Gold Price Forecast Of Plausible $12,600 By Year 2020

Since 1967 the gold price has enjoyed two secular bull markets:

Since 1967 the gold price has enjoyed two secular bull markets:

- The first began in 1967 and ended in January 1981.

- The second began in 2001 and is still in progress.

Here’s what happened in the first secular gold bull market.

Since 1934-1967 the US maintained the Gold Standard by keeping the gold price at a rock solid $35/oz. However, in late 1967 the Governors of the Central Banks of Belgium, Germany, Italy, Netherlands, Switzerland, United Kingdom and the United States convened in Frankfurt on November 26, 1967. There were severe accusations of Gold Price Suppression, Currency Swaps, Assorted Market Manipulations and Interventions. The upshot of this meeting released the heretofore iron hold of the gold price at $35/oz. Consequently, slowly but surely the gold price began to rise. Ergo, the first secular gold price bull was born.

The first chart below shows how the gold price continued rising from 1967 to its peak in 1975. Gold had effectively risen +457% in eight years ($35 to $195/oz). And as will happen in all secular bull markets, the gold price entered into correction. Subsequently, the gold price declined -49% -- and bottomed at $102/oz in 1976.

Once the correction ran its course, the gold price began its second leg up in this secular bull market. Hence, gold soared +763% during the next four years…peaking at $880 in January 1980. The price driving force for the gold price going viral was rampant hyper-inflation created by the irresponsible Jimmy Carter Presidency. (See first chart)

Spot Gold Price 1960-1981

Chart courtesy of http://www.sharelynx.com/

After the blow-off peaking in January 1980, investors worldwide quickly became disenchanted with the shiny yellow. Consequently, the gold price went into a Bear Market mode…relentlessly falling -71% ($880 to $102/oz) from 1980 to 2001. (See next chart)

Spot Gold Price 1980-2001

Chart courtesy of http://www.sharelynx.com/

A Second Secular Gold Bull Market Is Born In Early 2001

The second (i.e. current) secular gold bull market was birthed with the new millennium. Indeed, investors worldwide stampeded to buy gold as it bottomed at about $256/oz in 2001. And from 2001 to late 2011, the gold price soared hyperbolically +650%. But as all secular bull markets occasionally correct (regardless of asset class), gold too has corrected down 39% during the past three years. Consequently, the shiny yellow today is grossly over-sold…taking into account its extremely bullish fundamentals.

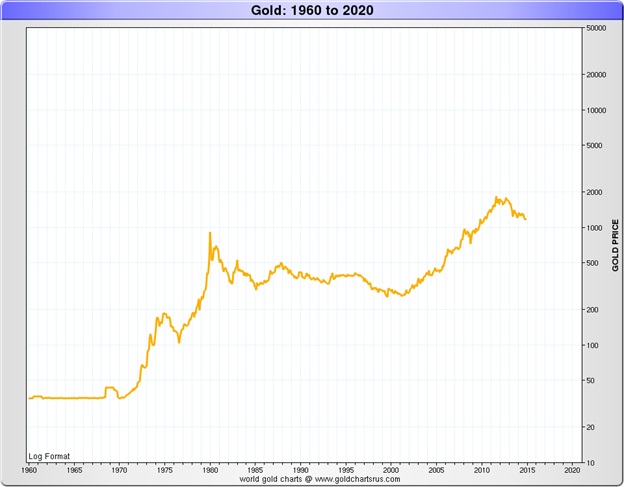

The gold price chart below covers the period from 1960 to 2020 (i.e. 60 years). It is imperative to notice the Price “Y-Axis” is in Logarithmic Scale…as this study suggests the US$ price of gold can go viral from here to the year 2020.

Chart courtesy of http://www.sharelynx.com/

Gold Price Secular Bull Forecast

The gold price forecast shown below is based upon gold price history and data of its two previous bull markets as detailed above…and their respective Compound Annual Growth Rates (CAGR).

- The CAGR of the gold price from 1967 to its peak in 1975 was +24% (during each of eight years)

- The CAGR of the gold price from 1976 to its peak in 1980 was +71% (during each of four years)

Basic Assumptions:

- The price of gold is presently bottoming in the $1,200 area.

- The next leg up in this secular bull market might project an average of the two aforementioned secular bull runs…that is to say the CAGR for gold might be +48% during each of the next six years.

Secular Bull Gold Forecast could possibly reach $12,600 by 2020.

Some skeptics may think this gold price prediction might be somewhat too high. However, internationally known gold pundit Jason Hamlin hit it on the head when he observed: “Gold at $10,000 or higher is not as unlikely as many people would think…In the worst case scenario of hyperinflation or a collapse of the US dollar, even some of the most outrageous gold predictions could end up being low.” See Hamlin’s brilliant latest wisdom Gold Price Forecast for Next Six Months: Buckle Up! …and… $10,000 Gold, Is it Possible? –

Worldwide economic conditions are testament to Gold’s Bullish Fundamentals that support ever-rising gold values going forward. Here are 10 of the more important factors that will indubitably fuel higher gold prices for many years to come:

- Increased likelihood of a US recession…and a market crash due to grossly over-valued stocks.

- The probability the Euro Union will implode, thus trashing the value of the Euro currency.

- Major world Central Banks are increasingly buying more gold for their nation’s reserves.

- Peoples Bank of China methodically continues to pursue its covert objective to replace the US$ with the Renminbi as the world’s reserve currency…and to dramatically reduce its US$ FOREX risk.

- Russia’s Putin sparks World War III over the growing turmoil in the Ukraine.

- Inflation and interest rates might soar as they did in the late 1970s under President Jimmy Carter, when gold price soared +507% ($140-$850) from 1977 to 1981 (a CAGR = 56.9%).

- In the first secular gold bull market, the number of investors in gold reached 5% of total investors worldwide. Today only about 1% of investors worldwide invest in gold. But as gold begins to rise, investors globally will again flock and stampede into the shiny yellow…thus fuelling the gold price into the stratosphere…where no man has gone before!!!

- Growing Global Gold Demand continues to outpace flat mining Supply. Prices must rise.

- Possible future currency devaluation contagion among all major countries.

- Internet marketing is instantaneous…allowing for worldwide communication of all the above.

This begs the question:

What effect might a much higher gold price (i.e. $12,600/oz) have on Gold & Silver Stocks (HUI Index)?

In a few words….HUI would go viral into orbit. Here’s how and why:

History is testament the HUI Index is much more volatile than gold itself (i.e. on the upside and on the downside). In deed and fact the HUI/Gold ratio is today (0.14) as low as it was in 2001 (when the present secular bull market made its debut into the international investment world (see chart below).

Consequently and in the event gold soars to the above $12,600/oz secular bull market forecast, the value of the HUI/Gold ratio might conceivably again reach 0.60 as it did in 2003, 2004 and 2006. And therefore the value of the HUI Index will have soared exponentially to about 7560. That means HUI’s value will have increased about 3,900% from today’s value of only 165.

Indeed…a once in a lifetime opportunity.

********

Related Articles:

Bullish Fundamentals To Push Gold Above $3,000 by 2020 (Gold Price Forecast)

Gold Price Forecasts And Gold Predictions For This Secular Bull Market

Gold Price Forecast Per Growth In US Money Supply

Gold Price Forecast Per US Federal Reserve Balance Sheet

Golden Opportunity For Global Investors

China Goes For The Gold As Beijing Gold Demand Goes Parabolic

Gold Price Forecast for Next Six Months: Buckle Up!

Central Banks Will Help Forge The Future Price Of Gold

Why Gold Is Headed Much Higher

Grandmaster Putin's Golden Trap

********