China Precious Metals’ Demand On The Rise

Strengths

-

The best performing metal this week was palladium, down 0.17 percent as hedge funds boosted their net bullish position to an eight-month high. October was a stellar month for gold after several months of losses. Holdings in gold-backed ETFs rose globally by 16.5 tonnes as the yellow metal benefitted from flight-to-safety investment flows tracking global stock markets, writes Financial Express. The month also marked the first in four of positive global inflows for gold-backed ETFs, as the bullion price rose 2.3 percent.

-

China, the world’s largest consumer of gold, continues to see demand rising. In the first three quarters of this year, the use of gold rose by 5.08 percent from a year ago to 849.7 tonnes, according to the China Gold Association. Jewelry sales contributed to nearly two thirds of total domestic consumption. The nation is also the number one gold producer, but has seen output fall 7.46 percent to just 289.75 tonnes in the first three quarters of this year. With demand rising and production falling, a tightening gold supply could lead to positive price movement. South Africa, once the world’s top miner of the yellow metal, has seen production retreat 19 percent from a year earlier, for the biggest plunge since 2015.

-

U.S. producer prices, as measured by the producer price index (PPI), rose by more than forecast in October to 2.9 percent higher from a year earlier, marking the biggest jump since 2012. Rising PPI, which measures wholesale and other selling prices at businesses, indicates that price pressures in the production pipeline are advancing steadily, writes Shobhana Chandra of Bloomberg. Core services inflation, which represents 75 percent of the core PCE price index, exhibits less volatility and is less influenced by U.S. dollar moves. This figure has been rising steadily since 2009 and is now at 2.9 percent year-over-year. Inflation has historically been positive for the price of gold.

Weaknesses

· The worst performing metal this week was silver, down 4.02 percent despite hedge funds cutting their bearish view to a 12-week low. Despite a brief rally, it looks as though optimism for gold has started to fade. Prices have fallen for six straight days, reports Bloomberg, making this the longest downward stretch since May 2017. In addition, gold took a hit after U.S. producer prices increased in October by the most since 2012. According to Tai Wong, head of base and precious metals trading at BMO Capital Markets, this “could be a signal inflation is starting to percolate,” prompting some to speculate the Federal Reserve will hike rates more aggressively.

· Exchange traded funds that focus on commodities saw outflows this week, with precious metals ETFs leading the decline, reports Bloomberg. This is a reversal from last week when precious metals funds saw inflows of $414 million; this week, they had $224 million of losses. Declines were also seen in India, with gold imports dropping 42 percent in October, falling to 38.8 metric tons from 66.9 metric tons a year earlier.

· Venezuela wants $550 million worth of gold back from the Bank of England, according to Reuters. In fact, Venezuelan authorities are attempting to repatriate 14 tons of gold bullion currently held at the Bank of England’s vault. According to Business Insider, the move is thought to be in response to recently announced sanctions by the U.S. aimed at disrupting the country’s exports – but the current economic crisis in Venezuela is also one of the prime motivating factors and the market is aware both Venezuela and Turkey have been gold sellers of late.

Opportunities

· Jewelry disruptor MENĒ launched as a publicly-traded company on the Toronto Stock Exchange this week. Since opening in January of this year, Mene has sold over 11,000 unique pieces of jewelry worth $7 million in 53 countries. MENĒ is changing the way consumers think about jewelry – shifting attitudes from a discretionary purchase to a precious metals investment that retains most of its original purchase value. Gold and precious metal jewelry is only offered as 24 karat purity and is sold by its weight, plus a 10 percent markup to cover design and manufacturing costs. In addition, MENĒ guarantees it will repurchase the item at spot gold less a 10 percent discount. This model could disrupt the traditional western selling model of diluting the gold content by nearly 50 percent and putting perhaps a four-fold mark up to the value of the contained gold.

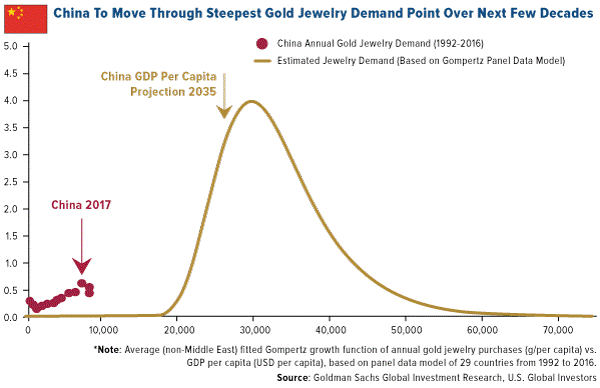

· GFMS released price forecasts this week saying “there is scope for further price appreciation, but it does look as if this will be something of a long haul.” The consultant forecasts gold to average $1,224 per ounce, before rising to $1,285 next year on strong Chinese and global central bank demand. Jewelry demand in China accounts for 60 percent of consumption and could rise even further as the country moves through the gold jewelry demand curve. According to Goldman Sachs, China gold demand for jewelry could continue to increase for decades into the future. In U.S. midterms this week, Democrats took control of the House, which will likely stop further tax cuts and require the Fed to implement fewer rate hikes, weighing on the dollar. Commerzbank says that should President Donald Trump focus more on foreign policy, it could generate additional geopolitical uncertainty, providing a boost for gold.

· This week the World Gold Council (WGC) launched a data and insights tool, called Goldhub, to help investors better understand gold’s value as a strategic asset. WGC studies showed that a lack of data was a key reason for institutional investors for not investing in gold and believe that Goldhub will fill that gap. One of the features of the platform includes an interactive portfolio simulator that allows users to create virtual portfolios and compare their historical performance.

Threats

· How much can the Fed raise interest rates and is it making a policy mistake? Bloomberg writes that if the Fed doesn’t slow or stop its unwind – of steadily reducing its holdings of Treasuries and mortgage-backed bonds – it could end up draining too much money from the banking system, which could cause volatility to surge and undermine its ability to control its rate setting policy. Priya Misra, head of global interest rate strategy at TD Securities, says that “the Fed is in denial” and that “if the Fed continues to let its balance-sheet runoff continue, then reserves will begin to become scarce.”

· In October, hedge funds experienced their worst month since 2011 and clients have already pulled $11.1 billion so far this year. More redemptions are expected by November 15, which is the deadline for investors to put managers on notice to get some of all of their money back at year end, writes Bloomberg.

· A former JPMorgan precious metals trader admitted this year that he had engaged in a spoofing scheme for six years that defrauded investors in gold, silver, platinum and palladium futures contracts, writes Zero Hedge. This is possibly the first major gold-bank trader coming clean about market manipulation that has long been suspected of occurring. There was once a time when the mere mention on gold manipulation would have branded someone as a conspiracy theorist, but more and more accounts of actual manipulation have come to light so far this year.

Frank Holmes is the CEO and Chief Investment Officer of

Frank Holmes is the CEO and Chief Investment Officer of