Correction In Gold Stocks Continues

Several weeks ago both gold and gold stocks hit major resistance after strong but extended moves. A correction or pause was to be expected. Clearly, we can now say, the sector is in correction mode.

Corrections tend to have three legs: a simple down up down or A-B-C pattern. The gold stocks (and gold) appear to be on the C leg of that A-B-C pattern.

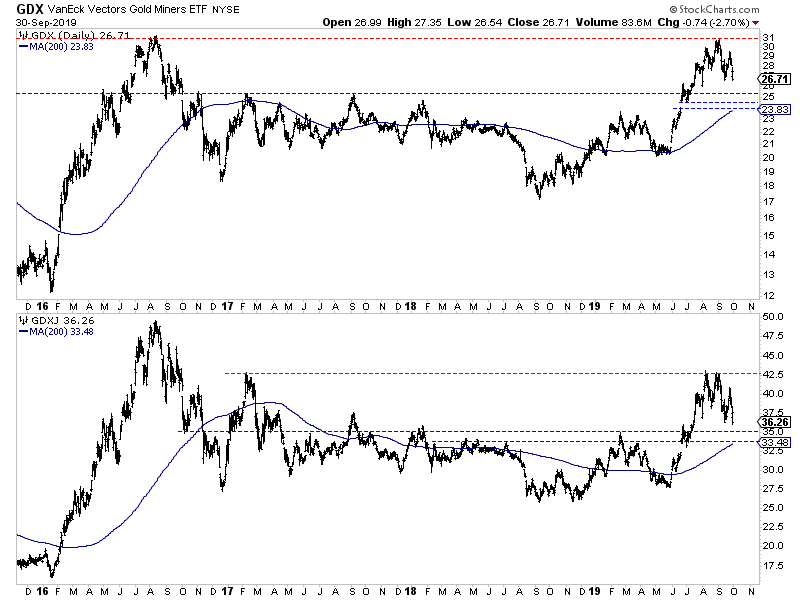

Below we plot the daily bar charts for GDX and GDXJ.

GDX has a confluence of strong support at $24-$25 while GDXJ has support at $34-$35 but could fill its open gap at $32.50 to $33.00.

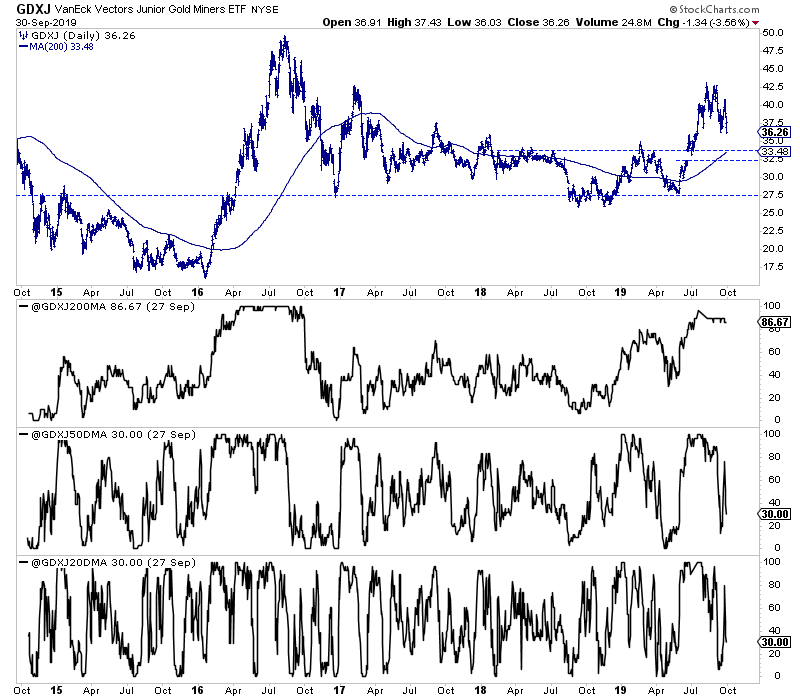

As the correction continues, another thing we will follow is our custom breadth indicators. In the chart below we plot GDXJ along with the percentage of GDXJ stocks that closed above their 200-day moving average, 50-day moving average and 20-day moving average.

At the recent short-term low during the Fed meeting, the percentage of GDXJ stocks trading above the 50-day moving average and 20-day moving average showed a very oversold condition.

Before Monday, the percentage of GDXJ stocks trading above the 200-day moving average was 87%. That needs to decrease quite a bit before we get a sustainable rebound.

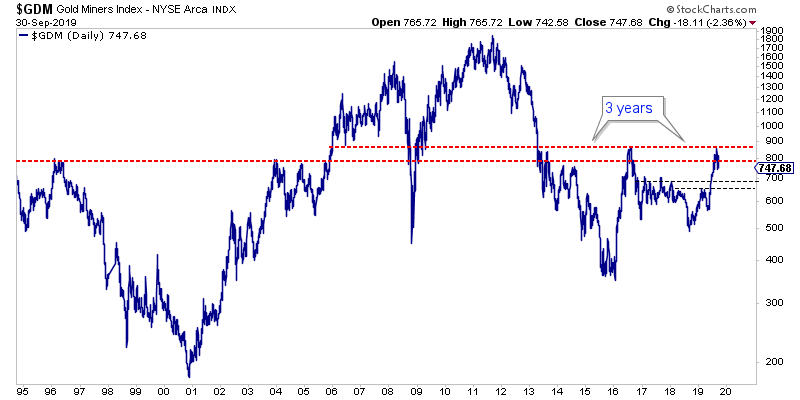

Circling back to GDX, it is critical to understand GDX’ long-term technical position. Below we plot the NYSE Gold Miners Index, which is the parent of GDX and has a history of 25 years.

The large-cap gold stocks (as evidenced by GDX) are correcting around resistance that dates back over 20 years.

After the 2013 crash and ensuing selloff, it took GDX three years to rally back to that level. Following that peak, it has taken another three years.

While it will not take another three years for the gold stocks to bust through that resistance, it’s unlikely to take only a few months. It could be anywhere from a few quarters to a year.

That will depend on the fundamental developments, which we have discussed in our past missives.

For now, look for more selling in the gold stocks but then a decent rebound into November that could eventually morph into a consolidation. What follows from there will depend on Fed policy and inflation.

In the meantime, better value and new opportunities will continue to emerge. Don’t panic. Instead, use this time to tweak your portfolio and err on the side of buying quality at a discount. To learn the stocks we own and intend to buy that have 3x to 5x potential, consider learning more about our premium service.

********