Buy And Sell Zones For Gold

Gold is majestically postured now, because America’s government and central bank continues to borrow, spend, and print money with surreal intensity.

The light at the end of the tunnel is a stagflationary freight train.

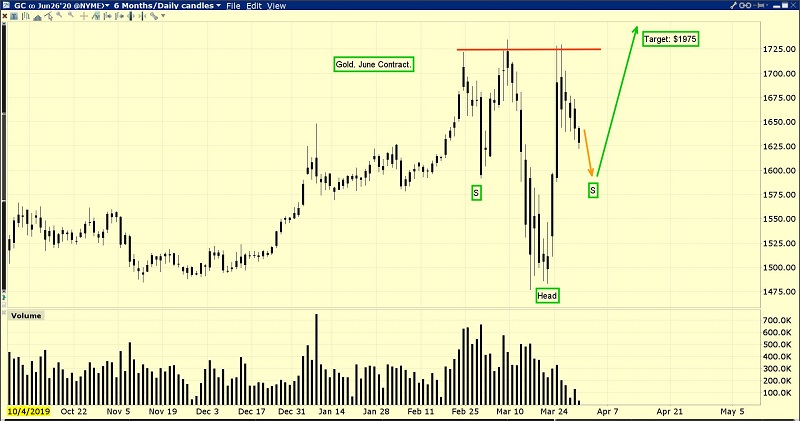

A beautiful inverse H&S bull continuation pattern is in play, with a target of $1975!

The red hats waved joyously in the air have been replaced with hand pump respirators from the stone age.

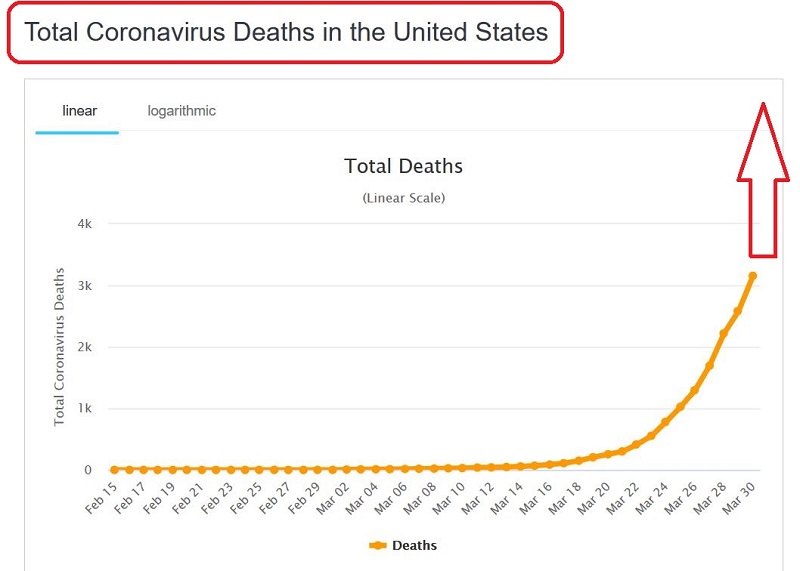

The hospital ships will be filled beyond capacity almost as soon as they open and social distancing is a farce.

The sad fact is that America is still walking the streets in close contact and Corona is spreading faster than a wildfire.

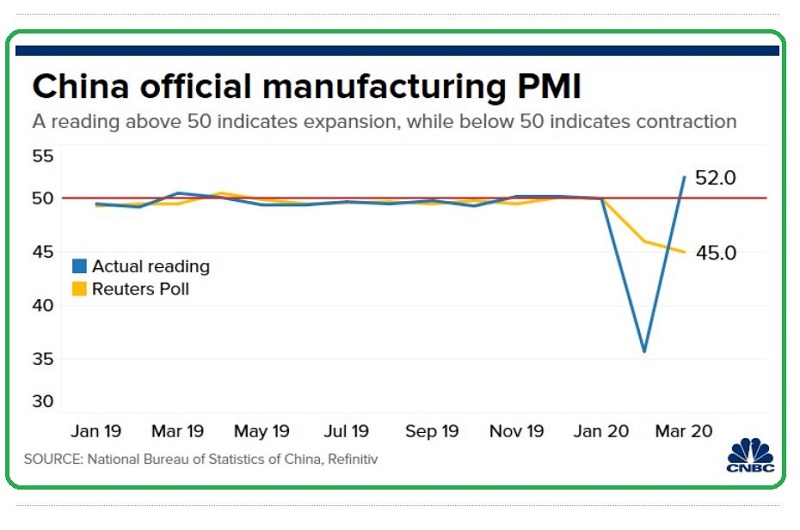

There is some good news though.As I predicted, China’s economy is making a V-bottom!

The Chinese stock market ETF chart.I own it and I like it.China feels quite stable now, and America feels highly unstable.I like being invested in stability.

Will Corona infect US police departments, and if so, is a breakdown of law and order in the cards?Unfortunately, I’m predicting that is what lies ahead.

The US stock market can rise in this mayhem, but the nation is in a depression.Because the government and citizens failed to take quick action, there won’t be any V-bottom for the US economy.

The Fed predicts 30% unemployment is coming to America.What’s their plan of action to help?Well, in an act of pure insanity, the Fed is printing money and using it to buy ETFs on the stock exchange!

This, while exhausted nurses work shifts on ridiculous hand pump respirators trying to keep patients alive.The bottom line: Socialism for the rich, while Corona ravages the nation.

America’s central bankers are beginning to look psychotic.

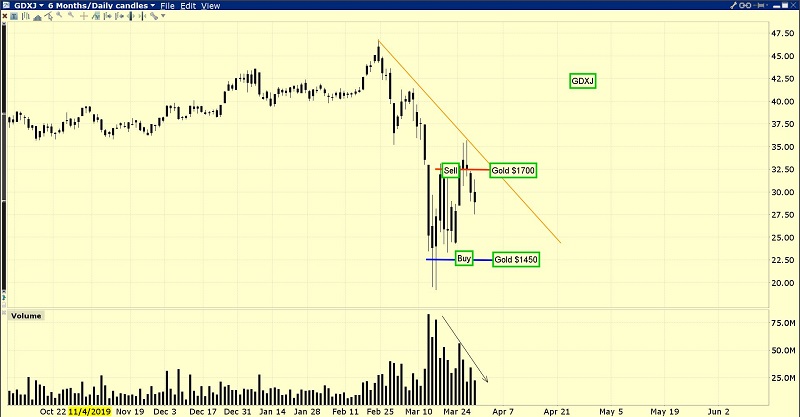

The GDXJ chart.It’s important to follow the rules.

The rules I’m talking about are the rules of HSR.Horizontal support and resistance.It doesn’t matter if you are bullion-oriented or miners-oriented.What matters is buying silver and the miners only when gold is at major support, and selling when you have a big profit with gold at resistance.

Investors who followed the rules bought GDXJ when gold traded near $1450.They sold when gold surged to $1700.That’s how to make 40% in a week… while sitting in a bunker!

Investors who followed the HSR rules also did well with the GOAU ETF.

There is often a lot of time between HSR events. It takes patience to follow the rules. The big zones to focus on now are at $1400 and $1700.

Nobody, including me, wants to see gold trade at $1400.It can happen, and unlike the pathetic preparation the US government did for the Corona war, I want gold bugs preparing all the time, to fight price wars on the gold, silver, and mining stock gridlines…. Price wars they can win!

If gold can move above $1700, then $1700 becomes a significant support zone, aka “buy-side HSR”.$1800 is the sell-side HSR zone of importance above there.

What about the short term?Well, for that, investors can look at my https://guswinger.com trading service. We shorted gold yesterday via DGLD, and the trade looks good.

NUGT and DUST are being revamped as double-leveraged trading vehicles instead of triple-leveraged.Because the price is calculated daily, they should never be used as long term investments.There’s far too much slippage.

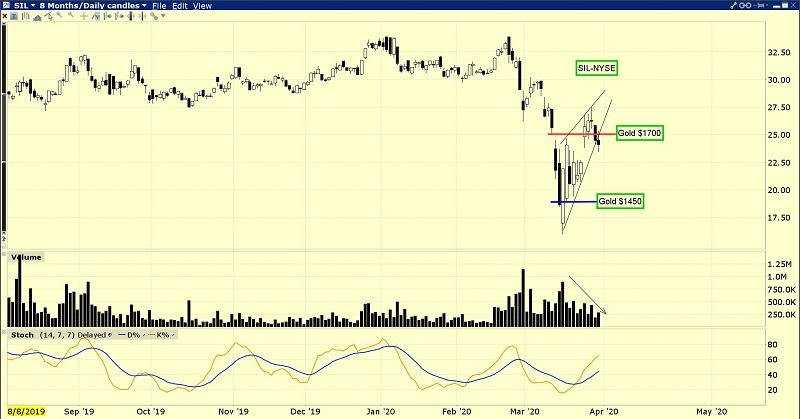

The SIL ETF chart.There’s a bear wedge in play and volume is a bit negative.

None of that should bother anyone following the HSR rules.Some analysts are looking for a “test of the lows”, but my focus is getting investors prepared to buy SIL, GDX, GOAU, GDXJ and individual miners at gold $1400… while cheering that a mighty blast over $1700 will be the next major move for gold.In my professional opinion, the odds of $1400 happening are 30%.The odds that $1700 comes next are 70%!

Special Offer For Gold-Eagle Readers: Please send me an Email to [email protected] and I’ll send you my free “Royalty Companies: Key Juniors & Seniors!” report. Low-debt gold and silver royalty companies are poised to prosper as Corona hurts other miners. I high five of the great ones, with key tactics for each stock!

Note: We are privacy oriented. We accept cheques, credit card, and if needed, PayPal.

Written between 4am-7am. 5-6 issues per week. Emailed at aprox 9am daily.

Email:

Rate Sheet (us funds):

Lifetime: $999

2yr: $299 (over 500 issues)

1yr: $199 (over 250 issues)

6 mths: $129 (over 125 issues)

To pay by credit card/paypal, please click this link:

https://gracelandupdates.com/subscribe-pp/

To pay by cheque, make cheque payable to “Stewart Thomson”

Mail to:

Stewart Thomson / 1276 Lakeview Drive / Oakville, Ontario L6H 2M8 Canada

Stewart Thomson is a retired Merrill Lynch broker. Stewart writes the Graceland Updates daily between 4am-7am. They are sent out around 8am-9am. The newsletter is attractively priced and the format is a unique numbered point form. Giving clarity of each point and saving valuable reading time.

Risks, Disclaimers, Legal

Stewart Thomson is no longer an investment advisor. The information provided by Stewart and Graceland Updates is for general information purposes only. Before taking any action on any investment, it is imperative that you consult with multiple properly licensed, experienced and qualified investment advisors and get numerous opinions before taking any action. Your minimum risk on any investment in the world is: 100% loss of all your money. You may be taking or preparing to take leveraged positions in investments and not know it, exposing yourself to unlimited risks. This is highly concerning if you are an investor in any derivatives products. There is an approx $700 trillion OTC Derivatives Iceberg with a tiny portion written off officially. The bottom line:

Are You Prepared?

*********

Stewart Thomson is president of Graceland Investment Management (Cayman) Ltd. Stewart was a very good English literature student, which helped him develop a unique way of communicating his investment ideas. He developed the “PGEN”, which is a unique capital allocation program. It is designed to allow investors of any size to mimic the action of the banks. Stewart owns GU Trader, which is a unique gold futures/ETF trading service, which closes out all trades by 5pm each day. High net worth individuals around the world follow Stewart on a daily basis. Website:

Stewart Thomson is president of Graceland Investment Management (Cayman) Ltd. Stewart was a very good English literature student, which helped him develop a unique way of communicating his investment ideas. He developed the “PGEN”, which is a unique capital allocation program. It is designed to allow investors of any size to mimic the action of the banks. Stewart owns GU Trader, which is a unique gold futures/ETF trading service, which closes out all trades by 5pm each day. High net worth individuals around the world follow Stewart on a daily basis. Website: