The Dollar’s Future And What That Means For The Gold Price

Strengths

- The best performing precious metal for the week was platinum, up 0.74 percent. Silver also clocked a positive gain of 0.28 percent. Economic growth in the U.S. slowed more than forecast last quarter on the biggest trade drag in six years, reports Bloomberg. Net exports subtracted 1.7 percentage points from expansion in the October – December period, as dollar strength likely was a drag on growth. Should the new Trump administration push for a weaker dollar, this could lend support to gold.

- China purchased a net 47 tons of bullion in November, according to data from the Hong Kong Census and Statistics Department and compiled by Bloomberg. Additionally, shipments of gold from Switzerland to China surged more than fivefold to 158 tons in December, Bloomberg continues, the highest since at least January 2014. Appetite for gold is soaring ahead of the Lunar New Year.

- According to Bloomberg, the four ETFs backed by gold that have attracted the most money this year are all based in Western Europe. Xetra-Gold, listed in Frankfurt, tops the list by bringing in around $544 million last week. Europeans are turning to the gold on fears that Trump’s “America first” rhetoric will impede global economic growth.

Weaknesses

- The worst performing precious metal for the week was palladium, down 6.65 percent. The metal is headed for its worst weekly drop in more than a year. CPM Group reported they see palladium and platinum in surplus for the next few years and estimated there are 25 million ounces of palladium in stockpiles, most held by investors.

- Physical gold demand fell in 2016 to its lowest level since 2009, reports Reuters, as increased prices weighed on appetite for the metal. GFMS, a research unit of Thomson Reuters, also notes that gold jewelry demand is at a 28-year low. Jewelry consumption is down 9.7 percent year-over-year at 551 metric tons in the fourth quarter.

- As U.S. equities looked to extend a rally on Friday, gold retreated for what might be a fourth-straight day of losses. However, real rates dropped a bit before the market open and gold eventually crawled into positive territory. “Gold was due for a short-term pullback, after rallying almost non-stop since late December,” Jordan Eliseo of Australian Bullion Co. said. “Strength in equity markets, with the Dow topping 20,000 points, soft physical markets and a greater focus on rate hikes from the Fed has seen the metal sell off.”

Opportunities

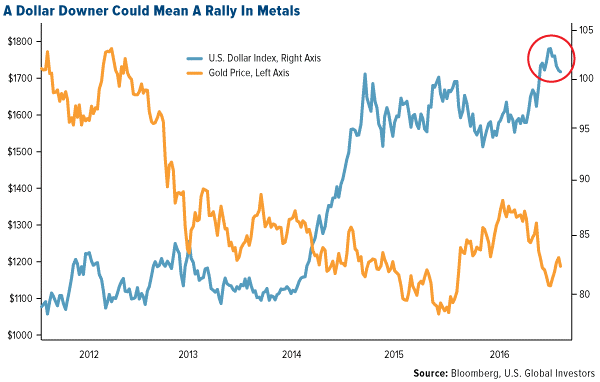

- UBS says the dollar has peaked and is likely to decline this year under President Trump, reports Bloomberg. The wealth management unit at UBS expects the currency’s future weakness to boost the price of base and precious metals. “We hold that view because we see real interest rates going deeper into negative territory.” Earlier in the week Steve Mnuchin also commented on the dollar, defying two decades of convention at the office of the U.S. Treasury Secretary by stating, “From time to time, an excessively strong dollar may have negative short-term implications on the economy.” In a similar note, Brown Brothers Harriman noted a recent St. Louis Fed study which showed how a strong dollar from 2014 to 2016 was associated with a drag on growth from net exporters.

- According to BlackRock, inflation is rising faster than many investors may realize, citing examples such as rising housing prices, uncontained medical inflation, rising wages and more. So what does this mean for investors? BlackRock says, “Should inflation expectations rise faster than nominal rates, gold is likely to continue to merit a place in most portfolios.”

- The World Gold Council believes the Indian government should lower the taxes on gold, currently at 13 percent, to help curb smuggling and promote transparency in local gold trade, reports Bloomberg. With a high customs duty, gold is being imported through the unofficial channel, the article continues. If India wants to eliminate corruption, a high tariff only encourages smuggling.

Threats

- BNP Paribas SA, the top gold and precious metals forecaster in the fourth quarter according to Bloomberg, expects the Federal Reserve to go “rapid-fire” on interest rates, boosting them every quarter in 2018. This tightening will strengthen the U.S. dollar and push gold down toward $1,000 an ounce, reports Bloomberg.

- The forecasted gold demand recovery from a seven-year low in India has been delayed, according to the World Gold Council. The WGC says gold consumption in the country will not return to normal levels until 2018, as a liquidity squeeze tightens spending this year, reports Bloomberg. In a report published Tuesday, the group estimates India’s usage between 850 metric tons to 950 tonnes by 2020 versus demand of 650 to 750 tonnes in 2016.

- Two of the biggest gold producers in South Africa, Sibanye Gold and AngloGold Ashanti, have been accused of putting workers’ lives at risk, reports Bloomberg. The Department of Mineral Resources argues that the companies are unwilling to follow the laws, while the two miners have criticized government inspectors for being too heavy-handed in temporarily closing mines for safety breaches, the article continues. AngloGold won a court ruling in October that blocked one such closure and Sibanye is suing Minister Mosebenzi Zwane and other officials for compensation after its Kroondal platinum mine was closed. Over the past decade AngloGold has reduced operating fatalities by more than 80 percent.

Courtesy of http://usfunds.com/

Frank Holmes is the CEO and Chief Investment Officer of

Frank Holmes is the CEO and Chief Investment Officer of