Gold And Stock Market: Investor Tactics Now

With India’s titanic physical market now switching from a price discount to a premium, the door is open for the end of gold’s healthy and graceful price reaction.

The daily gold chart.

A beautiful bull wedge pattern has formed.A week ago, I suggested gold would stall at $1480 minor resistance and an ensuing decline would complete a double bottom pattern.

That has occurred, and now it’s time for investors to get ready for some serious upside action.

From both a weekly and daily chart perspective, gold looks magnificent.

On this weekly chart I’ve highlighted my proprietary “traffic light” signals.There have only been five buy signals over the past twenty years!

The compounding effect of following the Graceland traffic light signals has been spectacular, and the market is still on a full green light signal now.

Investors who didn’t take the latest money-making signal should use the current pullback to get in on the action.Momentum players should await the bull wedge upside breakout, and then buy.

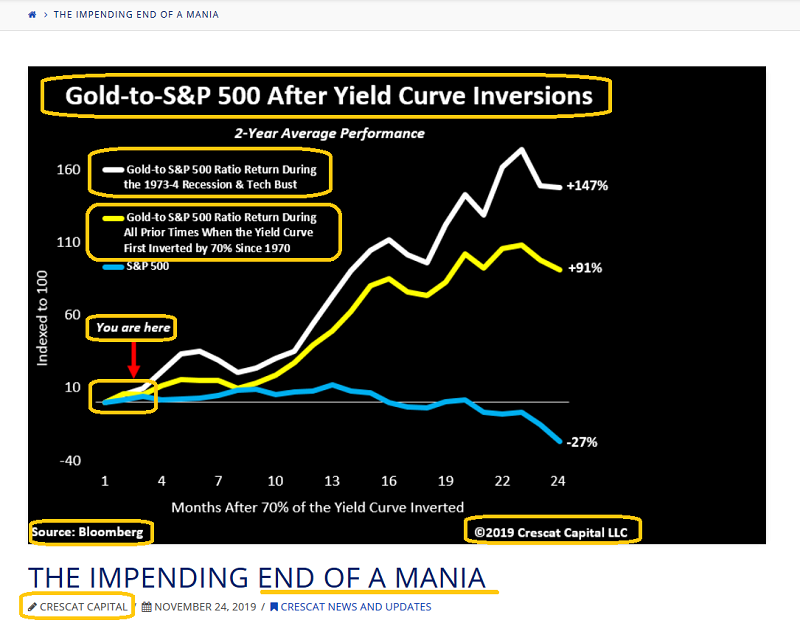

Crescat Capital’s yield inversion analysis is in-depth and should never be ignored.

I’ve suggested America is at a time much like the late 1960s, when stagflation began to emerge and the performance of gold left stock market investors in the dust.Crescat’s detailed yield curve analysis suggests something very similar to my scenario is happening right now.

Most of my new subscribers have been in the stock market for many years.They now want to diversify their holdings with gold.That’s a very wise move!

The swing trade stock market chart.

For all practical intents and investing purposes, it’s only US government propaganda and the Fed that keeps the hydrogen flowing into the stock market balloon.Earnings are sinking.GDP growth looks like a wet noodle, languishing in the sub 1% zone.

As noted by the elite Crescat team, it’s only a matter of time before the stock market comes tumbling down.My strategy is to own some core positions based on my weekly chart signals, but to increase focus on my https://guswinger.com swing trade signals.

That’s because it’s only a matter of time before stagflationary embers become a fire.The stock market hydrogen balloon could explode in a horrific way as that happens.

The bottom line is that only short-term traders will be able to get out with large profits intact before the next major meltdown takes all the profits away.

The US T-bond chart.

The gold and T-bond charts are both bullish. A breakout from the drifting rectangle seems likely to occur at almost the same time as gold bursts out of its bull wedge pattern.

Most Western governments can’t afford to let rates rise or their Ponzi scheme of borrowing ever-more money to enlarge their size and influence come to a fiery finish.

Central banks claim they want more inflation, but they really don’t.They are the enablers and promoters of deflation with their extreme low rate and QE policy, and they are doing it so the governments can keep expanding.

If the Fed, BOJ, and ECB really wanted inflation they would be buying enormous amounts of gold instead of buying T-bonds and the stock market.

The reality is that central banks are concerned that significant inflation is going to emerge, and then governments will act like dictators; the governments could pass “emergency” legislation to keep rates low.That would unleash enormous monetary inflation and create a gold-buying frenzy.

That’s coming, but as noted, America is probably only at a point like 1966 in the process (if the 1970s are used as an example).A “big parabola” like occurred in 1979 is a long way off, but the good news is that gold is likely going hundreds of percent higher over the coming decade, even before the parabolic fun begins.

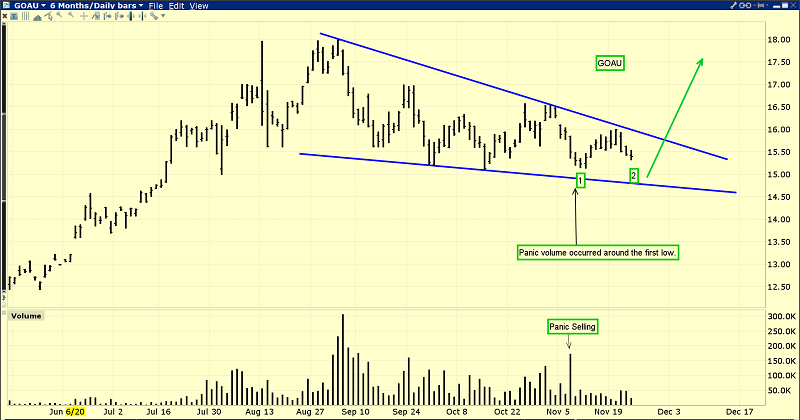

The bullish GOAU chart.As with gold, there’s a double bottom in play within the bull wedge.Stoploss enthusiasts can use the 14.90 area to place stops and limit risk.From both a time and price perspective, it’s a decent entry point for investors.It’s time for buy-side action, and I’m doing that this morning for myself and for the money I manage!

Special Offer For Gold-Eagle Readers: Please send me an Email to [email protected] and I’ll send you my free “Build My Own Gold Stocks ETF!” report. I highlight seven great stocks taken various precious metals ETFs that investors can buy in their brokerage accounts. Eager gold bugs can use these stocks to make a serious run at outperforming all the ETFs! I provide key entry and exit tactics for each stock.

Note: We are privacy oriented. We accept cheques, credit card, and if needed, PayPal.

Written between 4am-7am. 5-6 issues per week. Emailed at aprox 9am daily.

Email:

Rate Sheet (us funds):

Lifetime: $999

2yr: $299 (over 500 issues)

1yr: $199 (over 250 issues)

6 mths: $129 (over 125 issues)

To pay by credit card/paypal, please click this link:

https://gracelandupdates.com/subscribe-pp/

To pay by cheque, make cheque payable to “Stewart Thomson”

Mail to:

Stewart Thomson / 1276 Lakeview Drive / Oakville, Ontario L6H 2M8 Canada

Stewart Thomson is a retired Merrill Lynch broker. Stewart writes the Graceland Updates daily between 4am-7am. They are sent out around 8am-9am. The newsletter is attractively priced and the format is a unique numbered point form. Giving clarity of each point and saving valuable reading time.

Risks, Disclaimers, Legal

Stewart Thomson is no longer an investment advisor. The information provided by Stewart and Graceland Updates is for general information purposes only. Before taking any action on any investment, it is imperative that you consult with multiple properly licensed, experienced and qualified investment advisors and get numerous opinions before taking any action. Your minimum risk on any investment in the world is: 100% loss of all your money. You may be taking or preparing to take leveraged positions in investments and not know it, exposing yourself to unlimited risks. This is highly concerning if you are an investor in any derivatives products. There is an approx $700 trillion OTC Derivatives Iceberg with a tiny portion written off officially. The bottom line:

Are You Prepared?

********

Stewart Thomson is president of Graceland Investment Management (Cayman) Ltd. Stewart was a very good English literature student, which helped him develop a unique way of communicating his investment ideas. He developed the “PGEN”, which is a unique capital allocation program. It is designed to allow investors of any size to mimic the action of the banks. Stewart owns GU Trader, which is a unique gold futures/ETF trading service, which closes out all trades by 5pm each day. High net worth individuals around the world follow Stewart on a daily basis. Website:

Stewart Thomson is president of Graceland Investment Management (Cayman) Ltd. Stewart was a very good English literature student, which helped him develop a unique way of communicating his investment ideas. He developed the “PGEN”, which is a unique capital allocation program. It is designed to allow investors of any size to mimic the action of the banks. Stewart owns GU Trader, which is a unique gold futures/ETF trading service, which closes out all trades by 5pm each day. High net worth individuals around the world follow Stewart on a daily basis. Website: