Connecting The Dots

As much as we carry a long-term bias towards a continuation of the historically low yield market environment of the current decade, over the intermediate-term we still like the short side of Treasuries on the long end of the curve. From our perspective, this posture affords strong asymmetries, as we see much greater downside risks to bonds from several different policy outcomes through the end of the year, which are also structurally aligned with bearish technicals in these assets.

As much as we carry a long-term bias towards a continuation of the historically low yield market environment of the current decade, over the intermediate-term we still like the short side of Treasuries on the long end of the curve. From our perspective, this posture affords strong asymmetries, as we see much greater downside risks to bonds from several different policy outcomes through the end of the year, which are also structurally aligned with bearish technicals in these assets.

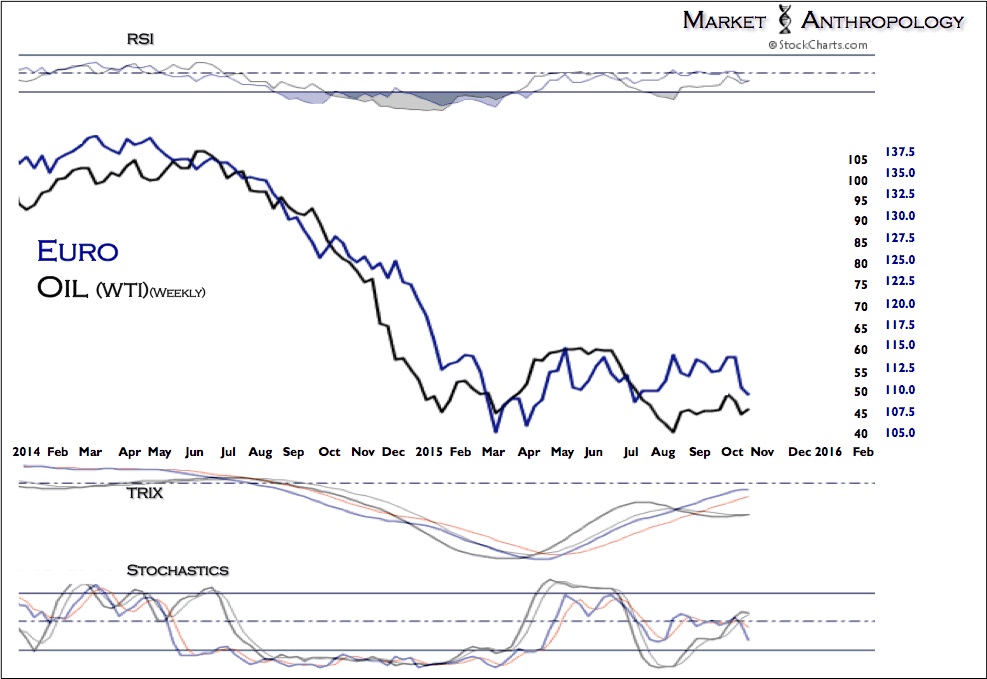

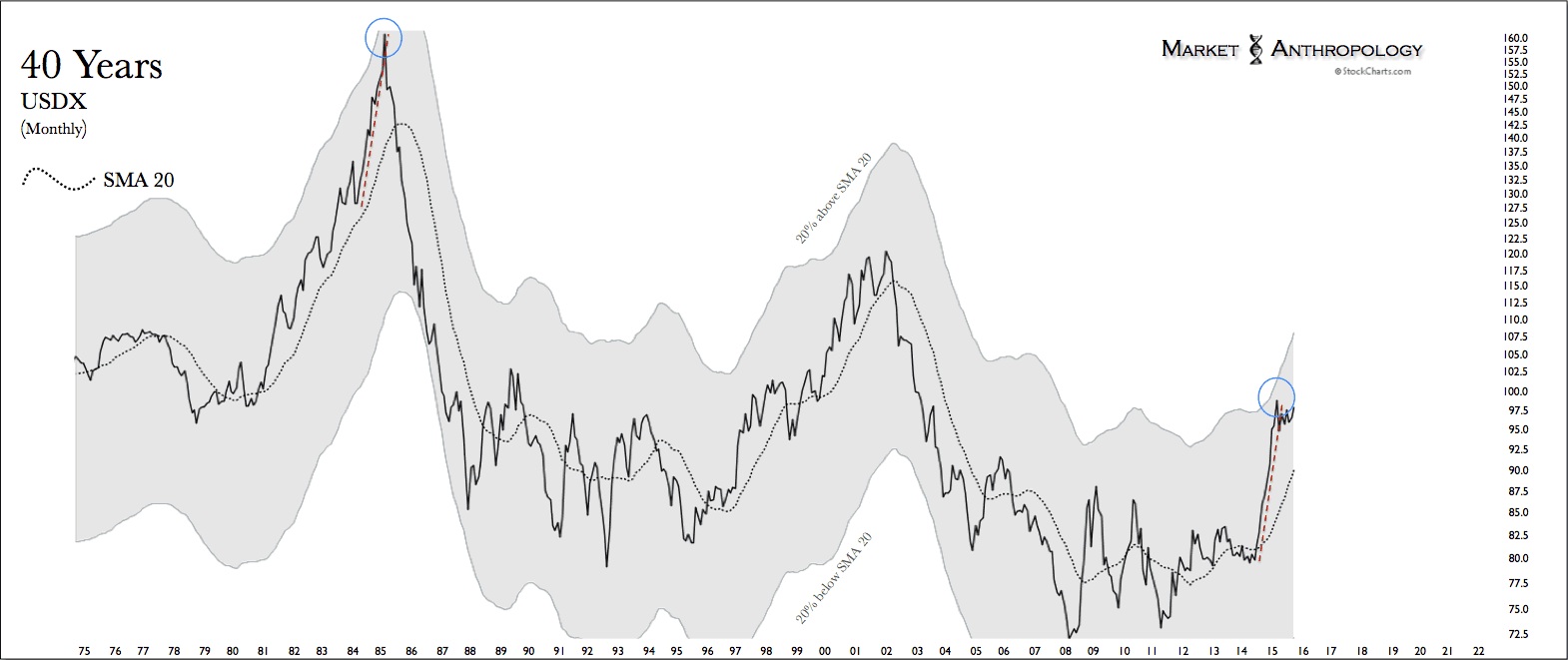

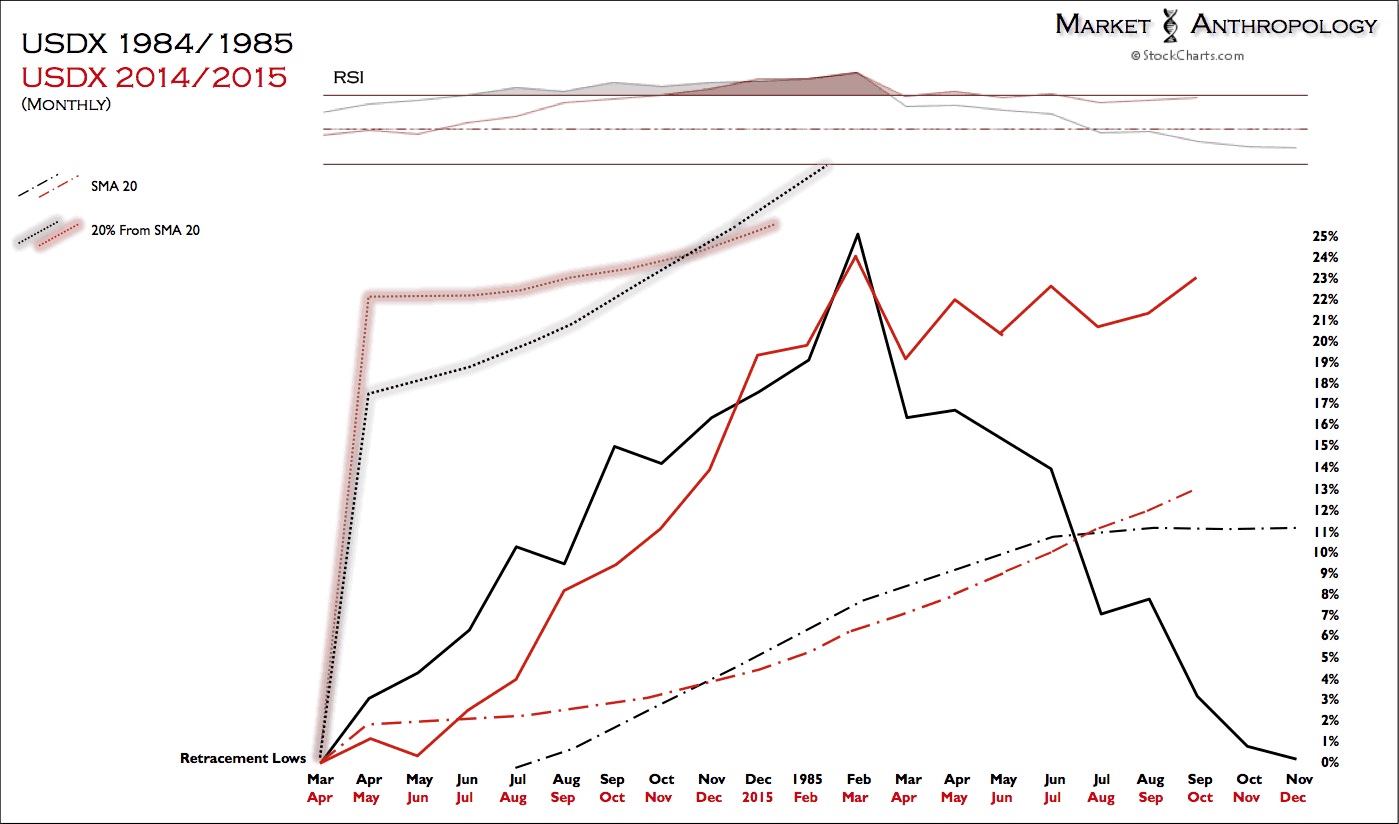

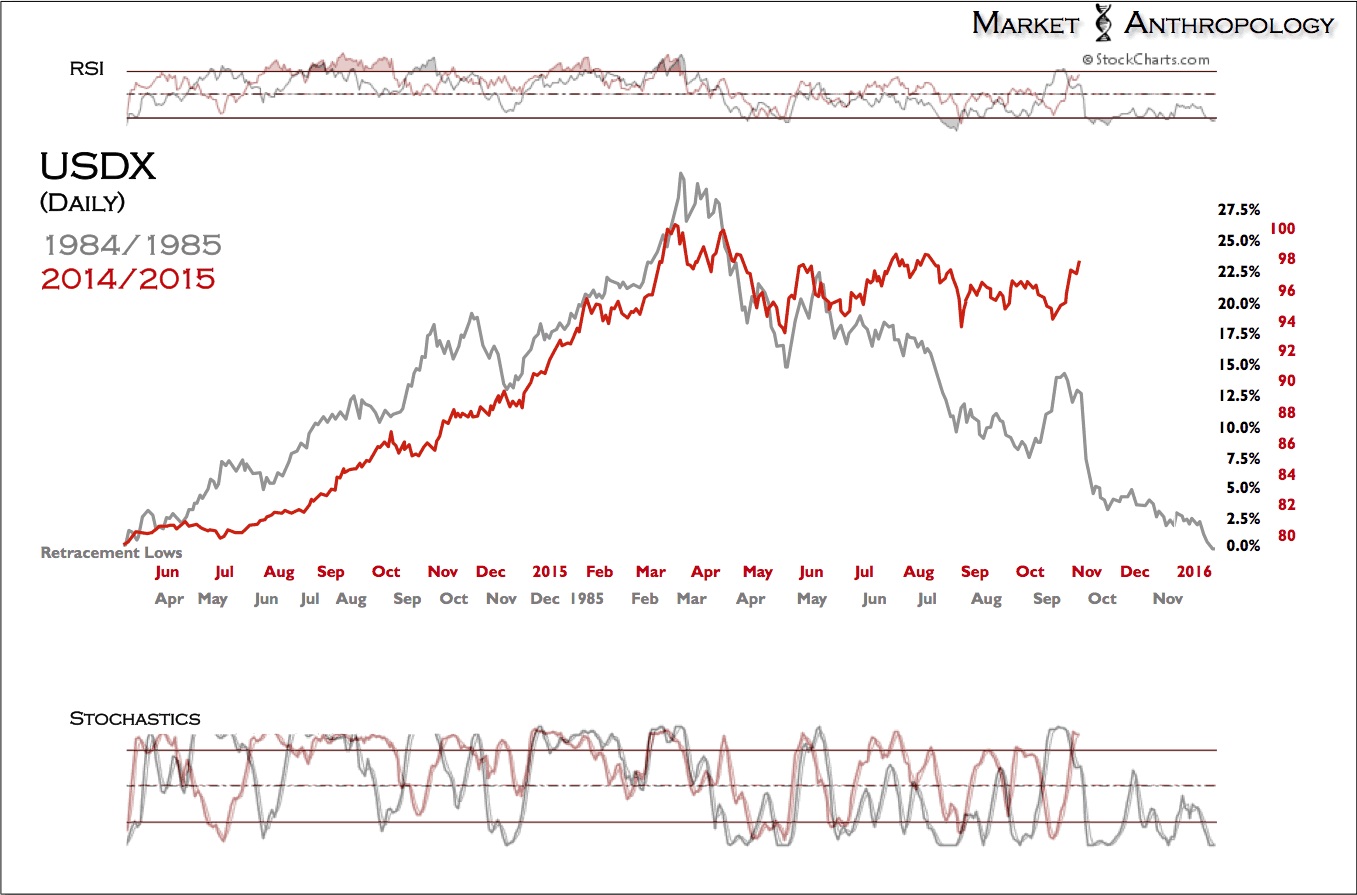

Similar to the correlated trend with the US dollar index over the past year (Figure 3), upside momentum in long-term Treasuries peaked at the end of January and has made progressively lower highs as momentum has been sold.

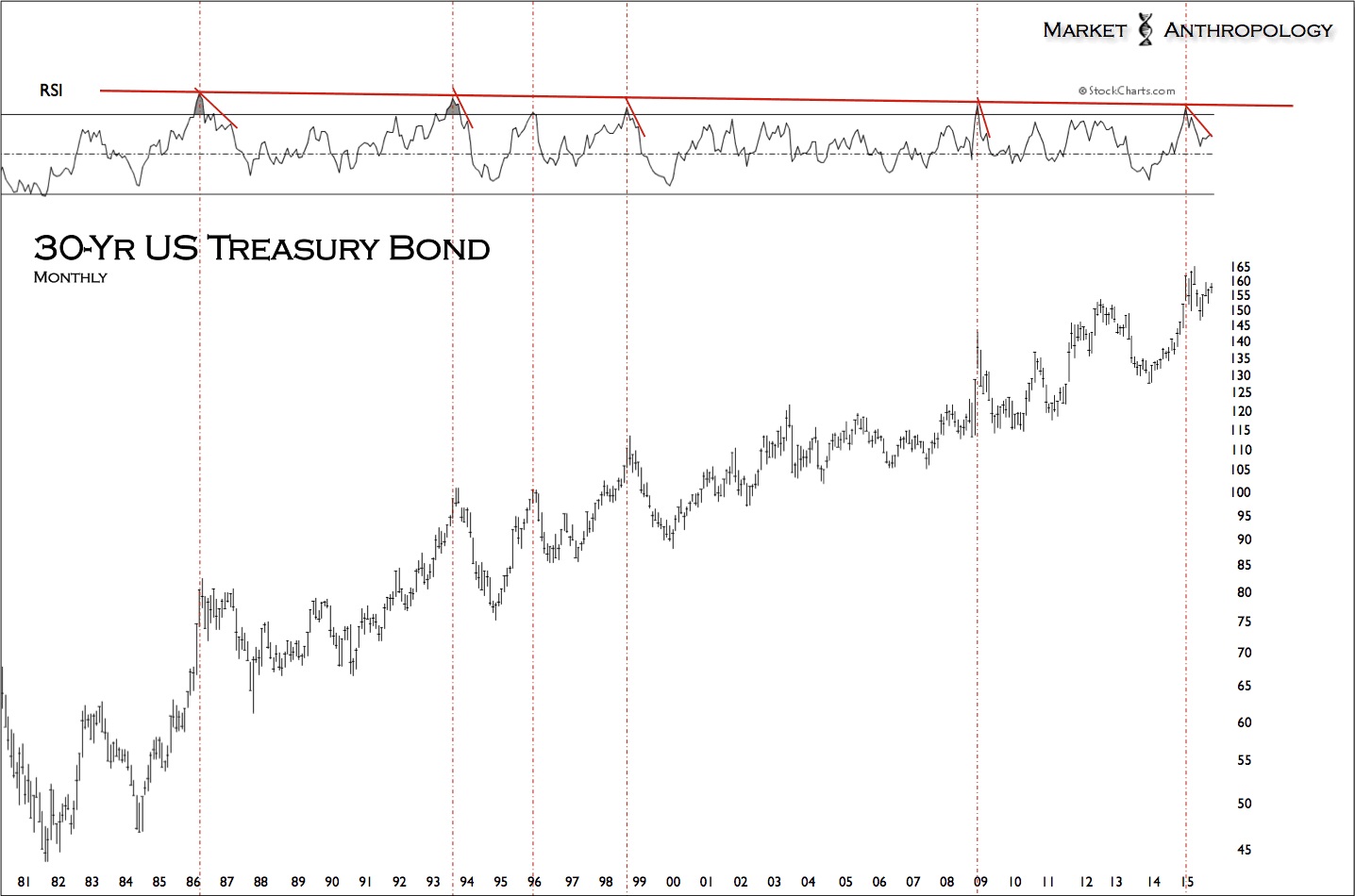

After the significant run-up in long-term Treasuries that began in January 2014, this descending topping pattern with diminishing momentum is typical (Figure 1) of how major bond runs have exhausted and reversed over the past thirty years, within their broader secular uptrends.

Since 10-year yields completed at the end of January our comparative retracement of the move that began with the taper tantrum in May 2013, we have speculated that the 10-year yield would eventually test long-term overhead resistance later this year. And while the trials and tribulations of the Fed's next move appear to have to pushed back that test, the song remains the same when it comes to the bearish topping structure still prevalent in long-term Treasuries and our suspicion that longer-term yields will at the very least test overhead resistance.

Curiously, we continue to follow the inverted profile of the secular high in the 10-year yield (Figures 11 & 12), that still appears to be replicating a comparative "head" of a massive head and shoulders reversal pattern. Should the long-term comparative remain even mildly prescient, our relative expectations towards the yield trough would need to be raised by approximately 100 basis points, subsequent to what would certainly be the most severe bear market in bonds since 1994. All things considered, we are less inclined to expect as severe market outcome, but will reserve judgement if and when the market tests and breaks above overhead resistance.

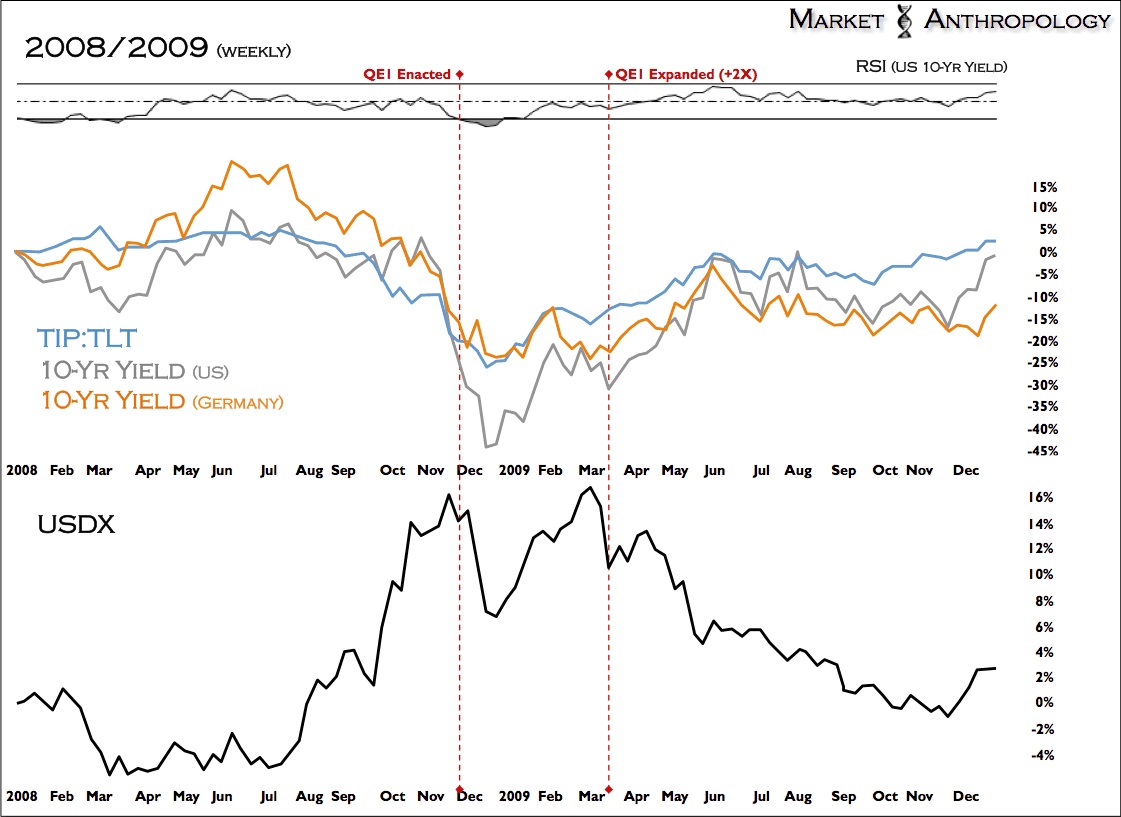

Outstanding of Fed policy, a major near-term potential catalyst to help instigate a move higher in yields is the hint by Draghi last week of his willingness to advocate a material increase in the ECB's stimulus program. With some now speculating (see Here) - as we comparatively suggested in September (see Here), of more than doubling the initial size; it would follow the Fed's playbook of how they expanded (2X) and built out their own stimulus programs in March 2009.

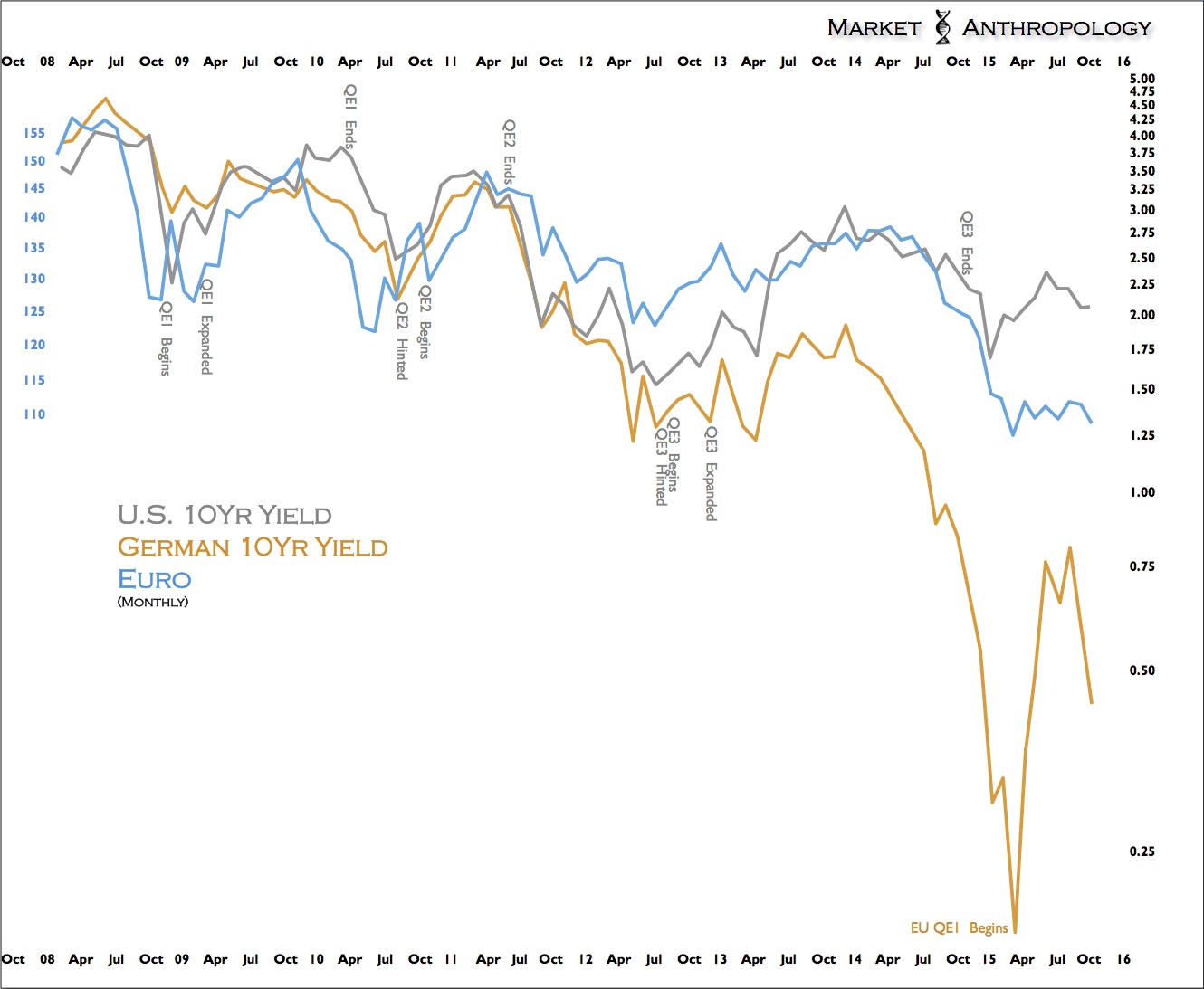

Our general take on the intermediate-term effects - which have been borne out in the markets since 2009 (*including the ECBs initial salvo this March - Figure 2), is that QE has historically supported yields as investors are shaken out of the safe-haven corners of the government bond market and into more reflationary asset positions that invariably weakens the dollar (Figures 6 & 7).

Moreover, from our perspective - and despite conventional wisdom that sees a weaker euro as the best remedy for what ails Europe, we would argue that a broadly weaker US dollar would have the greatest efficacy in the long-term, as it could reflexively affect inflation expectations worldwide - most notably in emerging markets that the IMF estimates will account for more than 70 percent of global growth through the end of this decade.

Despite a strong rally in the dollar Wednesday following the Fed decision that left rates unchanged but with a less dovish tone in the statement, we still find support from differentials in policy expectations already largely priced in to the dollar and expressing similar weak technical underpinnings (Figures 3, 9 & 10) of long-term Treasuries.

Figure 1

Figure 2

Figure 3

Figure 4

Figure 5

Figure 6

Figure 7

Figure 8

Figure 9

Figure 10

Erik Swarts is an independent trader and creator of the online market research site -- Market Anthropology. He uses a synthesis of technical and asset relationship analysis to determine a market's respective risk profile.

Erik Swarts is an independent trader and creator of the online market research site -- Market Anthropology. He uses a synthesis of technical and asset relationship analysis to determine a market's respective risk profile.