A Dying Fiat Empire & Gold

With the Fed set to hike rates and kill QE, markets are in turmoil. Some bank analysts are forecasting seven hikes this year.

Joe Biden’s crazed warmongering in Ukraine presents an additional danger. Russian citizens are bomb-sheltered, while Americans have no protection.

Clearly, the danger for citizens of the failed American fiat empire is immense, but the government has a psychotic history of using external “bad guys” to divert attention from a crashing domestic economy. It’s even used as a macabre scheme to boost GDP.

(Click on image to enlarge)

long-term Dow chart

My buy and sell signals are obvious.

The fundamentals are horrific. The Fed has deliberately created house market inflation for America’s wealthiest investors and now the average home buyer can barely afford a down payment.

A significant rise in mortgage rates will take a lot of potential buyers out of the market. Current homeowners whose mortgages are due for renewal later this year will face major stress as rates surge higher.

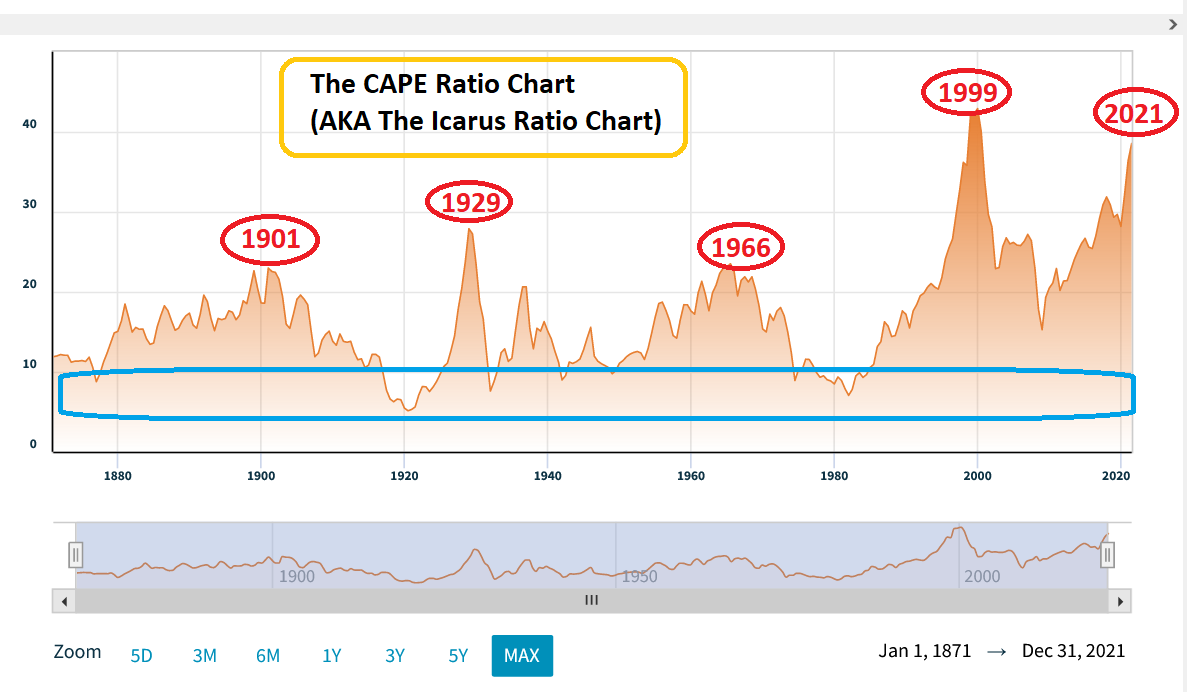

With key market valuations in the “Icarus” zone, the 2021-2025 war cycle intensifying, and the Fed killing its financial markets welfare programs, it seems impossible that the stock market could surge to a new high, but a final “truly ludicrous” blow-off rally could occur. It happened in 1929, and it could happen again.

(Click on image to enlarge)

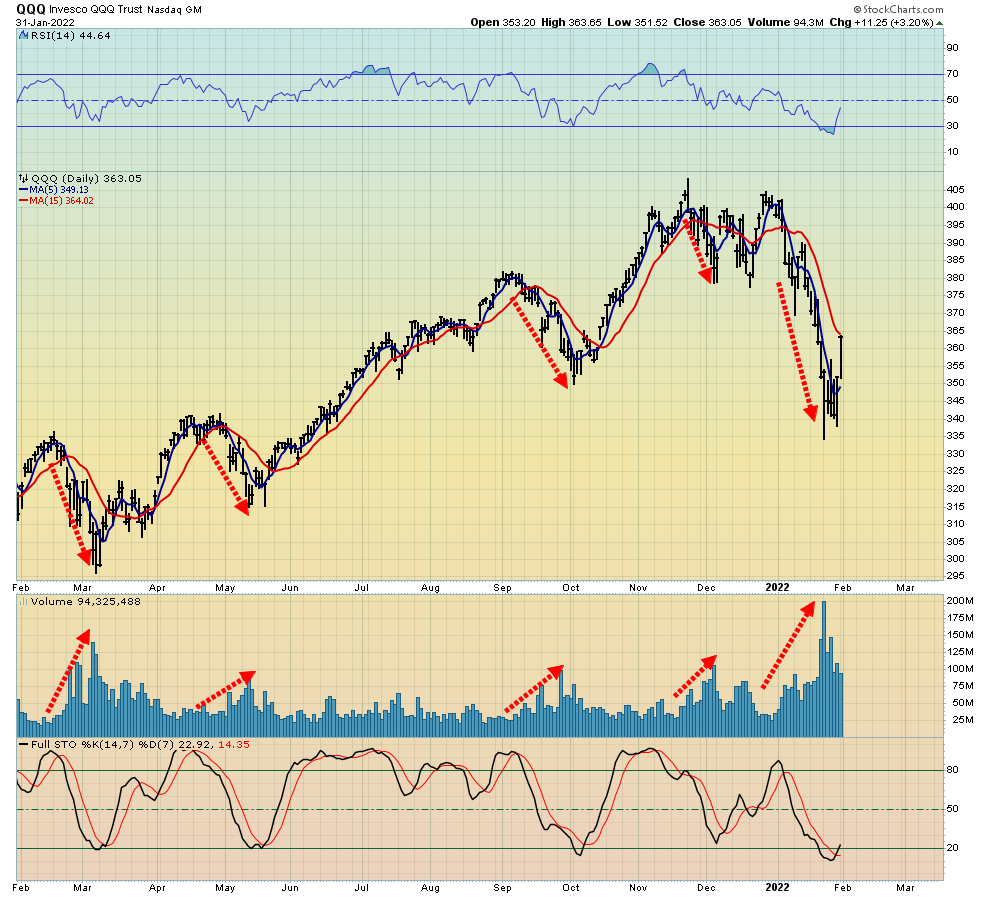

This “Q’s” chart (Nasdaq ETF QQQ) shows the weak technical picture; volume consistently surges as the price swoons.

The US stock market has volume versus price “Ebola”.

(Click on image to enlarge)

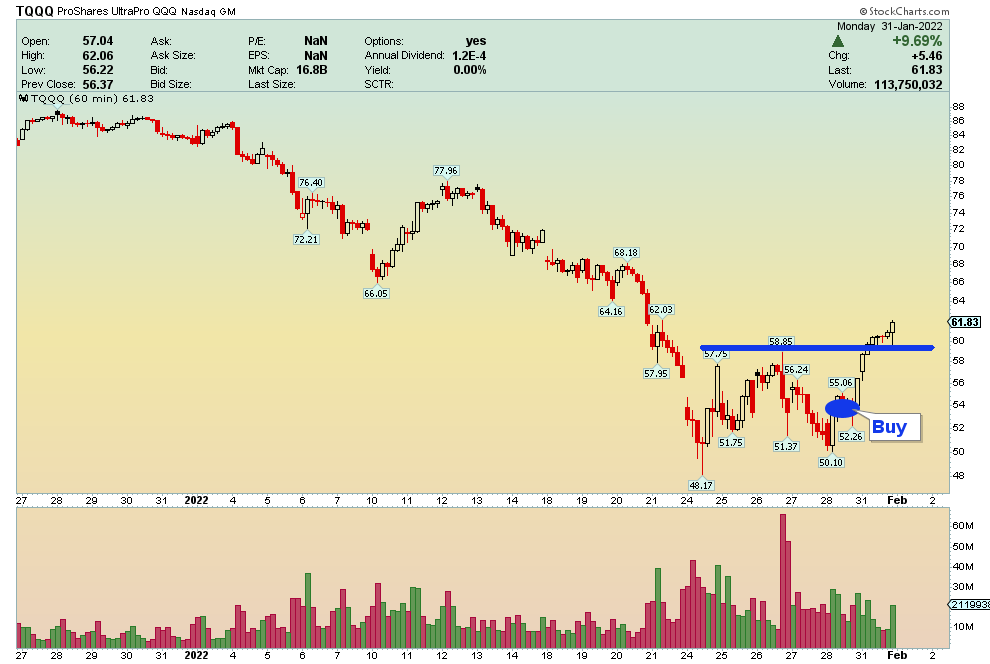

short-term TQQQ chart

I sold out of my US stock market core positions in 2021. Where did I put the proceeds?

Well, a lot went to gold bullion, some to fiat, and some is ready to go into the crypto market, and on that note, please see below.

(Click on image to enlarge)

Double-click to enlarge this key bitcoin signals chart. It’s possible that an Elliott “B Wave” has either ended or is ending now, and a C Wave with a target of $90,000 (and much higher) is about to begin.

In the big picture, the most likely scenario is that the “QE welfare addicts” invested in the US stock market are wiped off the map in late 2022-2023, and the US government starts a significant global war in an attempt to stop a civil war from developing.

My main concern is that the government will be successful in creating global war but will fail to stop a civil war. In a nutshell, “Mad Max” is likely set to lord over the floundering fiat empire once known as America, but not over citizens who have gold.

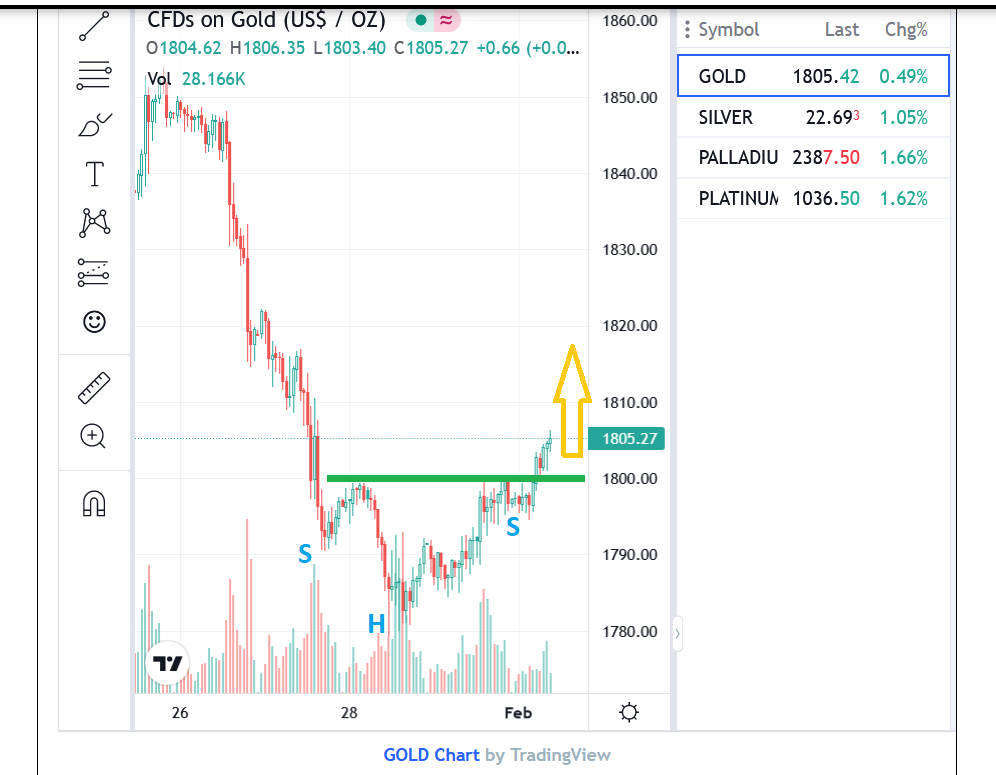

Gold is of course the world’s ultimate asset. For a short-term view of the action, please see below.

(Click on image to enlarge)

Gold is surging out of an inverse H&S bottom on this hourly chart and that’s in sync with the action on the dollar index chart.

(Click on image to enlarge)

An H&S top meltdown is in play for the dollar!

(Click on image to enlarge)

The short-term charts are in sync with a potential third fan line breakout and a rally to the neckline zone on this truly magnificent weekly chart.

Some technicians may wish to add a C&H (cup and handle) pattern to the chart, and others may debate about where to draw the neckline. The bottom line is that debates about minor technical details don’t make this chart into the work of art that it truly is. Market fundamentals are what created it, fundamentals will drive the upside breakout, and the fundamentals are incredibly bullish!

The miners? Well, the miners are the first love of most of the Western gold community, particularly in America. That’s likely because of the love of capitalism; if gold is money, the companies that mine it must be incredibly awesome investments!

That’s true, but mining stock investors need to pick their spots and focus on compounding booked profits. Hoping that the miners will do as well against the dollar as gold bullion does, with a buy and hold strategy, is not a great way to buy the miners.

(Click on image to enlarge)

Gold is either going to $1566 or $2089.Both zones are “cash cow” opportunities for buying the miners.$2089 is slightly more likely, and it’s coming even if $1566 gets touched first.

GDX and associated miners have a history of surging 20%-30% from these major support zones for bullion, allowing disciplined gold bugs to outperform the world’s top money managers. The juniors can surge 30%-50%. A gold price of $2089 is coming, and it’s a much bigger buy zone than the previous (and great) zones of $1671 and $1778.When it happens, I expect the seniors and intermediate miners to then surge 100%-200%, and the juniors to blast 300%-1000% higher. To get in on the action, simple patience is all that is required!

Special Offer For Gold-Eagle Readers: Please send me an Email to [email protected] and I’ll send you my free “Golden Footballs In Play!” report. I highlight eight fabulous junior miners that are set to “run with the ball” in January, as gold bursts above $1815! Key risk and reward tactics are included for eager investors.

Thanks!

Cheers

St

Stewart Thomson

Graceland Updates

Note: We are privacy oriented. We accept cheques, credit card, and if needed, PayPal.

Written between 4am-7am. 5-6 issues per week. Emailed at aprox 9am daily

Email:

Rate Sheet (us funds):

Lifetime: $1299

2yr: $299 (over 500 issues)

1yr: $199 (over 250 issues)

6 mths: $129 (over 125 issues)

To pay by credit card/paypal, please click this link:

https://gracelandupdates.com/subscribe-pp/

To pay by cheque, make cheque payable to “Stewart Thomson”

Mail to:

Stewart Thomson / 1276 Lakeview Drive / Oakville, Ontario L6H 2M8 Canada

Stewart Thomson is a retired Merrill Lynch broker. Stewart writes the Graceland Updates daily between 4am-7am. They are sent out around 8am-9am. The newsletter is attractively priced and the format is a unique numbered point form. Giving clarity of each point and saving valuable reading time.

Risks, Disclaimers, Legal

Stewart Thomson is no longer an investment advisor. The information provided by Stewart and Graceland Updates is for general information purposes only. Before taking any action on any investment, it is imperative that you consult with multiple properly licensed, experienced and qualified investment advisors and get numerous opinions before taking any action. Your minimum risk on any investment in the world is: 100% loss of all your money. You may be taking or preparing to take leveraged positions in investments and not know it, exposing yourself to unlimited risks. This is highly concerning if you are an investor in any derivatives products. There is an approx $700 trillion OTC Derivatives Iceberg with a tiny portion written off officially. The bottom line:

Are You Prepared?

********

Stewart Thomson is president of Graceland Investment Management (Cayman) Ltd. Stewart was a very good English literature student, which helped him develop a unique way of communicating his investment ideas. He developed the “PGEN”, which is a unique capital allocation program. It is designed to allow investors of any size to mimic the action of the banks. Stewart owns GU Trader, which is a unique gold futures/ETF trading service, which closes out all trades by 5pm each day. High net worth individuals around the world follow Stewart on a daily basis. Website:

Stewart Thomson is president of Graceland Investment Management (Cayman) Ltd. Stewart was a very good English literature student, which helped him develop a unique way of communicating his investment ideas. He developed the “PGEN”, which is a unique capital allocation program. It is designed to allow investors of any size to mimic the action of the banks. Stewart owns GU Trader, which is a unique gold futures/ETF trading service, which closes out all trades by 5pm each day. High net worth individuals around the world follow Stewart on a daily basis. Website: