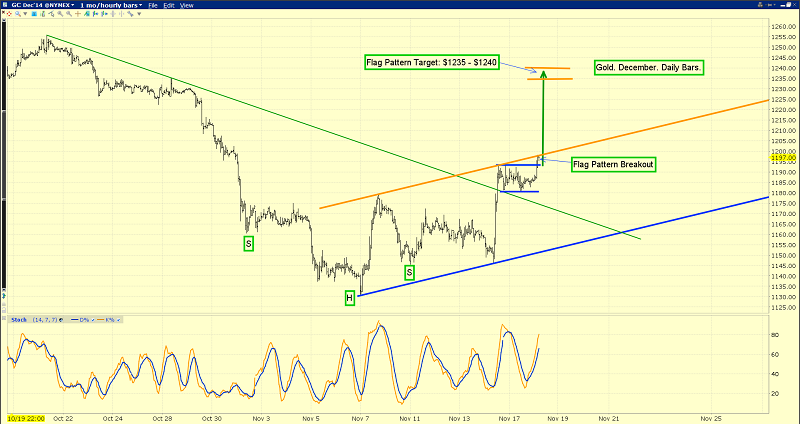

Gold: Bull Flag In Play

Gold staged a nice upside breakout from a bullish flag pattern just hours ago.

After rising from an inverse head and shoulders bottom pattern, gold promptly formed a bull flag. The target of this pattern is the $1235 - $1240 price zone.

That’s also an hourly bars chart, with the uptrend channel highlighted. A rise above $1200 could usher in a lot of momentum-oriented buying, creating a near-vertical surge to the $1235 -$1240 price zone.

In my professional opinion, gold demand in India for Diwali has been the main price driver of this rally, and that demand has overwhelmed speculators carrying short positions on the COMEX.

Tremendous corruption exists in the Indian government, and the bullion banks that have traditionally controlled most gold imports, are not happy with the recent decision of the Indian central bank to allow non-bank entities to compete with them.

The profits made by the bullion banks have shrunk from $100 - $200 an ounce to just $10 - $20 an ounce. As a result, the banks and the Indian finance ministry are putting tremendous pressure on the Indian central bank to restore the bullion bank imports cartel.

‘India is likely to announce measures to curb gold imports as early as Tuesday, a senior finance ministry source said…. "We are working on it. The measures to slow gold imports are almost ready and may be announced today or tomorrow," said the source, who declined to be named because of the sensitivity of the matter.’ –Reuters News, November 18, 2014.

A new round of restrictions appears to be imminent. That will empower the mafia and the bullion banks, but it’s unlikely to change the total amount of gold being imported into India.

Even if India has to take a step or two backwards temporarily, an important policy maker at the European Central Bank has just suggested that the ECB could begin a gold buying program. This is fabulous news for the Western gold community.

“The Board of Governors has unanimously advocated, where appropriate, to take further unconventional measures to counteract a lengthy period to lower inflation. Theoretically, this also includes the purchase of government bonds or other assets such as gold, shares, Exchange Traded Funds (ETF) etc.” –Yves Mersch, ECB Executive board member, in a speech posted on the ECB website yesterday. To view the entire speech, using the Google translator, please click here now.

Mersch speaks forcefully, about the need to raise the European inflation rate.

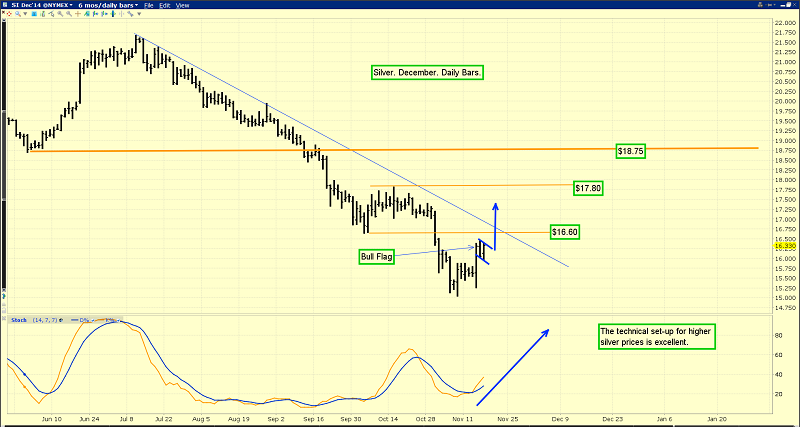

My Indian jeweller contacts believe gold and silver can rally for several more weeks before suffering a significant sell-off. That’s the daily silver chart, and it looks ready to rally.

