Beginning Of The End, But First A Bond Rally…

A recession (and bond rally) is oncoming, but first the stock market has to finish doing what it does…

[edit] In the time it took to write this post the stock market has rethought its initial celebratory impulse. Interesting. Gold and gold stocks are still fine. But cyclical commodities are not so fine. They are positively correlated to the economy, after all. It will be interesting to see how this plays out. Separately, bonds are doing as they should do.

Wayne? Garth? Tell the nice people what it does.

Party on!

Party on!For a while.

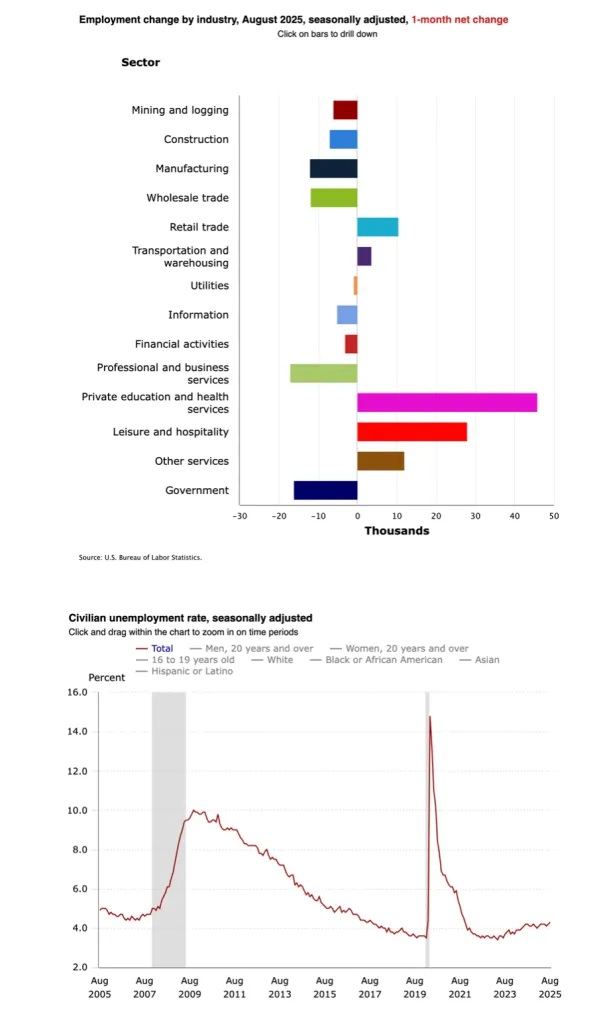

August Payrolls is just one among many quickly degrading economic markers. It is interesting that the Trump-decapitated BLS is reporting no better numbers than the BLS, pre-decapitation. The only thing keeping the Good Ship Lollipop afloat are the embedded Education & Health services and Leisure & Hospitality services.

Manufacturing: bad. Professional & Business services: bad. Construction: bad (and in line with poor commercial real estate data we reviewed several weeks ago in NFTRH).

BLS

BLSWhat the market does is celebrate bad news, because in our perverted version of capitalism, bad news (declining employment & economy) = good news (dovish Fed to the rescue of asset owners once again). We in the U.S. and in much of the west live within financialized economies, after all. Leveraged and financialized.

A successful Fed rescue operation is more theoretical (and doubtful) this time than it was before 2022’s bond market rebellion (driving yields up and bonds down). Due to the secular change in interest rate trends.

However, our interim plan is for yields down, bonds up and economy down prior to the next inflationary bailout phase, which is not likely to go nearly as swimmingly as the routine bailouts of the 2001-2020 period did.

So yes, I hold gold stocks (NFTRH has been bullish for a year+ now, per public posts you can see here. Just lately a video on gold stock TA and discussion, along with a few other precious metals articles have been posted. You should check them out if you have not, already. It’s right minded stuff and has, well, been right on to this point.

So yes, I hold what I call bull stocks. Because why? Because of how casino patrons act prior to a dovish Fed pivot. They celebrate the poor economic data that lead the Fed to flip. But, this…

If the chart’s message is not immediately obvious, take a minute and reflect upon it. Let it speak.

Will it be different this time? It could be. But I would not bet on it. Indeed, I will bet against it by keeping myself and NFTRH subscribers apprised of exactly what is in play every step of the way. We’ve gotten this far with profits in hand (and on paper). But the worm, my friends, does turn.

Precious metals, other more specialized commodity/resources areas and good old fashioned bull stocks are all bulling. But above I noted an “interim” play prior to the next phase when the Fed’s dovish (and ultimately inflationary) flip manifests in corrosive inflationary “effects” (the actually inflation is set to begin with the dovish pivot). Do you see the game?

A side note on the precious metals: The macro has shifted in gold’s favor. Big time. That does not mean the PMs will not get hit when the broad market does. But it does mean that the new gold-positive macro is secular. If you check out the “public posts” link above, pay particular attention to A Macro View & Gold’s Place Within It.

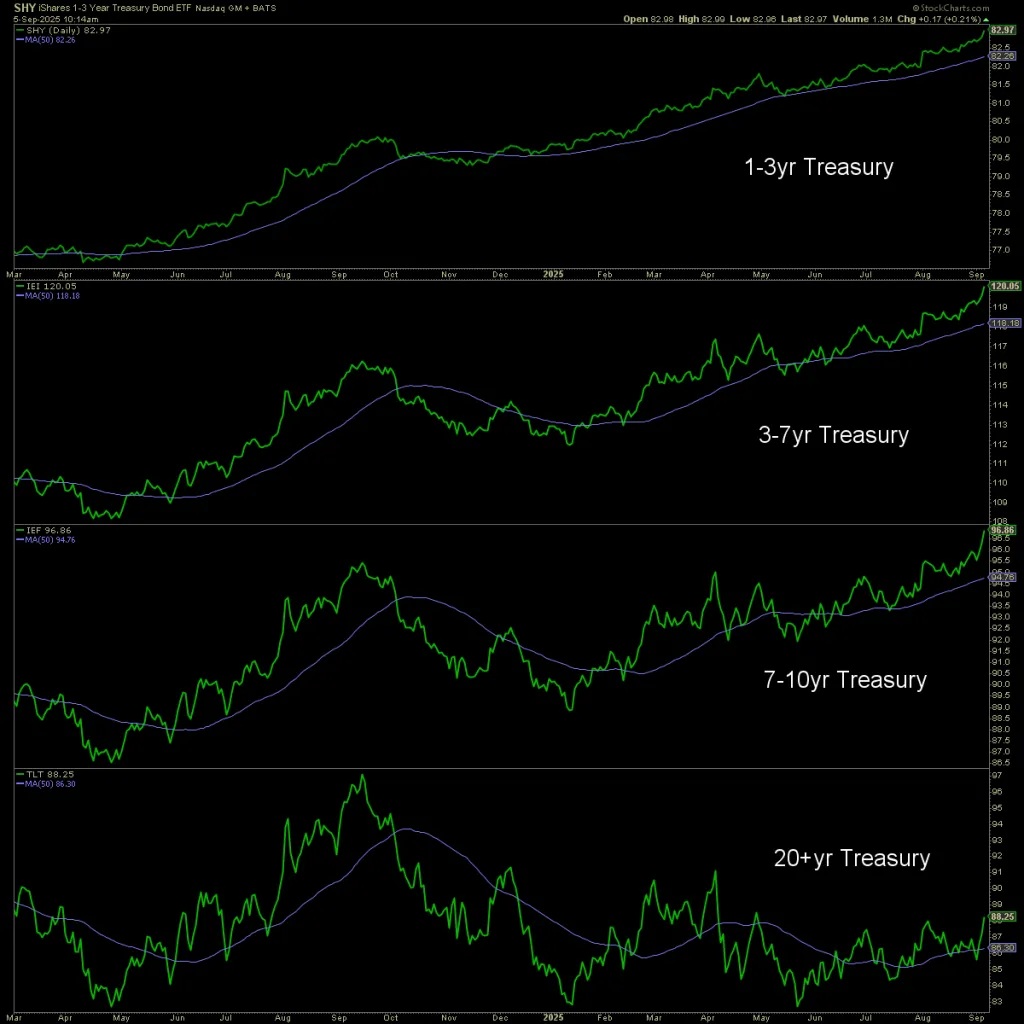

We have been on the interim disinflationary play since the height of the inflation hysteria that finally began to tamp down a bit in 2023. I have held short-term Treasury bonds directly (since matured and paid out nicely) and still hold the 1-3yr Treasury bond fund, SHY (while recently adding a more speculative position in the 7-10yr Treasury fund).

As you can see, the Treasury bond market (chart includes income distributions) has been less bullish the further out on the curve you go. But as you can also see, long-term bonds (20+ years) appear ready for an interim rally in “celebration” of the failing economy and its disinflationary pressure.

As noted many times in NFTRH, the idea here is that as the Fed is pressured (by the economy, not the president) to flip dovish, the handsome income paid out by cash holdings will diminish as the Fed punishes savers once again (basically Ben “ZIRP” Bernanke’s playbook) to largely foot the bill for its asset-owner bailout operations.

Then later comes the inflation. This time it is expected to be more economically corrosive than the cyclical operations that routinely succeeded during the pre-2022 era. In a sort of macro trade, we sold our house in June, 2024 and I expect to buy a downsized situation sometime in 2026. Real Estate prices are already rolling over and as the bond charts above show, interest rates are set to decline further.

This could be the last such play before the Continuum chart above reasserts its new inflationary trend of rising long-term yields, perhaps out in late 2026 or 2027. But that is future speculation, which we will need to fine tune along the way, as always.

For “best of breed” top-down macro analysis and market strategy covering Precious Metals, Commodities, Stocks and much more, subscribe to NFTRH Premium, which includes a comprehensive weekly market report, detailed NFTRH+ updates and chart/trade setup ideas, and Daily Market Notes. Receive actionable (free) public content at NFTRH.com and subscribe to our free Substack. Follow via X @NFTRHgt and BlueSky @nftrh.bsky.social, and subscribe to our YouTube Video Channel. Finally, check out Hammer’s trade (long and/or short) setups.

********