Despite Gold’s Decline This Week, Gold Miners Continue To Grow

Strengths

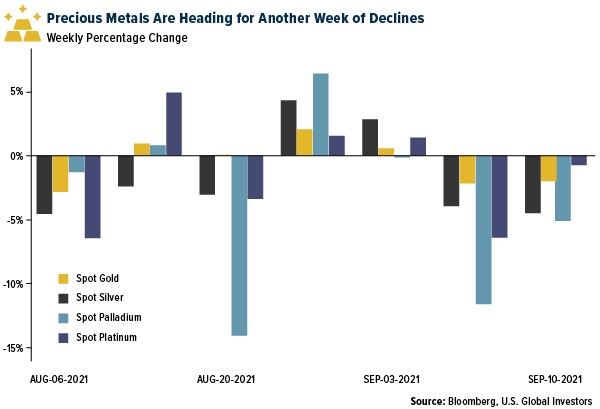

- The best performing precious metal for the week was gold, but still off 1.86%. Sibanye Stillwater, which has transformed itself from a South African gold miner to a platinum-group metals giant, branched out its reach this week to enter a joint venture to develop the Rhyolite Ridge lithium-boron project in Nevada and have additional exposure to battery metals. Earlier this year, Sibanye bought a stake in a nickel hydrometallurgical processing facility in France.

- Franco-Nevada CEO Paul Brink reiterated that the company expects to grow production from 600,000 gold equivalent ounces (GEO) in 2021 to 650,000 GEO in 2025, with the biggest driver being Cobre Panama, expanding to 100 million tonnes per year in 2023. The company is currently growing its cash balance $1 billion each year.

- Endeavour Mining CEO Sebastien de Montessus said the company is on track to achieve the top end of 2021 guidance (1,365-1,495 thousand ounces), with production benefiting from higher grades at Hounde (Kari Pump) and a late start to the rainy season.

Weaknesses

- The worst performing precious metal for the week was silver, down by 5.72%. Silver fell to its lowest level since December as stronger than expected retail sales across almost all categories more than offset the weaker automobile sales. Last week, ETFs reduced their silver holdings by 1.4 million troy ounces, platinum holdings by 35,666 troy ounces and palladium holdings by 15,297 troy ounces.

- Platinum and its sister metals palladium and rhodium -- used in pollution-cutting catalytic converters -- have all suffered sharp drops in recent weeks as carmakers shutter plants and trim output guidance. The price slump is a big contrast with the booming performance earlier in the pandemic, which was driven by supply shortages and hopes of a stimulus-led economic recovery. Rhodium, the most expensive precious metal, has suffered the most as its demand comes almost entirely from the auto sector. Palladium isn’t far behind, having this week dropped through $2,000 an ounce for the first time since July 2020.

- New Gold provided an update at its Rainy River mine in Ontario, Canada. Gold production at Rainy River is now expected to be between 235,000 and 250,000 ounces, reflecting the impact of prior disclosed negative grade reconciliation. National Bank Financial lowered its price target form C$2.50 to C$2.00 on the update.

Opportunities

- OceanaGold’s Didipio restart is progressing ahead of plan, with inventory sales of approximately 40% for $25 million and 65% of the workforce expected to be rehired by end of the third quarter. The company expects the asset to be fully ramped within 10 months.

- AngloGold announced that it has entered a definitive agreement to acquire Corvus Gold following the proposal announced on July 13. Under the agreement, AngloGold will pay C$4.10 per share in cash for the 80.5% of the shares it does not already own in a deal worth $370 million. The offer price is at a 59% premium to the share price on 5 May 2021, the day before AngloGold entered a $20 million unsecured loan facility and a 90-day exclusivity period.

- Americas Gold and Silver announced work had restarted at the Cosalá operation in Mexico, and the company expects to start shipping concentrate before the end of October after the 20-month blockade was lifted. Cosalá is a significant component of its valuation, so if the company can deliver on the plan, the market would likely rerate the stock higher.

Threats

- Centerra CEO Scott Perry reiterated the company’s revised 2021 guidance of 290,000 ounces, following derecognition of Kumtor. The company remains open to discussions with the Kyrgyz government (potentially taking back the government’s stake in Centerra and subsequently canceling those shares) but is also considering all legal options.

- Newmont CEO Tom Palmer noted that the Yanacocha Sulfides full funds decision has been deferred to late 2022 from late 2021 due to ongoing COVID-19 related issues in Peru (including low vaccination rates). In a Bloomberg interview this week, the CEO noted that labor tightness, higher energy prices and higher materials prices are pushing the company’s overall costs up by 5%.

- Gold fell, pressured by rising Treasury yields as lower-than-expected U.S. inflation data eased concerns over the Federal Reserve starting to reduce stimulus. The yield on the 10-year Treasury rebounded after dipping to a three-week low, reducing demand for bullion that generates no interest. The U.S. consumer price index (CPI) rose 0.3% in August from July, the smallest gain in seven months, data released Tuesday showed. The inflation print Tuesday offered some validation of the view held by Fed Chair Jerome Powell that high inflation caused by the economy reopening was transitory, alleviating worries that the central bank will be forced to soon tighten policy.

*********

Frank Holmes is the CEO and Chief Investment Officer of

Frank Holmes is the CEO and Chief Investment Officer of