There’s also a potential flag pattern in play on that chart. A breakout from the flag pattern appears to be imminent. That could help ignite a period of outperformance by silver against gold!

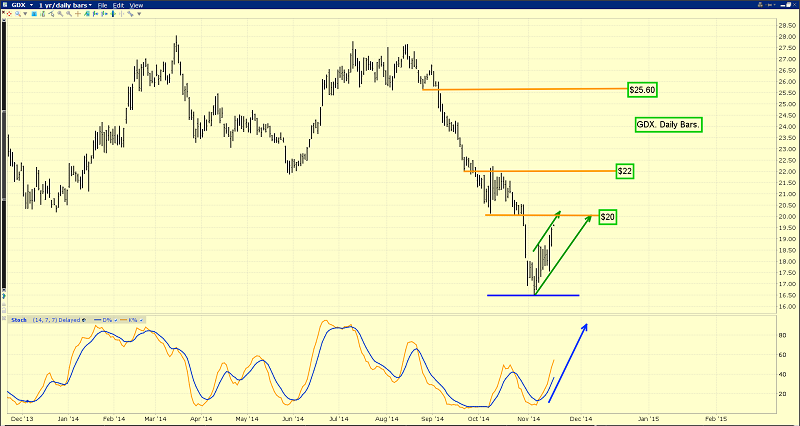

When gold and silver stage a tradable rally, the mining stocks tend to do very well. This GDX daily chart suggests that gold stocks are poised to rally to $20, $22, and perhaps to $25.60, before any kind of shorting or selling opportunity presents itself.

I think the $25.60 price target is realistic and achievable. That’s the GDX weekly chart, and it looks superb.

Note the action of the 14,3,3 Stochastics oscillator. GDX can easily rally ten dollars on a crossover buy signal, and it seems poised to do so right now.

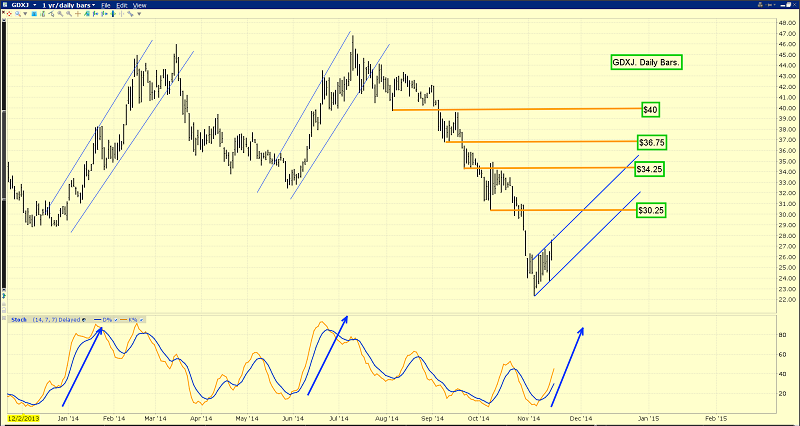

That’s the GDXJ daily chart. Junior gold stocks tend to outperform the seniors during a serious rally, just as silver tends to outperform gold, during a serious precious metals price rally.

If GDX can rise to $25.60, and I think it can, then GDXJ should rise to $40.

A lot of amateur investors have been caught off guard by this precious metals rally. There are a number of reasons for that, and an overly-simplistic view of the relationship between the Japanese yen and gold is one reason for their failure.

Many of them were carrying large short positions in gold. Carrying a small tactical short position is the action of a professional investor. In contrast, wildly shorting the world’s ultimate asset with large amounts of leverage is very dangerous.

Most fans of the yen-gold relationship thought that when the US dollar surged against the yen, it would surge against gold, but the opposite has now occurred; gold is surging against the dollar!

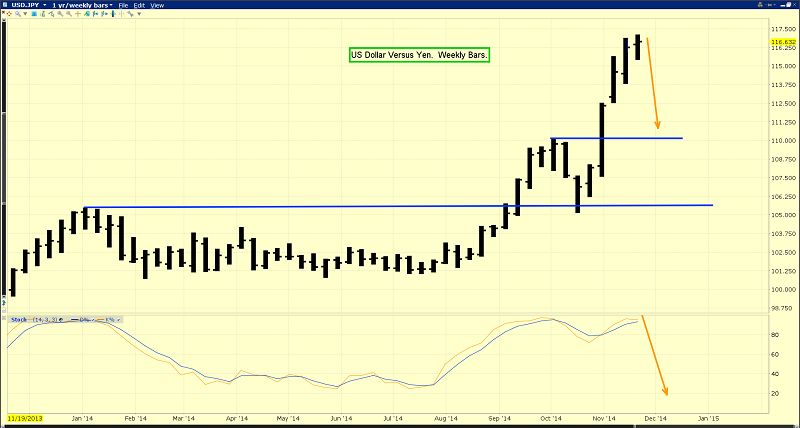

That’s the weekly chart of the US dollar versus the Japanese yen. The dollar’s upside progress is fading. The Stochastics oscillator looks ready to move sharply lower. If gold can move aggressively higher while the yen is collapsing, as it is now, one can only imagine the potential “super surge” in the gold price, if the yen begins to rally.

I think that situation is going to occur very soon. I also would not be too quick to count out the head of the Indian central bank, Raghuram Rajan. He is a master tactician and strategist, and turned the 80-20 import rule against the bullion banks, by adjusting the fine print of the rule. In India, home of the most powerful gold demand in the world, oil prices have fallen, the rupee is stable, inflation is moderating quickly, GDP is growing, and the current account deficit is now a tiny part of GDP. Yet, incredibly, the government and the bullion banks still seem obsessed with claiming that buying gold is a cause of financial weakness. This makes them look corrupt and ridiculous.

Gold is in a tremendously strong position right now. The weekly charts are very bullish, and flag patterns are in play on the shorter term charts. Fundamentally, India is a force to be reckoned with for decades to come, and the Swiss referendum and the potential for the ECB to become a gold buyer is growing. Almost all the lights are green, for gold!

********

Special Offer For Gold-Eagle Readers: Please send me an Email to [email protected] and I’ll send you my free “Natural Gas Price Explosion!” report. Prices are skyrocketing as cold weather hammers the East coast of America. I’ll show you how I’m playing this key asset, to manage risk and gain reward!

Note: We are privacy oriented. We accept cheques. And credit cards thru PayPal only on our website. For your protection. We don’t see your credit card information. Only PayPal does. They pay us. Minus their fee. PayPal is a highly reputable company. Owned by Ebay. With about 160 million accounts worldwide.

Email: [email protected]

Rate Sheet (us funds):

Lifetime: $799

2yr: $269 (over 500 issues)

1yr: $169 (over 250 issues)

6 mths: $99 (over 125 issues)

To pay by cheque, make cheque payable to “Stewart Thomson”

Mail to: Stewart Thomson / 1276 Lakeview Drive / Oakville, Ontario L6H 2M8 Canada

Stewart Thomson is a retired Merrill Lynch broker. Stewart writes the Graceland Updates daily between 4am-7am. They are sent out around 8am-9am. The newsletter is attractively priced and the format is a unique numbered point form. Giving clarity of each point and saving valuable reading time.

Risks, Disclaimers, Legal

Stewart Thomson is no longer an investment advisor. The information provided by Stewart and Graceland Updates is for general information purposes only. Before taking any action on any investment, it is imperative that you consult with multiple properly licensed, experienced and qualified investment advisors and get numerous opinions before taking any action. Your minimum risk on any investment in the world is: 100% loss of all your money. You may be taking or preparing to take leveraged positions in investments and not know it, exposing yourself to unlimited risks. This is highly concerning if you are an investor in any derivatives products. There is an approximate $700 trillion OTC Derivatives Iceberg with a tiny portion written off officially. The bottom line: Are You Prepared?

Stewart Thomson is president of Graceland Investment Management (Cayman) Ltd. Stewart was a very good English literature student, which helped him develop a unique way of communicating his investment ideas. He developed the “PGEN”, which is a unique capital allocation program. It is designed to allow investors of any size to mimic the action of the banks. Stewart owns GU Trader, which is a unique gold futures/ETF trading service, which closes out all trades by 5pm each day. High net worth individuals around the world follow Stewart on a daily basis. Website:

Stewart Thomson is president of Graceland Investment Management (Cayman) Ltd. Stewart was a very good English literature student, which helped him develop a unique way of communicating his investment ideas. He developed the “PGEN”, which is a unique capital allocation program. It is designed to allow investors of any size to mimic the action of the banks. Stewart owns GU Trader, which is a unique gold futures/ETF trading service, which closes out all trades by 5pm each day. High net worth individuals around the world follow Stewart on a daily basis. Website: