Giving Thanks To The Innovators And Creators Of Capital

Our office recently had the pleasure of welcoming Dr. Kaye E. Wilkins, who practices pediatric orthopedic surgery here in San Antonio. The recipient of the 2008 American Academy of Orthopedic Surgeons (AAOS) Humanitarian Award, Dr. Wilkins has made it his mission to bring life-changing treatments to underprivileged parts of the world. He established the Haiti Clubfoot Project, which trains non-physician technicians to correct this debilitating deformity and give Haitian children a second chance at life. We were humbled to see and hear of Dr. Wilkins’s lifelong altruism and passion for helping others, no matter their background.

Our office recently had the pleasure of welcoming Dr. Kaye E. Wilkins, who practices pediatric orthopedic surgery here in San Antonio. The recipient of the 2008 American Academy of Orthopedic Surgeons (AAOS) Humanitarian Award, Dr. Wilkins has made it his mission to bring life-changing treatments to underprivileged parts of the world. He established the Haiti Clubfoot Project, which trains non-physician technicians to correct this debilitating deformity and give Haitian children a second chance at life. We were humbled to see and hear of Dr. Wilkins’s lifelong altruism and passion for helping others, no matter their background.

No one needs justification to tout Dr. Wilkins’s accomplishments, but I bring him up because he’s reflective of the America I believe in. The United States ranks as the most giving, charitable country on Earth, and this is especially true during the Thanksgiving and Christmas seasons. Near the end of last year, Facebook CEO Mark Zuckerberg and wife Priscilla Chan donated nearly $1 billion to charity. One billion dollars! The combined amount of the top 20 largest donations of 2013 actually exceeds a mind-boggling $5.7 billion.

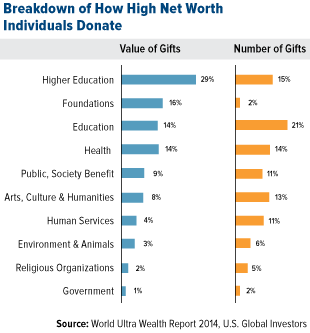

To the right you can see where high net worth individuals donate their money, broken down by the value and number of gifts. But a person need not travel abroad to poverty-stricken countries or donate thousands of dollars to make a difference. Our capitalist system allows entrepreneurs to find solutions to problems as well as profit from these solutions. Many critics tend to focus their derision on profit-seeking while taking for granted how much their own lives have improved as a result of private innovation and entrepreneurialism.

To the right you can see where high net worth individuals donate their money, broken down by the value and number of gifts. But a person need not travel abroad to poverty-stricken countries or donate thousands of dollars to make a difference. Our capitalist system allows entrepreneurs to find solutions to problems as well as profit from these solutions. Many critics tend to focus their derision on profit-seeking while taking for granted how much their own lives have improved as a result of private innovation and entrepreneurialism.

In a scintillating essay, Professor of Economics Mark Hendrickson writes that this Thanksgiving, we should be grateful for such entrepreneurs, the creators of our wealth:

Wealth doesn’t just appear spontaneously; someone has to produce it… In a free-market economy characterized by voluntary, and therefore positive-sum, transactions, the profits of entrepreneurs signify that at least that much wealth has been created for their customers. In other words, the larger profits are, the more wealth the entrepreneur has created for others, and indeed, the largest profits accrue to those firms that have supplied valuable goods and services to the masses.

Google, for instance, has made co-founders Larry Page and Sergey Brin billionaires many times over. But how much capital would you say it’s generated for the world? The amount is unfathomable. On top of that, Google employs about 55,000 people across the globe and each year hires an additional 6,000. The company’s success benefits not just its bottom line but also the lives of millions upon millions of people, from its employees to the users of its many services.

I’m grateful to live in a society that monetarily rewards such innovation and problem-solving, in addition to the intrinsic rewards entrepreneurs receive for improving the lives of others.

I’m grateful to live in a society that monetarily rewards such innovation and problem-solving, in addition to the intrinsic rewards entrepreneurs receive for improving the lives of others.

Here’s another example:

Last week we were visited by the management team of Calpian, including Chairman and CEO Harold Montgomery, President Craig Jessen and Chief Financial Officer Scott Arey. You might not have heard of Calpian before now, but the company is already changing people’s lives for the better by facilitating electronic and mobile payments, especially in India, the world’s second-largest cell phone market. In many parts of India, there’s poor to nonexistent point-of-sale payment mechanisms, and even though most transactions are done with cash, ATM machines are often very spotty. Calpian’s Money on Mobile service allows Indians of all classes to make transactions using their cell phones, thereby eliminating the need to carry cash or stand in hours-long lines to pay their water bill. Two years after its launch, Money on Mobile is used by approximately 112 million Indians.

I’m also thankful to be blessed with 1,440 minutes each day. So much can be achieved in this short amount of time—whether it’s staying active or helping others—so long as you have the will to put it to good use.

I asked our portfolio managers what they were most thankful for this season, with regard to a fund they manage. Here’s how they responded:

John Derrick – Near-Term Tax Free Fund (NEARX)

I’m most thankful that our fund received the 5-star overall rating from Morningstar, among 164 Municipal National Short-Term funds as of 10/31/2014, based on risk-adjusted return. Despite the global slowdown and decline in gold and oil prices, the municipal bond market this year has been up every month through October. I’m grateful that we can continue to perform well and deliver solid risk-adjusted returns for our investors and meet their high expectations of what a municipal bond fund is supposed to do.

Aside from that, I’m incredibly fortunate to work with such a dedicated team of portfolio managers, analysts and other investment professionals. Their support and camaraderie are greatly appreciated.

Xian Liang – China Region Fund (USCOX)

I would say I’m most grateful that China’s leadership appears to be delivering on the promises it made last November at the Third Plenary Session, specifically the liberalization of the financial sector and reform of the role capital markets play in allocating resources. Just as there was in the 1990s, there’s going to be some bullet-biting in the face of reforms, but short-term discomfort is often necessary for long-term growth. This leadership is determined and committed to putting China on the right path.

I also want to thank my fellow investment team members. We cross-pollinate our ideas and are always looking for ways to strengthen what we do.

Ralph Aldis – World Precious Minerals Fund (UNWPX) and Gold and Precious Metals Fund (USERX)

I’m going to have to go with Klondex Mines. It’s the largest holding in both funds, and it’s performed exactly how the management team said it would. In December of last year, Klondex raised the money to buy Midas Mine and Mill from Newmont Mining, and since then it’s been a steady grower. It looks as if it’ll conclude the year with $45 million in cash, which is even more remarkable when you recall that in the first quarter of 2014, it had just $6.8 million. Institutional investors tend to be reluctant about buying a new name in gold mining, but I think Klondex will prove to be too compelling to pass up much longer.

Brian Hicks – Global Resources Fund (PSPFX)

Even though commodity prices are in a slump right now, I’m grateful for quite a few things. I’m thankful for our five-factor model, which is designed to identify only the best-of-the-best stocks—I’m looking forward to using it when commodities recover. We’ve weathered this storm well, and I believe we’re in a good position to catch the upswing. Two very recent events have boded well for the fund: the Baker Hughes takeout and China’s rate cut, which will help stabilize commodity demand and improve market sentiment.

Commodities Update

Crude Oil

Last Thursday, the Organization of the Petroleum Exporting Countries (OPEC) unveiled its decision to keep oil production levels where they’ve been for the last three years, “in the interest of restoring market equilibrium.” Soon after this announcement, Brent and West Texas Intermediate (WTI) crude prices dropped to $72 and $68 per barrel, their lowest levels since May 2010. WTI plunged to a five-year intraday low of $63.

Another significant consequence of OPEC’s inaction is that the Russian ruble immediately fell to an all-time low of 49.90 versus the dollar. Since half of Russia’s budget revenue comes from oil and gas exports, OPEC’s decision to maintain current production levels is likely to hobble the country’s already fragile economy even further. We’ve been out of Russia since August, and this economic activity justifies our decision.

Precious Metals

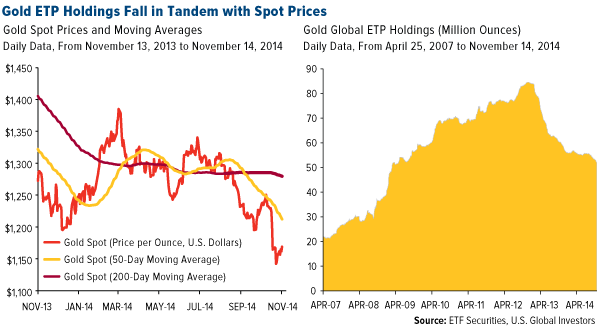

As expected, Switzerland voted against having its central bank hold more bullion, resulting in a 2-percent decline. Leading support to falling prices is the Reserve Bank of India’s announcement last Thursday that it was lifting gold import curbs ahead of the country’s wedding season.

At the same time that spot prices are dropping, more money is being pulled out of gold exchange-traded products (ETPs), suggesting that the market believes this decline to be long-term.

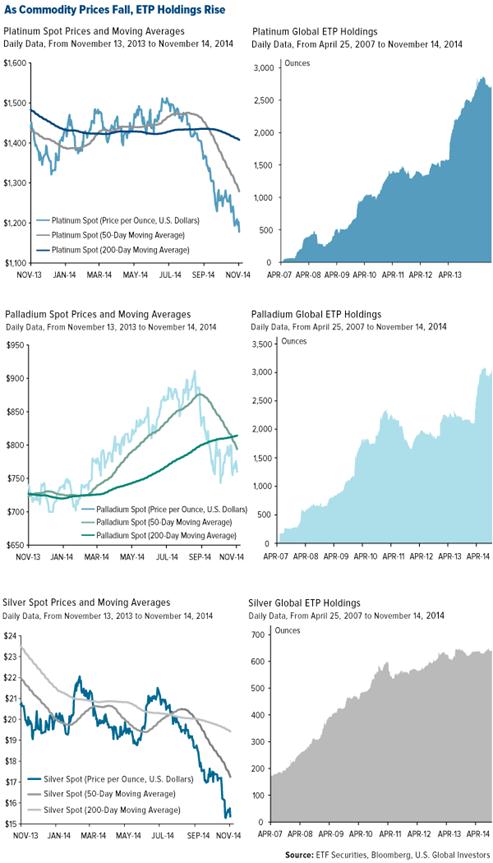

We’re seeing the opposite behavior when it comes to platinum, palladium and silver. Even as prices dip, more money is being placed into ETPs.

Although gold has many industrial applications, it’s seen more as currency. With the dollar still very strong, investors might be choosing to keep their wealth in cash instead.

The other metals, on the other hand, have well-known industrial uses—platinum and palladium in automobile production and silver in film, surgical instruments and solar panels. Some investors might be willing to risk short-term losses for long-term gain.

I wish to conclude by giving thanks to our loyal Investor Alert readers as well as investors. Visit us on Facebook or Twitter and let us know what you’re thankful for this season!

Please consider carefully a fund’s investment objectives, risks, charges and expenses. For this and other important information, obtain a fund prospectus by visiting www.usfunds.com or by calling 1-800-US-FUNDS (1-800-873-8637). Read it carefully before investing. Distributed by U.S. Global Brokerage, Inc.

Past performance does not guarantee future results.

5 Stars: Overall/164

5 Stars: 3-Year/164

5 Stars: 5-Years/137

4 Stars: 10-Years/103

Morningstar ratings based on risk-adjusted return and number of funds

Category: Municipal National Short-Term Funds

Through: 10/31/2014

Total Annualized Returns as of 9/30/2014

Bond funds are subject to interest-rate risk; their value declines as interest rates rise. Though the Near-Term Tax Free Fund seeks minimal fluctuations in share price, it is subject to the risk that the credit quality of a portfolio holding could decline, as well as risk related to changes in the economic conditions of a state, region or issuer. These risks could cause the fund’s share price to decline. Tax-exempt income is federal income tax free. A portion of this income may be subject to state and local taxes and at times the alternative minimum tax. The Near-Term Tax Free Fund may invest up to 20% of its assets in securities that pay taxable interest. Income or fund distributions attributable to capital gains are usually subject to both state and federal income taxes.

Foreign and emerging market investing involves special risks such as currency fluctuation and less public disclosure, as well as economic and political risk. By investing in a specific geographic region, a regional fund’s returns and share price may be more volatile than those of a less concentrated portfolio.

Gold, precious metals, and precious minerals funds may be susceptible to adverse economic, political or regulatory developments due to concentrating in a single theme. The prices of gold, precious metals, and precious minerals are subject to substantial price fluctuations over short periods of time and may be affected by unpredicted international monetary and political policies. We suggest investing no more than 5% to 10% of your portfolio in these sectors.

Because the Global Resources Fund concentrates its investments in specific industries, the fund may be subject to greater risks and fluctuations than a portfolio representing a broader range of industries.

Fund portfolios are actively managed, and holdings may change daily. Holdings are reported as of the most recent quarter-end. Holdings in the funds mentioned as a percentage of net assets as of 9/30/2014: Baker Hughes, Inc. 0.00%; Calpian 0.00%; Facebook 0.00%; Google 0.00%; Klondex Mines 7.76% in Gold and Precious Metals Fund, 7.51% in World Precious Minerals Fund, 1.22% in Global Resources Fund; Newmont Mining Corp 1.11% in Gold and Precious Metals Fund, 0.26% in World Precious Minerals Fund; Twitter 0.00%.

Morningstar Ratings are based on risk-adjusted return. The Morningstar Rating for a fund is derived from a weighted-average of the performance figures associated with its three-, five- and ten-year (if applicable) Morningstar Rating metrics. Past performance does not guarantee future results. For each fund with at least a three-year history, Morningstar calculates a Morningstar Ratingä based on a Morningstar Risk-Adjusted Return measure that accounts for variation in a fund’s monthly performance (including the effects of sales charges, loads, and redemption fees), placing more emphasis on downward variations and rewarding consistent performance. The top 10% of funds in each category receive 5 stars, the next 22.5% receive 4 stars, the next 35% receive 3 stars, the next 22.5% receive 2 stars and the bottom 10% receive 1 star. (Each share class is counted as a fraction of one fund within this scale and rated separately, which may cause slight variations in the distribution percentages.)

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor. By clicking the link(s) above, you will be directed to a third-party website(s). U.S. Global Investors does not endorse all information supplied by this/these website(s) and is not responsible for its/their content.

Frank Holmes is the CEO and Chief Investment Officer of

Frank Holmes is the CEO and Chief Investment Officer of