Dear Bullion Banks, Please Come Back!

One of our colleagues recently wrote an open letter to Ted Butler. The point was that Monetary Metals gold leasing is a different kind of activity than what is called “gold leasing” in the institutional bullion market. We make it possible for gold owners to lease their metal to gold-using businesses, and thereby earn interest in gold. Today, I want to discuss something that few in the gold community would defend: bullion banks aka market makers.

Where Have the Bullion Banks Gone?

There has been a trend for several years, of bullion banks leaving the market. This is due to country-specific regulatory pressures in some cases, global regulatory pressures, and no doubt, the adverse treatment of gold on the balance sheet under Basel III. Either this trend has hit critical mass, or something else happened around the time of peak government response to COVID-19. But there was unprecedented impact to the gold market. For example, we wrote that for the first time ever (or at least 1996), the expiring gold and silver futures contracts had rising basis).

By impact, we mean the gold and silver markets have become less efficient.

To understand this, we need to understand what efficiency means. Too many people take it to mean that everything has the right price. The so called Efficient Market Hypothesis holds that:

“…asset prices reflect all available information.”

According to this view, you cannot beat the market (i.e. make money as a speculator):

“…since market prices should only react to new information.”

Let’s Define Insider Trading

Indeed, one of the key principles of securities regulation is embodied in the insider trading laws. Everyone is, by law, supposed to have access to new information at the same time you do. Or if they are able to get it earlier, they are prohibited from trading based on it.

We will leave aside the question of whether the government has the moral right to throw people in prison for trading based on what they know. Economically, it’s a fool’s errand based on a false hypothesis.

Let’s take a simple example. The information is out there that the dollar will collapse. The question is why the gold price is not orders of magnitude higher than its current $1,800.

It is one thing to say that information is published out there somewhere. It is quite another to assume that therefore everyone must form the same conclusion. This assumption flies in the face of every controversy, ever. Understanding is not automatic, and that is assuming that everything published as a fact is really true. And that flies in the face of every controversy, ever, too.

Obviously, most people do not believe that the dollar will collapse.

We might as well revert to belief that if the central bank doubles the quantity of its irredeemable currency, then everyone will buy and buy until all prices eventually double. After all, the information is out there that M0 doubled!

We categorically reject the idea that information is out there in the sense that everyone knows all relevant things to an asset price. Much less that they agree on the importance of each fact’s degree of relevance.

How Efficiency Affects Gold Prices

Back to the gold price, the assets owned by the Federal Reserve have increased quite massively. In September last year, the Fed had $3.8 trillion worth of bonds. In June this year, it hit $7.2 trillion. This is a gain of 89%. The price of gold was $1,500 back then. Many people think that it should have climbed to $3,400 as a result of the increase in the quantity of dollars. However, other people obviously do not think that. It turns out that gold is a two-way market (and God help us all, when one day gold becomes a one-way market).

Clearly, an efficient market does not mean one in which all prices reflect all information. That’s because the proposition is absurd. However, there is a sense in which market efficiency makes sense.

We are referring to when the cost of trading is low.

As the cost of trading rises, the marginal market participant leaves the market. This is not usually the speculator, because someone is betting on an 89% price move is not worried about a few percent cost. However those who are hedging their price exposure, for example, care a great deal. The cost of trading is like friction. The greater the friction, the more that it stops motion.

In the metals markets, the most important cost is the carry (which we usually quote as an annualized percentage, the basis). To carry gold, one buys physical metal at the spot price and sells a futures contract. Since the cost of storage is very low, the basis should be marginally above the rate of interest available to banks. In fact, the falling interest rate has been the driver of the falling basis over the decades.

Early Signs of an Inefficient Market

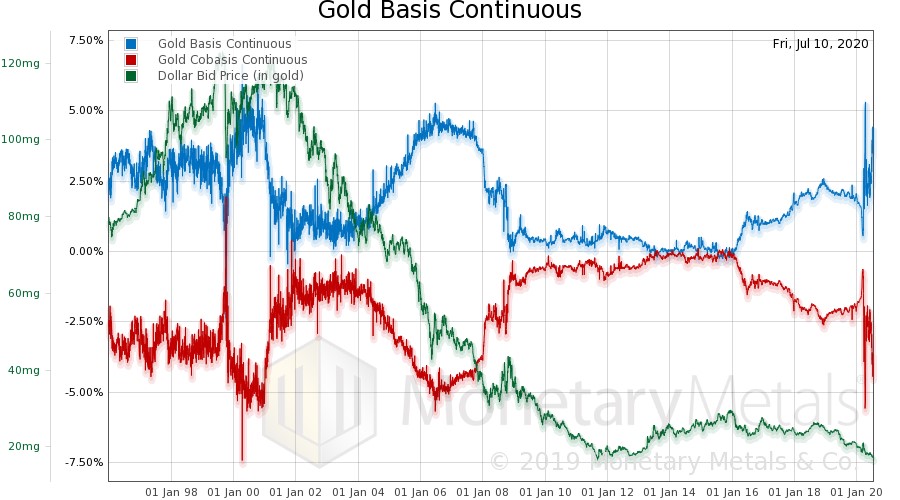

In this long-term chart of the continuous basis (we use the continuous basis, rather than the basis of individual contracts to remove the discontinuity as each basis falls into expiry and reverts back to normal as the next contract takes over being the most active), look back to 2008.

As the Fed is cutting rates in 2008, the basis is falling. Then it stays near zero for years, rising with the Fed’s Kibuki theater when they play-acted hiking rates. Then it begins to fall. Until March this year, when it explodes higher. To us, this move looks unprecedented (keeping in mind the greater volatility inherent in the market data prior to 2004).

Silver does not look too different.

The Fed Funds Rate was in decline before that point (and collapsed to all but zero by April). So why this rise in basis? This is not showing the near contract, so the issue is not the distortion caused by the buying of longs that we have recently discussed.

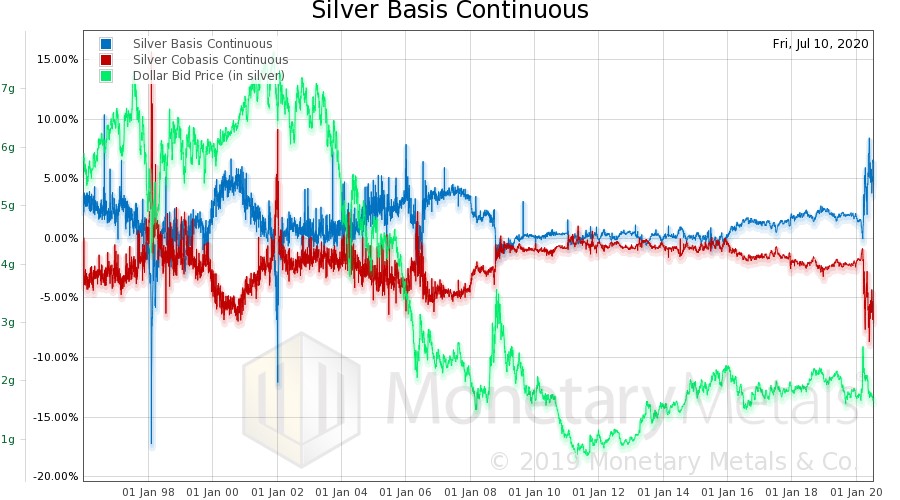

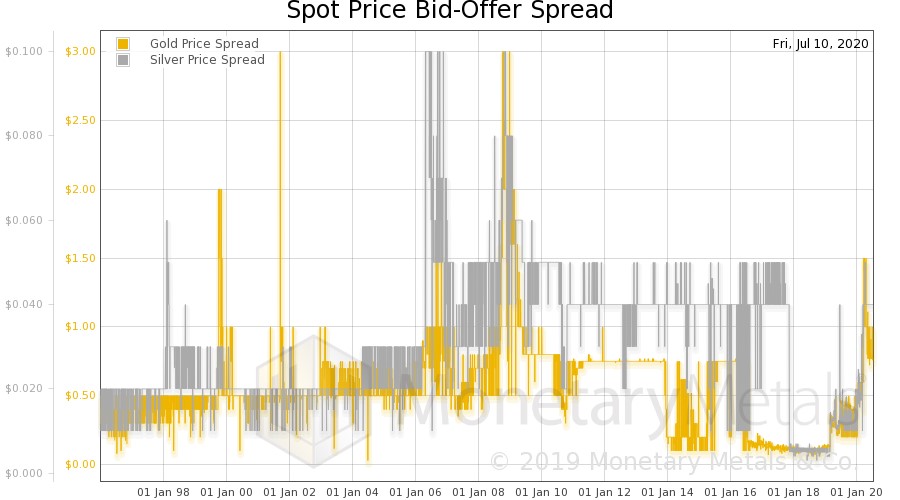

Now look at this graph of the bid-ask spread in spot gold and silver.

The action is silver is not unprecedented. But gold will be, if the current trend continues. The spread for buying and selling of physical gold in the commercial market has widened. This is part of why the spread you may encounter at your bullion dealer is wider.

These are pictures of a market becoming less efficient. In part, it is the decrease in coordination (or increase in discoordination) that has generally occurred in the wake of COVID.

For example, meat processing plants closed. This caused a massive fissure to open up. On one side, farmers had no market for their products and had to destroy many animals. On the other of the chasm, consumers could not find meat on the shelf at the supermarket (or when meat was there, the price was a lot higher).

But the bid-ask spread tells a bigger story. The spread in silver and gold began widening in March—of 2019. At first, it wasn’t that much. Gold went from 15 to 35 cents, and then bounced around between 20 and 50 cents during 2019. By February, it was up to 60 cents, before spiking to $1.50 in late March. It is currently 77 cents.

Another One Bites the Dust

The latest bank to leave the gold business is Scotia, which is closing its Mocatta division.

We recall a decade ago, some joker was promoting the idiotic idea of buying silver (at over $27 an ounce) with the intention to crash JP Morgan Chase. The idea was idiotic, for three reasons.

One, if you are going to speculate, you should do so with the intention to profit, not to hurt someone else. Two, the bank is not affected by the silver price. And three, no rational human being wants mayhem and destruction. That’s why the Joker is a villain in a comic book world.

We now know how it worked out. Those who followed this instruction, were not bold destroyers engaged in espionage for the cause.

They turned out to be more like Ratbert, manipulated by Dogbert. Dogbert had a scheme to become an iron-fisted dictator and Ratbert wanted looting, but instead ends up as a stain on a tank tread. This is especially true if they held the silver after its price peaked and crashed a few months later.

Why We Need the Market Makers

Anyways, our point today is that people who care about the gold market should not want to see the banks leaving the market. The consequence is higher friction, a higher cost of doing business for miners, refiners, mints, and dealers. This will be reflected in the form of higher premiums paid when you buy a coin or bar, and a lower price realized when you sell it.

Who likes to pay a higher cost for the same thing?

No one (we assume) is happy to see banks departing because they like (or understand) that it will lead to higher costs. The problem is that the market maker is not understood, and gets no sympathy.

In the 17th century coffeehouse stock exchange, people who wanted to buy lined up in descending order of the price they were willing to pay. On the other side, people who wanted to sell lined up in ascending order of the price they demanded. In other words, bid and offer.

But then this curious fellow showed up and stood in the middle. He claimed he was willing to buy or sell. And his bid was higher than the others, and his offer lower. The others in the coffee house thought he was dodgy, maybe even criminal. They called him a “jobber”.

Today, he is called a “HFT” (High Frequency Trader) and the regulators are often investigating him for spoofing, front-running, manipulation (of the small and temporary kind, no Motte and Bailey thank you very much) and other real or imagined ills.

A market foolish enough to truly banish the market maker will suffer higher frictional costs, and hence lower volumes.

Let’s hope that this situation is rectified, and new market makers come to the gold and silver market.

© 2020 Monetary Metals

********

Dr. Keith Weiner is the CEO of Monetary Metals and the president of the

Dr. Keith Weiner is the CEO of Monetary Metals and the president of the