Cycles Called For A Bottom In Both Gold And Silver Prices

At buygoldprice.com, we use a combination of cycle and technical analysis tools to forecast precious metal prices. Though these tools are not flawless when combined, they often forecast certain lows, give or take a few days. Below are the updates released to Premium subscribers Thursday morning.

At buygoldprice.com, we use a combination of cycle and technical analysis tools to forecast precious metal prices. Though these tools are not flawless when combined, they often forecast certain lows, give or take a few days. Below are the updates released to Premium subscribers Thursday morning.

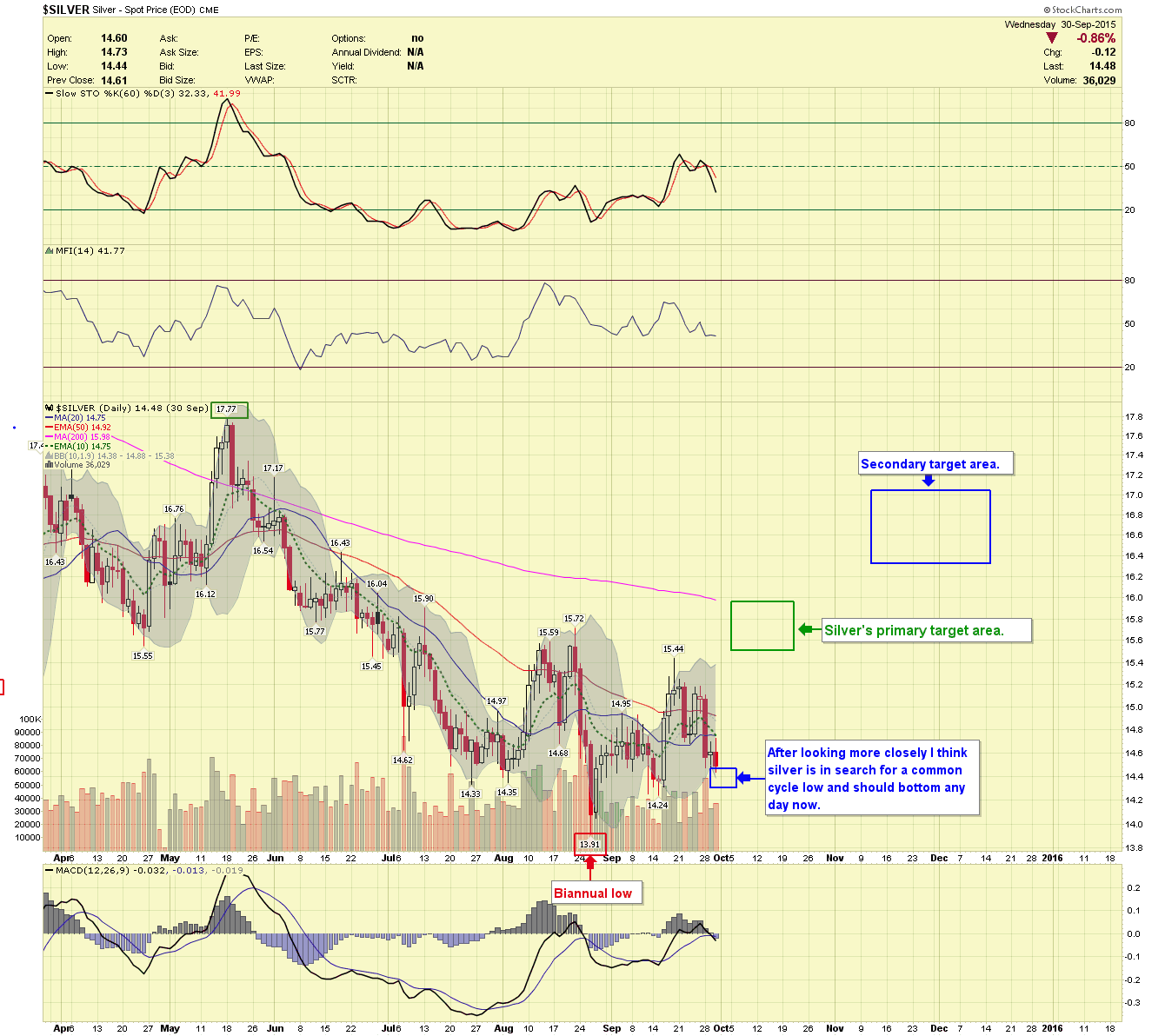

Thursday 9:57 am- After looking more closely at the Silver chart, I believe I understand what is going on. Silver is searching for a common cycle low -- and should bottom either yesterday, today (10/1/15) or tomorrow. The nonfarm payroll numbers will be out tomorrow morning, and that may add volatility, but prices should bottom soon and head higher toward either the primary or secondary targets.

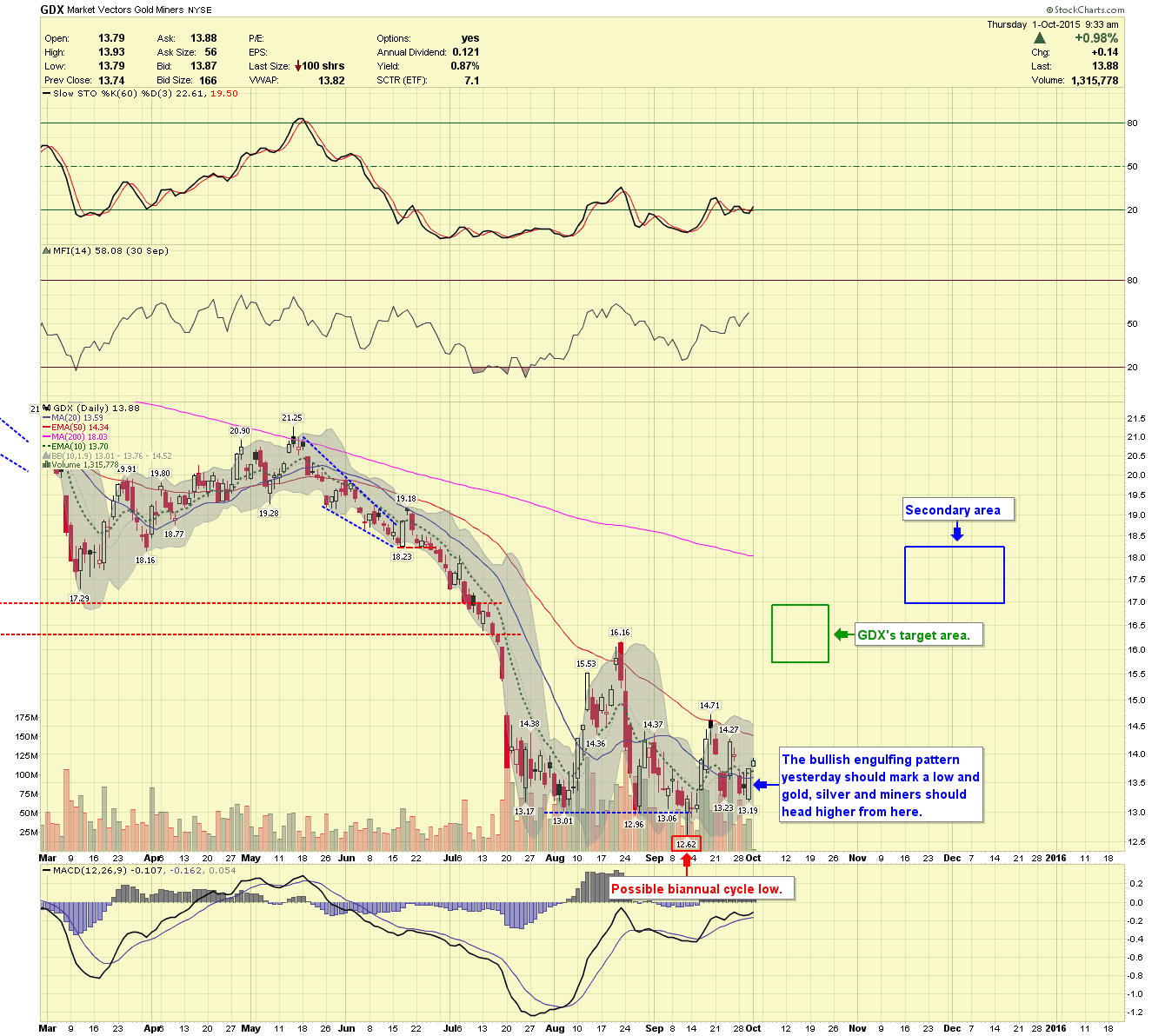

Thursday 9:50 am- GDX may have tipped its hand yesterday as it formed a bullish engulfing pattern while both Gold and Silver were weak. I think prices formed a bottom yesterday and should head higher from here.

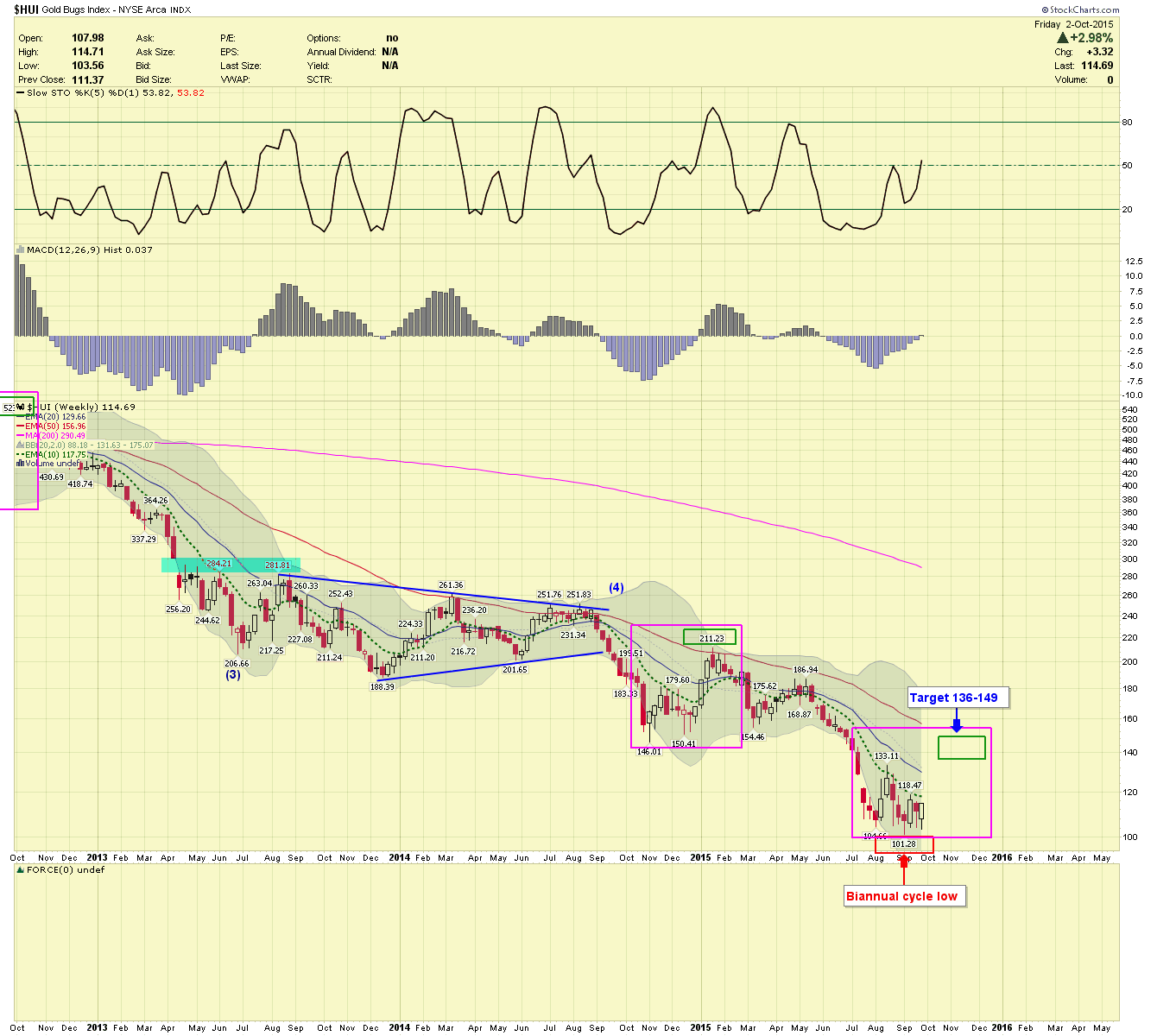

Calling cycle lows is the easy part of my newsletter business, what’s often more difficult is forecasting and timing the cycle tops. For that, I rely on technical analysis, current trends and past/present price structure. I look for similarities during previous cycles, then break them down and extrapolate potential price targets.

Over the last three years, I have seen two similar setups. Each had an impulse wave from a biannual cycle low that was followed by a B-wave retracement. From that point, prices rallied past the original impulse high in a strong manner. The chart below shows potential target areas for such a rally with the corresponding timing. As the trend progress towards my target area, I can often fine-tune and narrow down certain price levels.

Once we top later this fall, my cycle work suggests we will head down into the final 8-year cycle low sometime in 2016. As the name suggests this rare and uncommon low arrives just once every 8-9 years and with it comes excellent buying opportunities. My tong-term work suggests great potential for both Gold prices and Silver prices once the major cycle low arrives. In the meantime we suggest staying nimble and saving your money for next year’s opportunity.

********

For more information regarding gold, silver and mining technical analysis contact us at buygoldprice.com