Another Golden Day Begins

For the world gold community, another great day is underway. The news flow is very solid today, and so is the price of gold itself.

Back in the summer of 2013, most analysts were predicting much higher or much lower prices.

In contrast, I predicted gold would begin a long period of sideways price action. The fundamental drivers of that sideways market that has obviously occurred are a fade in the dominance of the fear trade (system risk) of the West, a rise in the global inflation trade, and a rise in the Eastern love trade.

Many gold analysts wondered if the Millennials in China and India would stop buying gold and focus on useless technology-oriented trinkets instead of gold jewellery.

I was adamant that Chindian Millennials would simply demand new designs for their gold jewellery. I was even more adamant that overall demand for gold jewellery there would rise by about 6% -8% annually for decades.

That demand growth is in play now, and it’s accelerating. It will ultimately swamp mine supply, scrap supply, and even central bank supply.

While US tariffs are a short-term concern, over the long term it’s absolutely impossible for an American population of about 350 million to compete with 3 billion Chindians. The bottom line:

The gold bull era is real and it’s beginning now. Western gold bugs who are maniacally obsessed with buying only North American junior miners can prosper, but it will be a bit of an emotional roller coaster for them.

Simply put: If an investor takes on a lot of risk, they have to accept that both the thrills of victory and the agony of defeat will be experienced repeatedly for a long time.

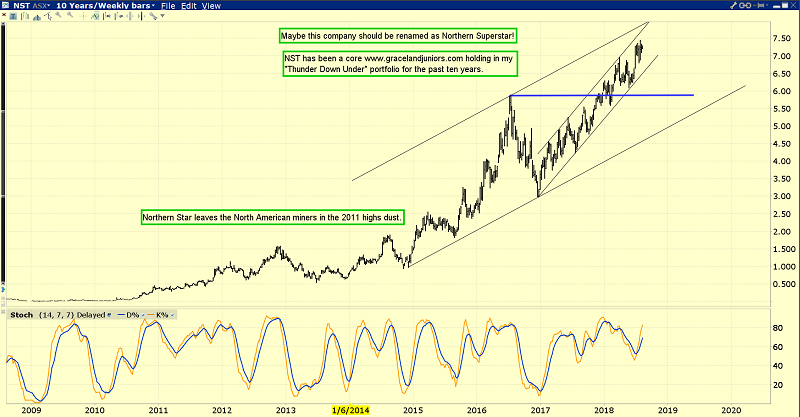

It’s very important that the new breed of gold investor be well-diversified in all sectors of the precious metals asset class. They need access to the Australian market where the gold and silver miners generally trade with much more stability.

Need I say more?

My simple advice to Western gold market investors is this: If you don’t have access to Aussie markets, get access, and join the bull era fun!

Novo Resources is a stock that could become the next Northern Star. I own a small position now. If it becomes an intermediate producer, I’ll buy a lot more stock because of its potential in the decades ahead to become a “reserves monster” that trades in the Aussie market. As time progresses I’d like to see Novo and most Aussie miners sell all their gold directly to Chinese and Indian jewellers. It’s more efficient, and blockchain technology will almost guarantee that this will happen.

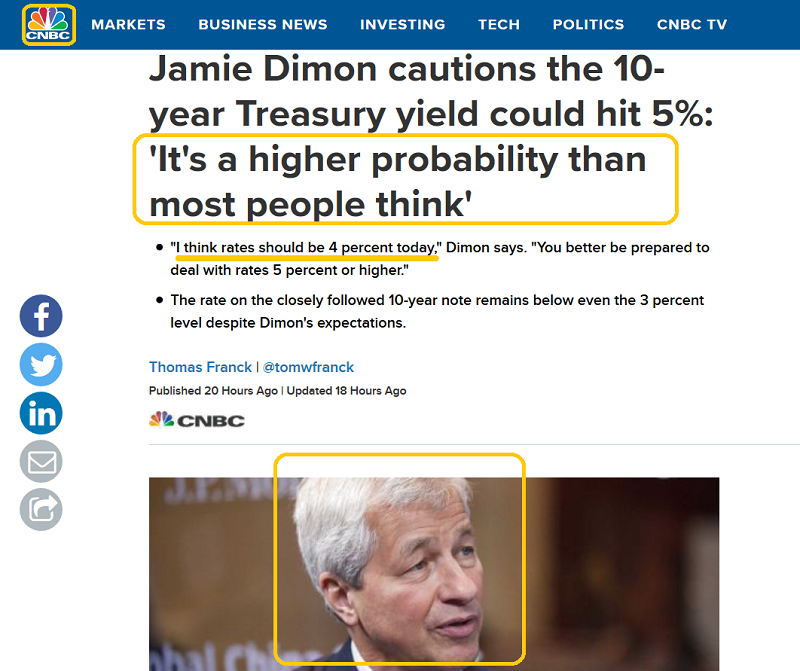

Like Jamie Dimon, I’ve predicted US long bond rates are headed to 5%. That’s partly because inflation is headed to 5%, and because the Fed’s balance sheet contraction is inflationary.

I’ve also suggested that 5% inflation in America will create enormous institutional interest in gold stocks, even bigger than the 1970s.

I don’t see anything to be concerned about on this gold chart. There’s a short-term tariffs-oriented price sale in play during the weak season for gold in China and India. Western inflation is here, but not concerningly here. The price action reflects the fundamentals.

The huge inverse bull continuation H&S formation on this long-term gold chart looks like a bull era starship sitting on the launchpad!

I talked about the need for gold to trade in the $1200 - $1180 area before blast-off could occur to create full price pattern symmetry. Nothing is occurring in the gold market that is technically or fundamentally negative in the big picture. Nothing.

I’m not sure why so many dollar bugs are so excited about the dollar.

I see nothing positive on this US dollar index chart. It’s gone nowhere during most republican administrations, it’s gone nowhere since Trump took office, and I don’t see it going anywhere in the coming years except relentlessly lower.

A lower dollar is one of President Trump’s campaign pledges, and he’s building a reputation of doing what he promises to do.

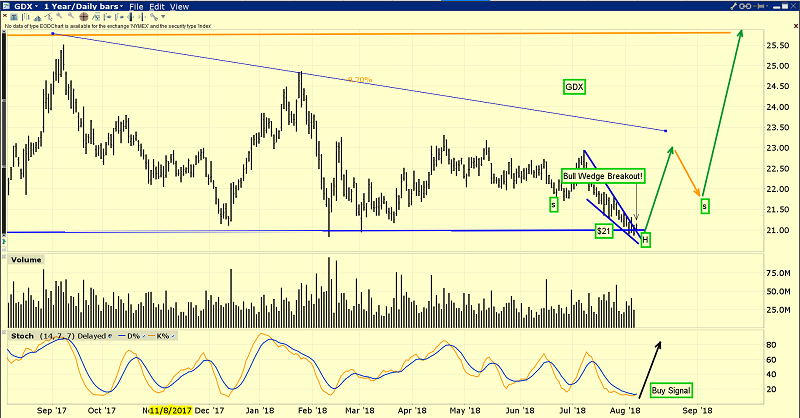

Is GDX the ultimate “no-brainer” buy this morning for all bull era gold bugs? Well, I’m a GDX buyer this morning but some of the individual component stocks of this key ETF look even sweeter right now!

The $100 area for bitcoin that was touched a few years ago is the only buy zone in any market that rivals the current GDX price area in terms of its potential to make investors vastly richer.

Simply put, I’ve identified the $23 - $18 price zone for GDX in 2018 as the most important buying area in the history of markets. I stand by that call, and I’m taking buy-side action right now at about $21, which itself is the “meat and potatoes” area of the entire $23 - $18 zone!

*********

Special Offer For Gold-Eagle Readers: Please send me an Email to [email protected] and I’ll send you my free “Golden Steamrollers!” report. I highlight the key mid-tier gold stocks poised to act like juniors on steroids over the next 24 months as the main global institutional money manager focus switches from growth to inflation! I include money-making buy and sell points for each great stock! Email me today, and I’ll send you the report tomorrow!

Note: We are privacy oriented. We accept cheques, credit card, and if needed, PayPal.

Written between 4am-7am. 5-6 issues per week. Emailed at approx 9am daily.

Email:

Rate Sheet (us funds):

Lifetime: $999

2yr: $299 (over 500 issues)

1yr: $199 (over 250 issues)

6 mths: $129 (over 125 issues)

To pay by credit card/paypal, please click this link:

https://gracelandupdates.com/subscribe-pp/

To pay by cheque, make cheque payable to “Stewart Thomson”

Mail to:

Stewart Thomson / 1276 Lakeview Drive / Oakville, Ontario L6H 2M8 Canada

Stewart Thomson is a retired Merrill Lynch broker. Stewart writes the Graceland Updates daily between 4am-7am. They are sent out around 8am-9am. The newsletter is attractively priced and the format is a unique numbered point form. Giving clarity of each point and saving valuable reading time.

Risks, Disclaimers, Legal

Stewart Thomson is no longer an investment advisor. The information provided by Stewart and Graceland Updates is for general information purposes only. Before taking any action on any investment, it is imperative that you consult with multiple properly licensed, experienced and qualified investment advisors and get numerous opinions before taking any action. Your minimum risk on any investment in the world is: 100% loss of all your money. You may be taking or preparing to take leveraged positions in investments and not know it, exposing yourself to unlimited risks. This is highly concerning if you are an investor in any derivatives products. There is an approx $700 trillion OTC Derivatives Iceberg with a tiny portion written off officially. The bottom line:

Are You Prepared?

Stewart Thomson is president of Graceland Investment Management (Cayman) Ltd. Stewart was a very good English literature student, which helped him develop a unique way of communicating his investment ideas. He developed the “PGEN”, which is a unique capital allocation program. It is designed to allow investors of any size to mimic the action of the banks. Stewart owns GU Trader, which is a unique gold futures/ETF trading service, which closes out all trades by 5pm each day. High net worth individuals around the world follow Stewart on a daily basis. Website:

Stewart Thomson is president of Graceland Investment Management (Cayman) Ltd. Stewart was a very good English literature student, which helped him develop a unique way of communicating his investment ideas. He developed the “PGEN”, which is a unique capital allocation program. It is designed to allow investors of any size to mimic the action of the banks. Stewart owns GU Trader, which is a unique gold futures/ETF trading service, which closes out all trades by 5pm each day. High net worth individuals around the world follow Stewart on a daily basis. Website: