Gold Above $1,800 An Ounce

Strengths

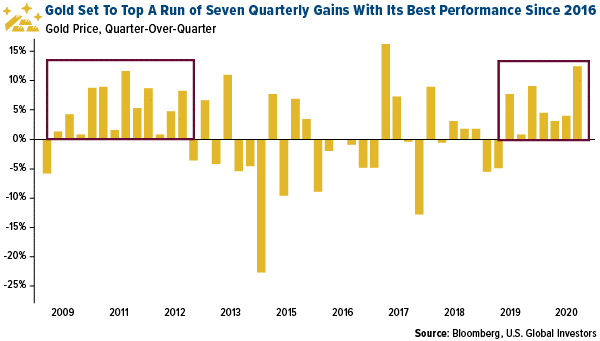

- The best performing precious metal for the week was palladium, up 1.49 percent after falling for previous three weeks. Gold futures rose above $1,800 an ounce for the first time since 2012 on June 30 and ended the second quarter with its best in four years. Bullion also had its longest streak of weekly gains since January, with the week ended June 26 being its third straight. Bank of America head of commodities and derivatives research Francisco Blanch raised his 18-month price target for gold to $3,000 an ounce.

- President Nicolas Maduro’s Bank of Venezuela sued the Bank of England earlier this year to try and retrieve $1 billion worth of gold held in its vaults. This week a London judge sided with opposition leader Juan Guaido, saying that he should be recognized as the country’s interim president, and blocked the attempt to access the gold. Venezuela is in a state of crisis and desperately needs funds to help its economy and people but remains in a battle between Maduro and Guaido. The blocking of gold will prevent Maduro from potentially misusing it.

- According to the World Platinum Investment Council, sales of platinum bars and cars surged to record highs in the first quarter of this year. Purchases totaled 312koz – an annualized rate five times higher than that in any other year in the last 40 years. “It is widely understood that this increased demand came from savvy industrial and manufacturing buyers – including jewelry fabricators – exercising a value-led response and taking the opportunity to increase stock levels.” Kitco News notes that platinum prices are still lagging compared to gold.

Weaknesses

- The worst performing precious metal for the week was gold, up 0.23 percent. After rising early in the week, gold retreated on Friday after better-than-expected jobs data. The Bureau of Labor Statistics said that 4.8 million jobs were created in the U.S. in June, above expectations of 3 million. Unemployment fell to 11.1 percent, down sharply from the April high of 14.7 percent, reports Kitco News. Gold also retreated on Thursday after news broke of a new experimental vaccine for the coronavirus.

- Palladium had a fourth monthly loss in June, the longest streak since 2015, as car sales plummet due to the economic impact of COVID-19. This is in stark contrast to palladium soaring almost 50 percent in 2019 due to stricter environmental standards boosting demand for car catalysts.

- The Perth Mint said its sales of gold products declined 30 percent in June from a month earlier. Gold coin and minted bar sales fell to 44,371 ounces last month, down from 63,393 in May. However, silver coin sales surged to 1,573,752 ounces, up from 997,171 in May.

Opportunities

- According to Moody’s Investors Service, gold producers are expected to bounce back quickly from COVID-19 related setbacks. Due to higher gold prices and lower operating costs, miners could see greater margins. Moody’s expects second-quarter production to come in lower, but that levels will normalize in the second half of the year. Low fuel and energy process could reduce operating costs by 3 to 5 percent.

- Anglo American Plc is making a big green shift. The mining giant is advancing plans to convert its fleet of more than 400 diesel-fueled mine trucks to hydrogen power, reports Bloomberg. A pilot project will start next year at Anglo American Platinum’s open-fit Mogalakwena operation in South Africa where a 3.5-megawatt electrolyzer will produce hydrogen on site.

- Norilsk Nickel was already the world’s top palladium miner, but due to the pandemic it has grown market share even more. Norilsk’s Russian operations have barely missed a beat, while its main rivals in South Africa had to close operations for weeks due to a nationwide lockdown, reports Bloomberg. The miner has so far maintained its 2020 palladium output guidance, despite the pandemic and lower metal prices.

Threats

- Kirkland Lake Gold was sued on Monday in U.S. federal court for allegedly defrauding shareholders about its business plans before its $3 billion purchases of Detour Gold Corp caused its stock to fall, reports Kitco News. A shareholder accused the Canadian miner of making false statements about its all-in sustaining costs and reserve grade.

- Commerce Department data released Thursday shows that the U.S. trade deficit increased 9.7 percent to $54.6 billion. The pandemic has pushed exports to their lowest since 2009 and has strengthened expectations that the economy will contract in the second quarter at its steepest pace since the Great Depression.

- The economic recovery appears further in the distance as COVID-19 cases surge in America. New virus cases rose by nearly 50,000 on Wednesday alone – lead by populous states such as California, Florida and Texas. With the holiday weekend, there’s a risk of even more infections if residents do not adhere to social distancing and protection measures. San Francisco Fed President Mary Daly said on Wednesday that in her best-case scenario unemployment will still be above 10 percent at the end of this year and it could take four to five years to get to a pre-pandemic level.

********

Frank Holmes is the CEO and Chief Investment Officer of

Frank Holmes is the CEO and Chief Investment Officer of