50-Year High In Central Bank Gold Purchases

Strengths

- The best performing metal this week was palladium, up 2.04 percent as hedge funds increased their net-long position in the futures market to a five-week high. Gold traders and analysts are mostly bullish going into next week in the Bloomberg survey amid mixed signals over progress in the U.S.-China trade war. The yellow metal climbed sharply early in the week after President Trump said that he would be willing to wait another year before striking a deal with China.

- The ISM non-manufacturing PMI fell to 53.9 in November, missing the median estimate of 54.5. Bloomberg reports the decrease was driven by the weakest reading of business activity since 2010. Gold rebounded slightly on Wednesday after ADP data showed fewer-than-expected jobs were added to the economy.

- Australia’s Perth Mint reported a 67 percent increase of sales of coins and minted bars in November from October of 54,261 ounces. This buying is largely driven by purchases by Britons amid uncertainty surrounding Brexit. The Australian Bureau of Statistics shows that Britons bought $5.3 billion of Australian gold in the third quarter of this year, which is the most ever in a single quarter and a 1,400 percent increase over the prior quarter.

Weaknesses

- The worst performing metal this week was silver, down 2.67 percent on little news. According to a government report on Friday morning, the economy added 266,000 jobs in November, the most since January. Gold fell sharply on the news. Gold imports by India fell for a fifth straight month in November amid the slowest economic growth in six years that has curbed demand during peak wedding season, reports Bloomberg. Turkey’s gold reserves continue to fall. The central bank’s holdings fell $102 million from the previous week to now total $26.5 billion. Russia’s gold production from January to September rose 11 percent year-over-year to 268.6 tons.

- Bank of America downgraded Fresnillo to neutral from buy following “fairly disappointing longer-term production guidance”, reports Bloomberg. Centerra Gold says that two employees are missing at its Kumtor Mine in the Kyrgyz Republic after a big rock movement, according to a company statement. Newmont Goldcorp lowered its production forecast and raised its cost outlook. Bloomberg reports that the world’s largest gold miner says output will be 6.7 million ounces in 2020 and all-in sustaining costs will be $975 an ounce. On a positive note, Newmont said it will repurchase as much as $1 billion of its own shares over the next year.

- Burkina Faso has become increasingly dangerous for miners as a wave of militants from neighboring Mali moved eastward. Last month 39 people were killed on a bus convoy that was heading for a Semafo operation. The country is responding by increasing spending on defense and security to 13 percent of its 2020 budget. Bloomberg reports that gold mining and cotton are expected to help push economic growth in the West African nation to around 6 percent next year.

Opportunities

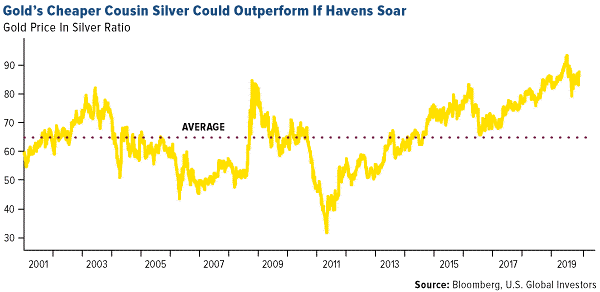

- 2019 is on track to be a 50-year high in central banks’ net gold purchases. Bloomberg Intelligence reports that central banks have been absorbing about 20 percent of global gold mine supply. Based on the gold-to-silver ratio, it looks like silver might have more upside if demand for safe haven assets rises. Bloomberg’s Eddie van der Walt writes that the gold-silver ratio has dropped to 86 from 93 in July and that means silver has outperformed on the back of gold’s gains. UBS analyst Giovanni Staunovo is bullish on palladium and platinum. Staunovo wrote in a December 5 report that palladium will likely enter its ninth straight year of market deficit in 2020 and could climb above $2,000 an ounce. Even as platinum is set to enter a surplus, its price could be driven by gold. “As platinum is highly correlated to gold, our bullish view for gold should mean higher platinum prices, which we expect to trade at around $1,000 an ounce next year.”

- Zijin Mining Group Co. has agreed to buy Continental Gold in a rare all-cash deal worth C$1.37 billion – the second big takeover in a few weeks of a junior Canadian gold miner. Bloomberg reports the offer reflects a 29 percent premium to the Continental Gold share price from the past 20 days and that major shareholder Newmont Goldcorp was supportive of the deal. In hostile M&A news, Centamin Plc rejected Endeavour Mining Corp.’s $1.9 billion takeover offer saying that it undervalues its assets, reports Bloomberg News. Centamin has been a takeover candidate since the size of its Egyptian mine was discovered at the start of the decade, though the company has faced many operational setbacks.

- Kinross Gold has been busy raising cash. Kinross announced this week that it has agreed to sell its remaining shares of Lundin Gold for C$150 million to Newcrest Mining and the Lundin Family Trust. Kinross earlier announced that it has sold its royalty portfolio to Maverix Metals for $74 million.

Threats

- ABN Amro strategist Georgette Boele says they see gold weakening in the coming weeks and months with a price average of $1,400 an ounce. However, they do expect prices to increase to $1,600 by December of 2020. Before this happens, extreme net-long positioning would clear up because “these positions currently hang over the market and prevent prices from moving substantially higher.”

- Another sign of a weakening economy was released last week. The ISM manufacturing PMI unexpectedly declined to 48.1 in November, below the median forecast of 49.2. The reading remains below the 50 level that indicates activity is shrinking.

Bloomberg’s Enda Curran writes that cheap borrowing costs have sent global debt to another record - $250 trillion of government, corporate and household debt. This level is almost three times global economic output and policymakers are now grappling with how to keep economies afloat – with more debt? According to Cornerstone Macro’s head of technical analysis Carter Worth, his S&P 500 chart signals a 5 to 8 percent decline in the coming months. Bloomberg reports that the S&P 500 fell 1.4 percent on Tuesday, pushing it below an upward trend line established in October.

*********

Frank Holmes is the CEO and Chief Investment Officer of

Frank Holmes is the CEO and Chief Investment Officer of