August 15, 1971 – The Beginning of the End for US Hegemony

Fifty-four years ago (August 15, 1971), Nixon took the USD off its gold standard, thereby officially putting the final nail in the Constitutionally mandated concept of US money.

But hey, at least the Constitution can still serve as a nice museum piece for kids to walk past.

Lies from on High

Back in 1971, the lies from on high (which are nothing new to any sophisticated and critically thinking citizen) were at full swing.

Nixon got on live TV and promised us the decoupling was “only temporary” (sound familiar?) and that “your dollar will be worth just as much tomorrow as today.”

But the fibbing did not start or end there.

Prior to the decoupling of August 15, the Treasury Secretary and Fed officials were making the case that gold was actually holding the dollar down and that decoupling gold would strengthen the dollar going forward, while gold’s value would, in fact, fall.

Hmmm.

Facts from Math…

A little fact-checking may be worth a smirk here…

First, the decoupling from gold has lasted more than half a century, so it hardly feels “temporary.”

As for the USD holding its purchasing power, well, when measured against a milligram of gold, that paper dollar has lost > 99% of its value since 1971.

Meanwhile, and contrary to the expert hearing testimony of a 1971 Fed Chairman and Treasury Secretary, gold has not got down in price, but has risen, by well… 8000%.

EIGHT THOUSAND PERCENT.

Huh?

What the Heck?

How was this possible? What did gold do in the last 54 years?

In fact, gold did very little.

But the dollar, now unfettered by its Constitutionally mandated gold-backing, got very, very, very busy multiplying (i.e., debasing) itself to pay for just criminally negligent deficit-spending.

Like a teenager with dad’s Amex, the debt and spend addiction of US “leadership” was officially born on August 15, 1971 –the very same day the USD’s death spiral began.

Don’t want to believe me? Don’t see the correlation?

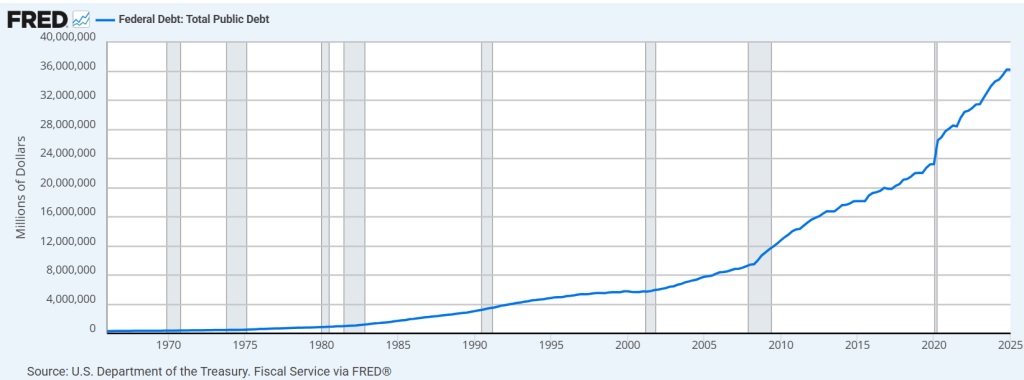

Here’s another stubborn fact: In 1971, US public (governmental debt) was $ $398B.

As of this writing, that number has skyrocketed to $37.2T in the literal course of my lifetime…

History Ignored = History Repeated

The lesson is simple: Currencies backed by nothing will encourage debt addictions, which debase the purchasing power of paper money.

This is a cycle which has been repeated countless times throughout history. (See: The Faces and Cycles of Gold).

Gold, which is far more honest than policy makers, rises because paper money ALWAYS dies under the weight of dishonest spending.

From Dishonesty to Desperation

Dishonesty, of course, is always followed by a lack of accountability, which is in turn followed by behavioral patterns of desperation, finger-pointing and madness – like a sitting President calling a Fed Chairman, of whom we are no fans, “a total loser.”

The scope of policy desperation now masquerading as bold action (tariff policies, the Genuis Act, Fed name-calling and even increased “buzz” of a gold revaluation) is now a daily thing.

What’s even scarier is that such patterns aren’t unique to the USA; they are global…

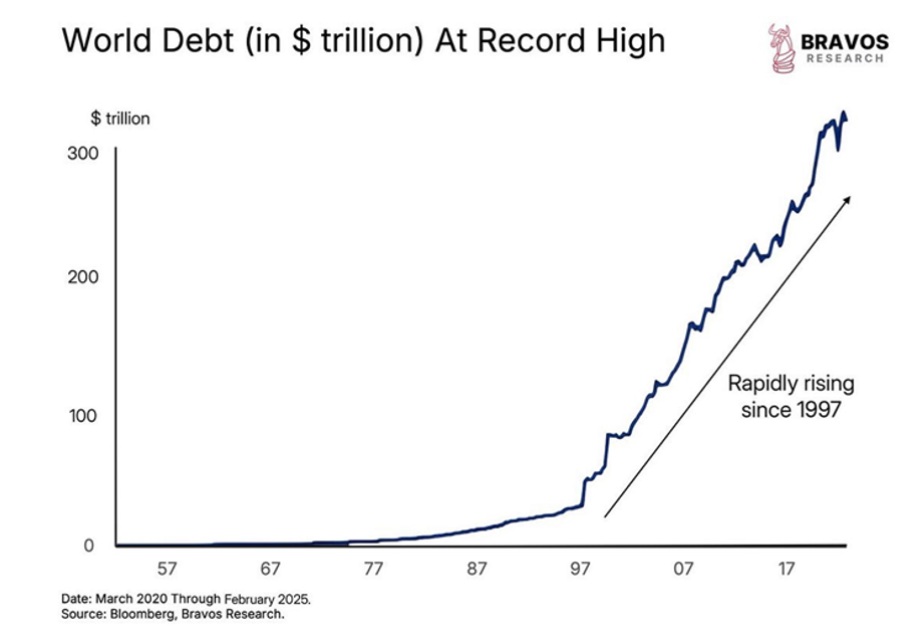

Global debt in 1997 was $30T. Today, that figure has skyrocketed well past $300T.

In the interim, politicians and paid-for economists in DC think-tanks (oxymoron?) have hypnotized the masses into falsely believing that such otherwise unthinkable debt-levels could be sustained.

How?

By the equally unthinkable proposal that currencies mouse-clicked at a central bank could safely absorb such debt with no risk to the currency, economy or market.

But as we (and common sense) have reminded for years: You can’t solve a debt crisis with more debt that is then monetized with money created ex-nihilo out of thin air.

The First Kinks in the Armor: Credit Markets

Debt (as David Hume, von Mises and other critical-thinking “gold bugs” have warned for generations) breaks, well, just about everything…

Nowhere is this truer than in the US and global credit markets, where policy makers and investors whistle past debt crisis after debt crisis.

But debt crises are effectively just liquidity crises, and we have seen quite a string of them in recent (yet media-ignored) memory.

The repo crisis of 2019, for example, as well as the market implosion of 2020, the GILT crisis of 2022, the banking crisis of 2023 and even the tariff crisis of April, 2025 were ultimately just signposts of a liquidity/credit/debt crisis percolating in plain yet ignored sight.

In each instance, the foregoing credit implosions were “resolved” by dovish central bank reactions of either lower rates or higher money printing.

In other words: Can kicking to buy time, votes and excuses as the next generation inherits a nightmare.

The Second Kink in the Armor: Inflated Equity Bubbles

But expanding currency creation via grotesque credit expansion to provide “emergency” liquidity while subsidizing an otherwise unloved UST market and inflating an objectively over-valued stock market is no “solution.”

It is merely a frog-boil currency debasement which widens the pace of wealth inequality while rapidly feeding market bubbles, and by extension, market risk.

Market Bubbles Don’t Equal Strong Economies

For years, we have openly mocked the falsely positive fiction writing of the Bureau of Labor Statistics (BLS) for their false inflation reporting and comically (and seemingly constant) optimistic labor data.

But with Main Street now crawling under the invisible and misreported tax of inflation as well as downwardly revised job growth (which confirms a recession we have said is already here), Trump just fired the head of the same BLS for actually telling the truth.

Folks, regardless of your political bias, one really can’t make this kind of crazy up.

But why worry, as the immortal S&P, NASDAQ and DOW (90% owned by the USA’s top 10%) is going to save us, right?

Hmmm.

This S&P takes 40% of its market cap from 7 stocks whose net-income-margins are just waiting for a mean-reversion whenever the AI meme (just like prior memes, from dotcoms, real estate, electricity, automobiles and railroads) becomes over-crowed and over-bought.

Margin debt in US markets has surpassed the $1T mark, which is greater than prior peaks in the dot.com and pre-08 bubbles.

Meanwhile, insiders like Bezos are selling billions in personal shares, and Buffet himself is sitting largely (hundreds of billions) in cash as the NASDAQ trades at 49X earnings.

In short, if you think the markets with such a profile will save the US economy, think otherwise.

They are teetering on interest rate and recession risk reminiscent of 1929 America and 1989 Japan. When these bubbles popped, it took decades, not months, to recover prior highs.

Just saying.

The World (and Gold’s) Reaction to US Decline

As a post-2022 world turns increasingly away from a weaponized USD, and as the BRICS+ nations look with each passing day for new ways to trade outside the Greenback and net settle global trade deals in physical gold, the trend away from the USD and US debt, just like the BLS’ pessimistic labor data, can no longer be hidden in plain sight.

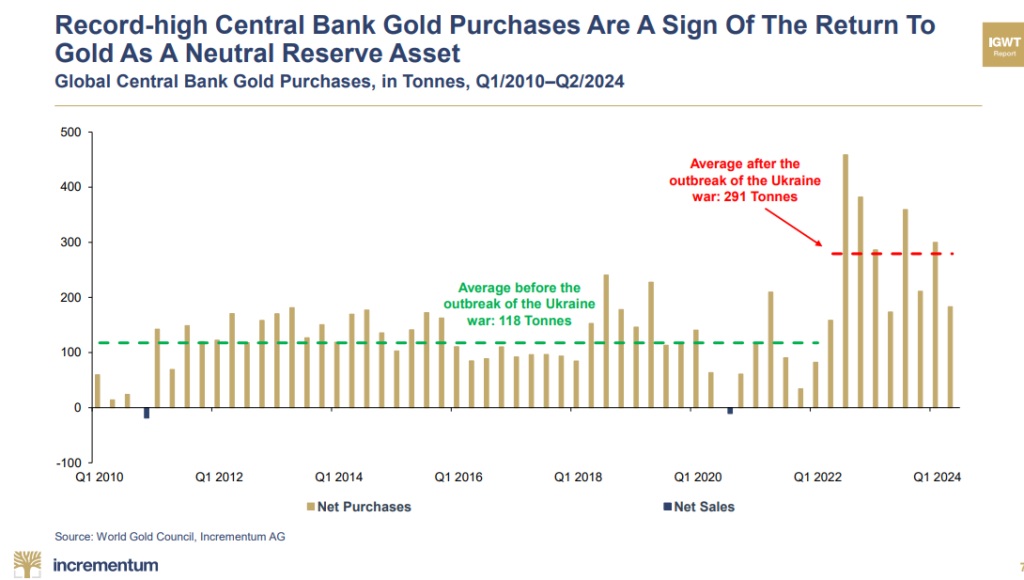

Equally undeniable is gold’s objective rise as a strategic global reserve asset preferred over the UST.

Since the USA shot itself in the foot by weaponizing an allegedly neutral reserve asset (the USD) in 2022, central bank stacking of gold has tripled while demand for USTs has tanked.

As of July 2025, even the BIS has confirmed gold’s status as a Tier-1 asset alongside the far less credible 10Y UST.

Demand for physical gold has shattered the hitherto (and legal)price-fixing at the New York and London metals exchange.

Rather than lever gold with paper, these dubious market-makers/exchanges are now forced to execute actual delivery rather than churn short contracts.

Meanwhile, gold trades are moving East, where the Shanghai and St. Petersburg exchanges are turning the tables on Western manipulation of an asset the East has understood far better (and longer) than the West.

More Desperation Follows…

In this backdrop of a world awash in unloved US Dollars, IOU’s and fantasy policies, DC has been forced to become more desperate in the face of a DXY which has seen the worst half-year performance in 40 years.

This desperation takes many forms, including shoot-from-the-hip tariff policies which change almost daily and send markets up and down like yo-yos, wherein trillions of equity market caps can be made or lost in hours.

Genuis Act Ruse

As demand and trust in the USD gyrates, DC is forced to create clever new projects to boost this demand, of which the Genuis Act (2nd oxymoron?) is the most recent example.

By pairing stablecoins to UST’s (and hence the USD), this king-maker act simply allows fintech giants (Tether, Circle Internet) and favored banks (JP Morgan) to issue stablecoin users a digital buck while the issuers reinvest client money into a UST arbitrage whereby they keep all the yield (profits) and the coin owner just gets a trackable, programable and take-able “coin.”

Such a profile, of course, makes stablecoins a CBDC in substance rather than form, as they are merely CBDC’s issued by private actors (directly tied to the Fed) rather than a central bank.

In short, a classic distinction without a difference.

Nor are stablecoins (3rd oxymoron?) either “stable” or a “coin.”

Like the banks which failed in 2023 due to UST volatility and interest rate swings, stablecoins rise and fall with bond yield gyrations.

Hence, these “stablecoins” are no more stable than Signature Valley Bank or the Treasury market itself, which, for anyone paying attention, is anything but stable…

The Only Option Left: More Debasement

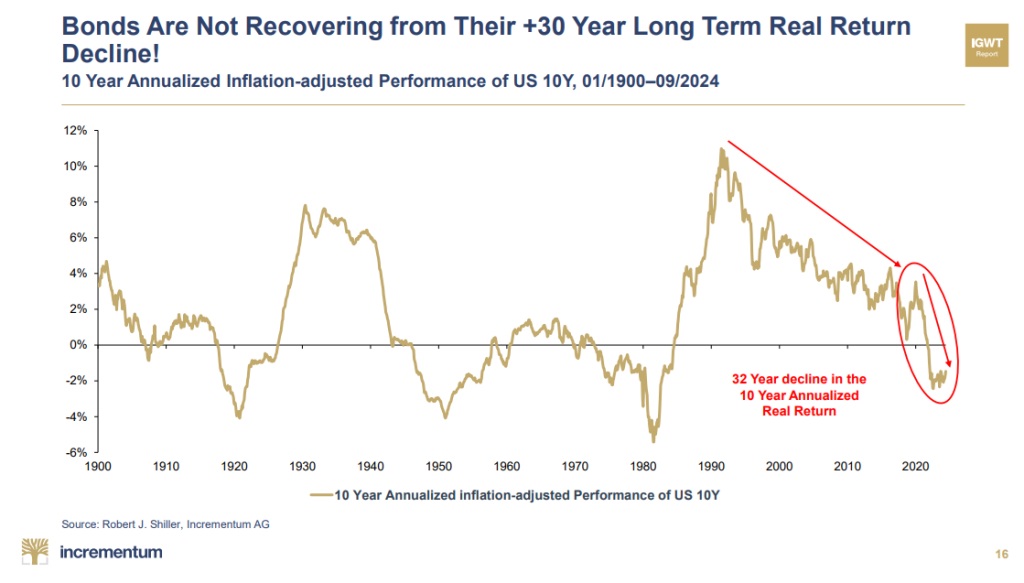

Uncle Sam’s sovereign bonds are as sick as Uncle Sam’s fatally ill debt levels.

Unless trillions are “printed” at the Fed to buy those bonds, their demand and hence prices will fall, which means their yields will rise.

Bond yields, of course, represent the true cost of debt/borrowing, and with the US so indebted, it can NOT afford to allow bond yields to spike.

Like all debt-soaked nations throughout history, the Fed will thus be forced to chose between saving the bond market or saving the currency.

The dollar will be sacrificed (debased) to sustain the bond/debt market for the simple reason that debt is the only “force” supporting so-called American “growth” and “hegemony.”

Gold Revaluation – More Desperate than Effective

Meanwhile, there is serious talk of revaluing Uncle Sam’s 261 million ounces of $42.22 gold certificates to market or higher. There is equal and realistic buzz of a gold-backed Treasury, themes I’ve addressed at length elsewhere: Gold Revaluation: Trump’s Red Button Option.

Gold owners certainly welcome such revaluation, but the very need for such policies is merely enhanced confirmation that gold is needed and trusted more than the USD – even among US leadership…

Looking Ahead? It Looks Bad…

All of the foregoing facts confirm just how debt-distorted the US economy and narrative are, as of 2025.

They also confirm just how debt-trapped US policies have become. More importantly, they confirm just how doomed the US economy is going forward.

This is because the US growth narrative has zero good options left to it. Once debt/GDP ratios cross the 100% Rubicon (we are now at 120%+), growth mathematically slows by 1/3.

And the only way to bring this debt ratio down is via massive spending cuts well beyond the DOGE or USAID cuts. The real debts come from entitlements and military spending, which no politician can or will touch.

The US Already in Default?

Again, this leaves the US with only bad options to address unsustainable debt. It can either default or inflate away its debt.

Guess which option DC will (and has) take(n)?

But here’s the rub.

By inflating away its debt via currency debasement, inflation levels are soaring past UST yields, resulting in negative real rates – i.e. a NEGATIVE returning UST, which by definition, IS a defaulting bond.

The ironies abound…

But the US avoids publicly displaying this irony and default by simply lying about (i.e., misreporting) the US inflation rate, measured by a CPI scale that has been “modified” over 20 times since the Volcker era to mask actual inflation data.

Again: Just more desperation hiding in plain sight.

Gold Is Now So Clear

All of this explains gold’s massive rise after the 2022 turning point. If folks like you and I can see the desperation and balance sheet of the USA, the rest of the world can too.

That is why central banks, sovereign wealth funds and even the BIS itself are openly transitioning from bad “money” (i.e. fiat/paper “money”) to real money, i.e., physical gold.

Silver

Silver’s real moves, already significant in 2024 and 2025, are yet to come. In gold bull markets, silver dramatically outperforms.

We are not close to the gold/silver ratios of 1980 or 2011 (15 & 32, respectively), for the simple reason that despite 40% rises in 2025 (and outperforming the S&P since 2000), the gold bull market has yet to even gain its stride.

Meanwhile, silver, sitting atop a 5-year supply deficit and a 45-year cup & handle formation, continues to rise, and when priced in gold terms, silver is still attractively undervalued.

For patient investors, silver will be quite rewarding.

Preservation Is Wealth

Ultimately, however, our aim is wealth preservation first and foremost. Gold’s historical role as a store of value in times of paper money debacles means wealth is made by: (1) not losing it and (2) not measuring it in fiat terms.

If your own governments fail to protect your currency and wealth, the responsibility rests within each individual.

And with capital controls and centralization (as evidenced most recently by Stablecoin rushes) on the rise, the importance of holding an analog “pet rock” – directly in your name and outside of a dangerous banking system (with a legal firewall between your government) – could not be more compelling than today.

********