlights the recent surge in risky assets like stocks and cryptocurrency as a concerning sign. He notes that historically, such speculation often precedes market corrections.

‘You look at all the kind of speculation that we’ve had out there; it’s indicative of a lot of overconfidence, and that usually gets corrected and corrected violently,’ he said in an interview with Business Insider on May 6.

Shilling was one of the investors in the mid-2000s who accurately predicted the subprime mortgage bubble.

Weakening labor market and savings as main signs of recession

Key indicators of economic weakness include high interest rates, a weakening labor market, and a decrease in job turnover rates. Shilling believes that companies have retained more workers than necessary due to labor shortages during the pandemic.

Still, layoffs may increase as the economy falters, leading to unemployment rates of 5% to 7%.

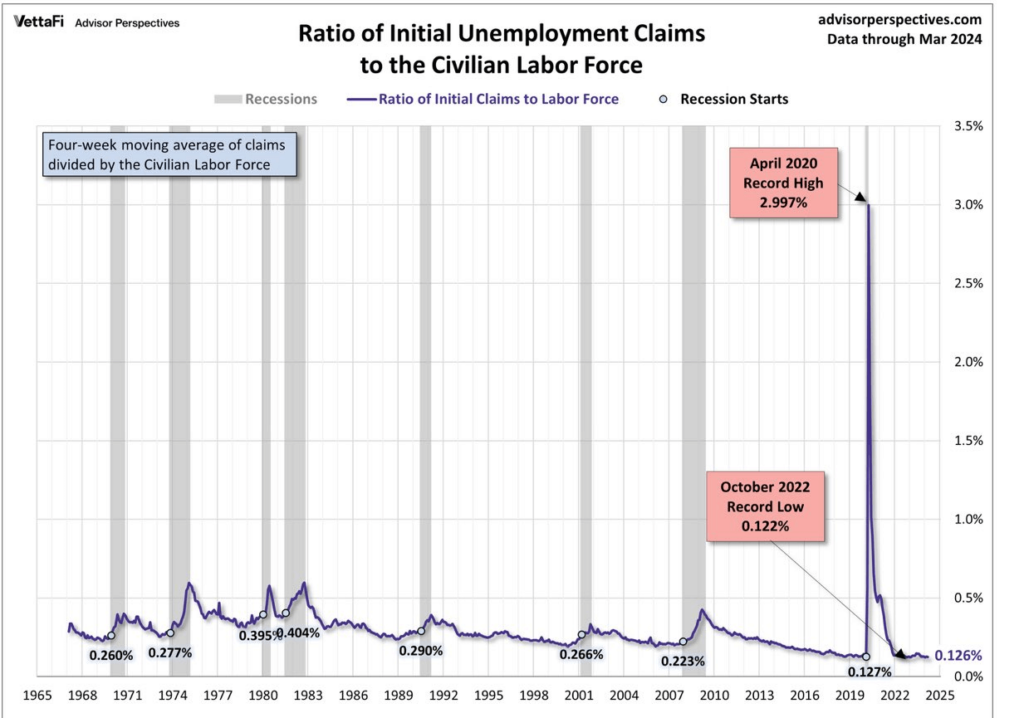

Rise in jobless claims in the US. Source: Logan Mohtashami

Rise in jobless claims in the US. Source: Logan MohtashamiAdditionally, consumer savings from the pandemic have likely been depleted, exacerbating the potential impact of job losses. Recession indicators, such as the 2-10 Treasury yield curve and the Conference Board’s Leading Economic Index, have been flashing warning signs for months.

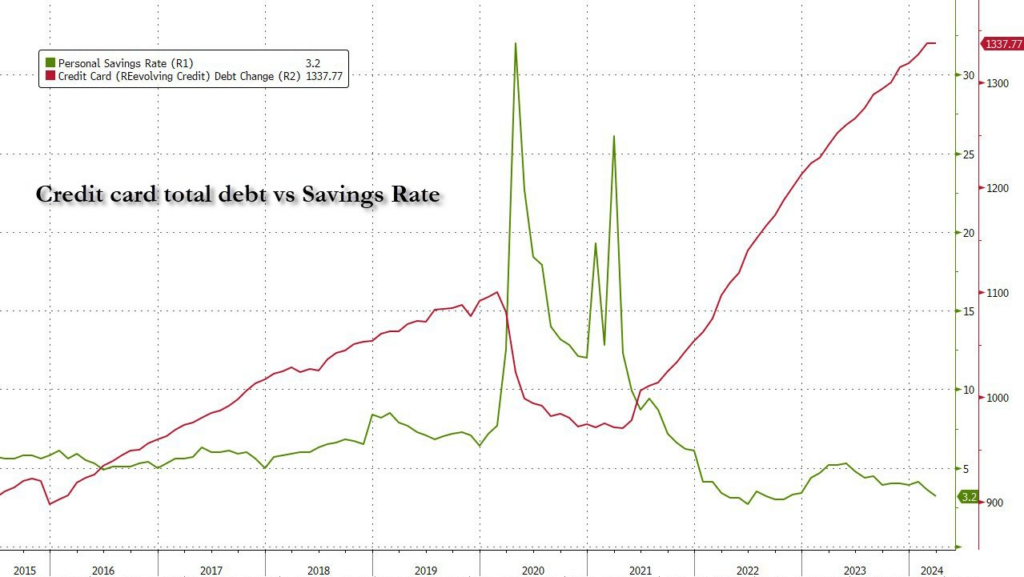

The disparity between credit card debt and consumer savings in the US. Source: zerohedge

The disparity between credit card debt and consumer savings in the US. Source: zerohedgeShilling goes against the bulls on Wall Street

Shilling’s bearish outlook starkly contrasts the prevailing optimism among Wall Street strategists, such as Oppenheimer’s John Stoltzfus and Bank of America’s Savita Subramanian. He underscores the significance of considering contrarian perspectives, empowering investors to make informed decisions as consensus views may already be factored into market prices.

This contradicts the bullish sentiment on Wall Street, where many predict that the S&P 500 index will reach record highs in 2024. There’s also the expectation of at least one interest rate cut from the Federal Reserve, even though the market initially projected at least four rate cuts at the beginning of this year.

FinBold