Agnico Eagle Mines is Weighing What to do with its only Australian Gold Mine.

Strengths

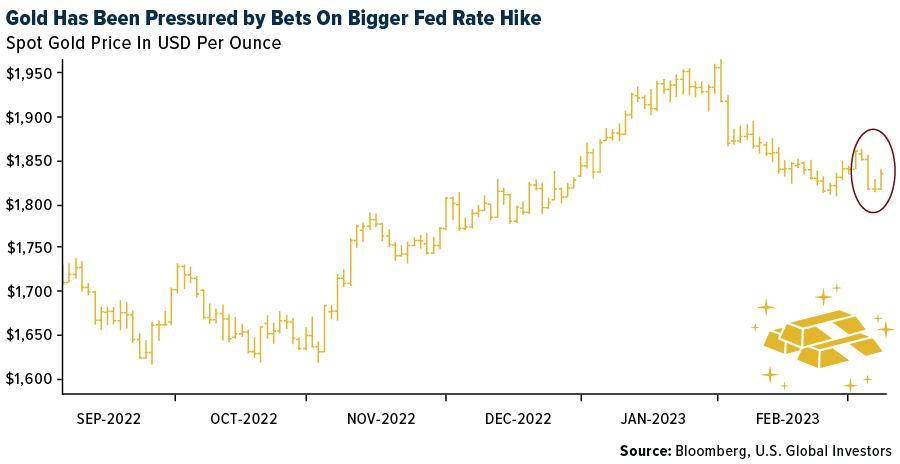

- The best performing precious metal for the week was gold, up 0.98%. Gold rose from near its lowest this year after a metric of U.S. unemployment came in higher than expected, reports Bloomberg, softening expectations that the Federal Reserve will keep aggressively raising rates. The dollar and bond yields extended declines following the report, pushing gold up as much as 1.2%.

- Despite retail gold ETF investors exiting bullion, the long-term money is making a contrary bet. The People’s Bank of China (PBOC) raised its gold holdings 25 tons in February, with current total holdings now at 2,050 tons, after the nation boosted its reserves by about 77 tons in January. Turkey purchased 23 tons of gold in January, becoming the second biggest buyer among central banks globally over this period. Singapore boosted its gold reserves by about 30% in January.

- World Gold Council data shows gold demand up 18% in 2022, to the highest level since 2011. This was second half weighted, the time when the yield relationship was changing the most. Central bank demand rose 685 tons or 150% year-over-year to a record high, offsetting ETF outflows.

Weaknesses

- The worst performing precious metal for the week was palladium, down 5.83%, in what has been a continuous slide in weekly price losses since early October. ADP Employment Change in the U.S. came in stronger than expected, strengthening the dollar against gold and gold companies. Jerome Powell’s hawkish speech on Tuesday made it sound as if the Federal Reserve is ready to be more aggressive on rate hikes in the future.

- According to UBS, gold producers have underperformed year-to-date as cash margins remain under pressure. Newmont's scrip bid for Newcrest highlights the sector's need to replenish inventories of wasting assets and the lack of new discoveries globally. This cycle could continue and suggests scarcity value in known operating mines and/or undeveloped deposits as grades decline and cash margins remain under pressure.

- Exchange-traded funds (ETFs) cut 392,165 troy ounces of gold from their holdings in the last trading session, bringing this year's net sales to 1.68 million ounces, according to data compiled by Bloomberg. This was the biggest one-day decrease since December 5, 2022, and the fifth straight day of declines. As noted above, central bank buying completely offset gold ETF outflows.

Opportunities

- According to CIBC, Oceana Gold operations have significantly improved at Haile, with higher recoveries and higher mining productivity, underpinned by a labor turnover rate that has improved from 27% to 17%. Overall, CIBC observed a noticeable improvement in culture at both the site level and corporate level that it believes has been a key driver to a much more profitable operation. National Bank Financial also penned a positive review and expects that production from the underground mine will ramp up in the fourth quarter of 2023 and will start contributing ore to the mill, helping to boost production higher and lower operating cost per ounce.

- Agnico Eagle Mines is weighing what to do with its only Australian gold mine after landing two big takeovers within two years that turned the Canadian company into the world’s third-largest gold producer. Agnico gained an Australian mine as part of its combination with Kirkland Lake Gold Ltd., giving it a foothold into a region beyond its North American focus. Agnico’s latest deal, set to close this month, reinforces the Toronto-based firm’s homegrown roots by taking full control of the Canadian Malartic mine in Quebec.

- The collapse of Silicon Vally Bank falling under FDIC control, along with a number of other regional banks being heavily scrutinized, had a big influence on bond markets this week. Investors began transferring money from bank deposits to U.S. treasuries with much higher yields. The U.S. dollar lost all of its gains for the week, and on Friday, FED swaps fully priced in a 25-basis point rate cut by year-end. The beneficiary was gold and silver, where prices have grown, and will grow more if the Federal Reserve becomes less hawkish.

Threats

- Marathon Gold noted that the early works were completed in its new major expansion, but engineering was behind plan of 68% (at 61%) because of delays in process plant engineering due to resource availability and rework on construction packages and layouts. The company noted that the overall permitting progress was at 71% versus the plan of 93%.

- According to Morgan Stanley, gold did not fall as much as the rise in real yields would have implied. Using the 2018-2021 regression, the second half 2022 move in real rates from 0.67% to 1.57% would have taken gold down 18%. Instead, the price was flat. Rising safe haven demand may have played a part, but this really only drove inflows through the first quarter.

- Future economic data points, primarily those that impact the power of the U.S. dollar, along with the Federal Reserve’s decision about rates, continue to be risks for the gold market. Economic forecasts by Bloomberg also show the probability of recession at 60% currently.

********

Frank Holmes is the CEO and Chief Investment Officer of

Frank Holmes is the CEO and Chief Investment Officer of