China Crackup…The Final Trap Looms

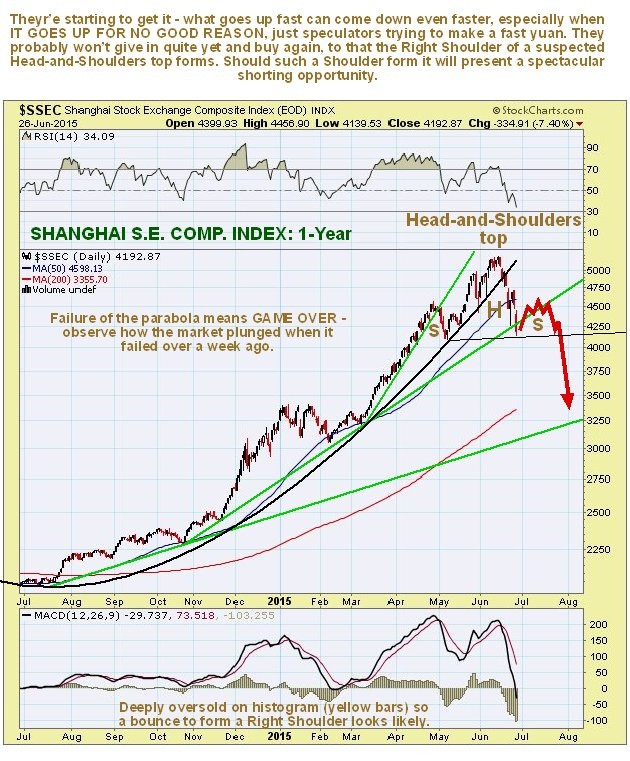

What was predicted for China has started to happen with the dramatic failure of its parabolic uptrend just over a week ago leading to a plunge. The update China Crash was posted when all indicators were at “nosebleed” levels late in April, right after which the third steepest fan-line shown on our 1-year chart for the Shanghai Composite Index below was breached. Somewhat amazingly, that overbought peak late in April was not the final top – it rose even higher into early-mid June, but after that, just over a week ago, it finally broke below the parabola and started to cave in.

What was predicted for China has started to happen with the dramatic failure of its parabolic uptrend just over a week ago leading to a plunge. The update China Crash was posted when all indicators were at “nosebleed” levels late in April, right after which the third steepest fan-line shown on our 1-year chart for the Shanghai Composite Index below was breached. Somewhat amazingly, that overbought peak late in April was not the final top – it rose even higher into early-mid June, but after that, just over a week ago, it finally broke below the parabola and started to cave in.

While low grade Chinese speculators who are leveraged to the hilt and up to their eyeballs in margin debt may have been unnerved by what has just transpired and are probably starting to break out in a sweat, it is considered unlikely that they appreciate the full gravity of the situation – many of them think that this is just a correction, albeit a larger fiercer one. So they are likely to buy this dip, some of them appreciative of the opportunity to get more stock at better prices. They have no idea what is really going on, but we do.

Here is what is going on – the market has just dropped back from the peak of the Head of a Head-and-Shoulders top shown on our chart and if this interpretation is correct it should now rally from the vicinity of the low of the Left Shoulder trough of the pattern that occurred early in May, where there is support. The expected Right Shoulder, projected to form as shown on the chart in red, will be the final trap. Once it descends from the peak of the expected Right Shoulder, after a little hesitation at support at the “neckline” of the pattern, where we might see a minor bounce, it should breach this support and then crash – not drop – crash – because the low grade highly leveraged speculators who currently populate this market will be forced to flee in panic.

Recent action is shown in more detail on the 6-month chart below with expected pattern development shown in red…

Action in the Chinese action has some implications for other Western markets, since a crash in the Chinese market is likely to have a knock-on effect on bloated markets elsewhere. If the Head-and-Shoulders top in the Chinese market completes in a symmetrical manner, then we have about 3 weeks until neckline failure and a crash, and, perhaps, 3 weeks to prepare for Western markets to follow suit.

********

Courtesy of http://www.clivemaund.com/