Gold Downturn: Why Strong Fundamentals Are Not Everything

So much money printed. Excessive debt. Even pandemic! And gold failed to hold gains. But that’s how markets work, no matter what gold permabulls say.

Gold plunged yesterday, just as it was likely to. The fake reason? U.S. retail sales exceeded expectations. The real reason? A major downtrend.

On the above gold chart, I added annotations that show what happened in the previous 3 cases after the retail sales reports. We saw the following:

- gold declined after retail sales disappointed in June

- gold topped after retail sales outperformed in July

- gold paused its rally after retail sales disappointed in August

- gold declined after retail sales outperformed in September

What should one make of that?

Nothing.

There is no clear link (and perhaps no link whatsoever) between U.S. retail sales and the price of gold. If gold had declined based only on great retail sales, then it surely should have soared based on disappointing retails sales in June, right? It plunged then.

For many weeks, months, and years, I’ve been writing that markets don’t need a trigger to move in a certain way. Getting one could speed things up, but the markets might eventually rally or decline on just about any piece of news, provided that they really “want to”. By markets “wanting” to move in a given way, I mean the fact that markets move in trends and cycles, and even if a given market has a very favorable fundamental situation for the long run, it doesn’t mean that it won’t slide in the short or medium term. That’s how markets work, and that’s been the case for decades, regardless of what gold permabulls might tell you.

Let’s face it, the monetary authorities around the world are printing ridiculous amounts of money, stagflation is likely next, and gold is extremely likely to soar based on that in the following years, just like what we saw in the 1970s.

But.

This is already the case – lots of money has been already printed, and the world has been suffering from the pandemic for well over a year. Gold should be soaring in this environment! Silver should be soaring! Gold stocks should be soaring too!

And what’s the reality?

Gold failed to hold its gains above its 2011 highs. Can you imagine that? So much money printed. Excessive debts. Even pandemic! And gold still failed to hold gains above its 2011 highs. If this doesn’t make you question the validity of the bullish narrative in the medium term in the precious metals sector, consider this:

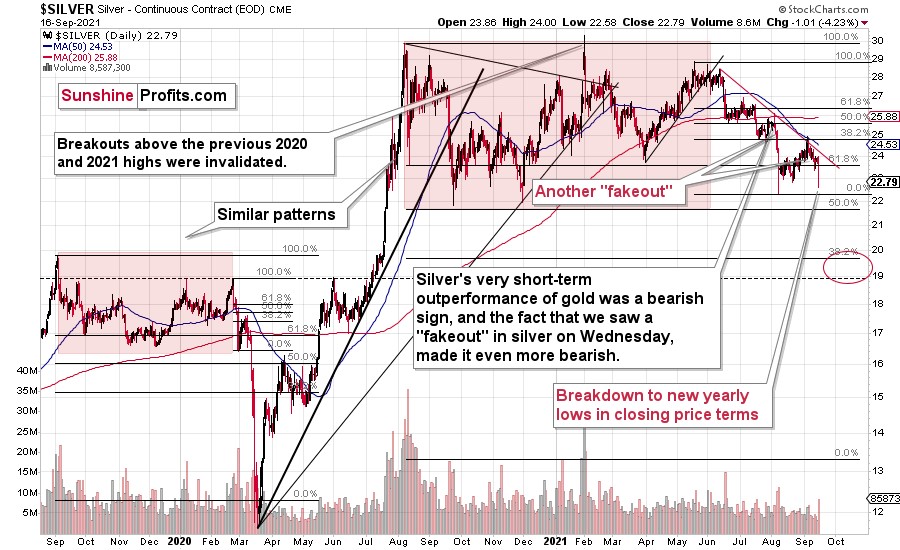

Silver – with an even better fundamental situation than gold – wasn’t even close to its 2011 highs (~50). The closest it got to this level was a brief rally above $30. And now, after even more money was printed, silver is in its low 20s.

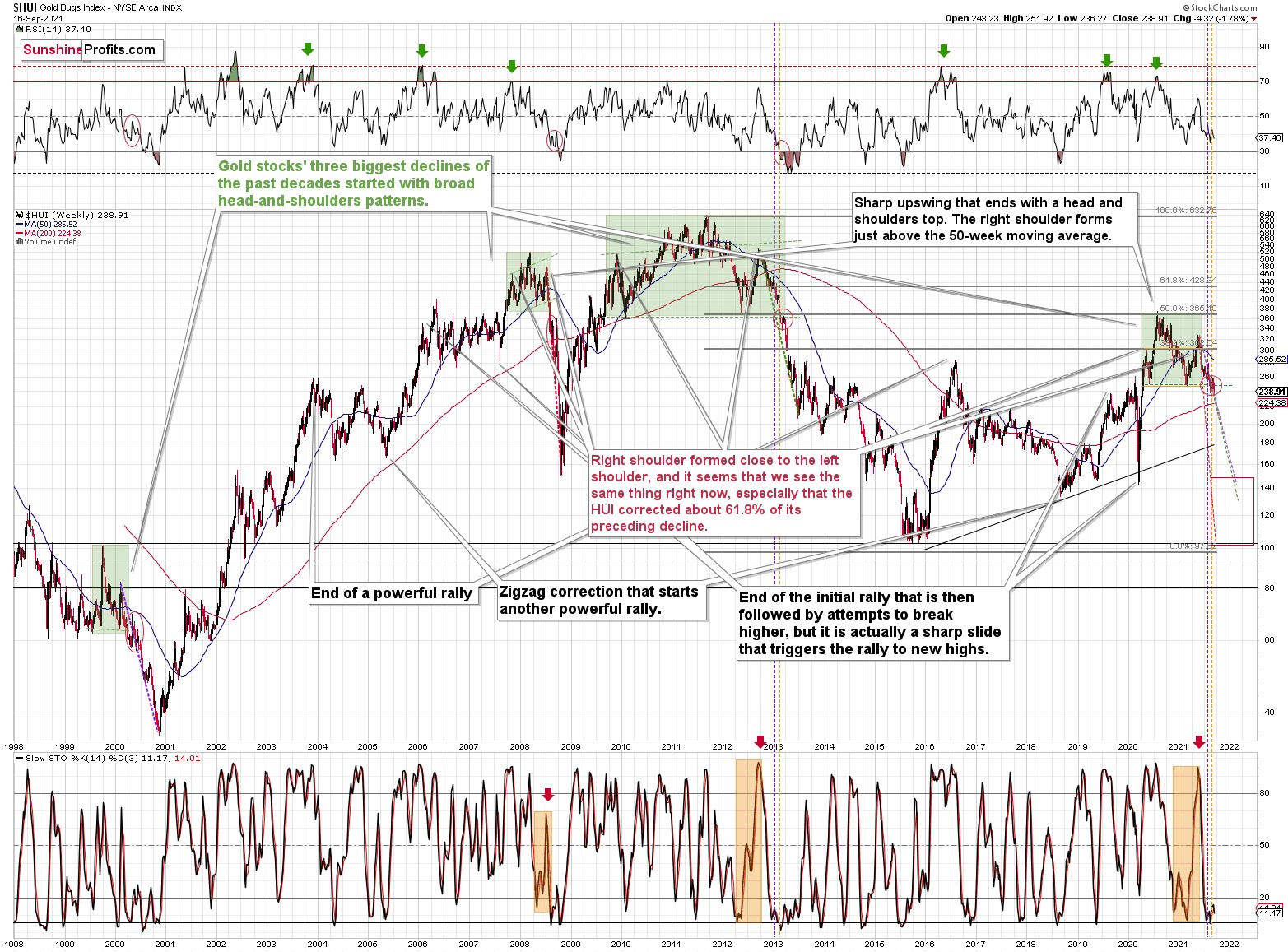

And gold stocks? Gold stocks are not above their 2011 highs, they were not even close. They were not above their 2008 highs either. In fact, the HUI Index – the flagship proxy for gold stocks – is trading below its 2003 high! And that’s in nominal prices. In real prices, it’s even lower. Just imagine how weak the precious metals sector is if the part of the sector that is supposed to rally first (that’s what we usually see at the beginning of major rallies) is underperforming in such a ridiculous manner.

And that’s just the beginning of the decline in the mining stocks.

More to Come!

The breakdown below the broad head and shoulders pattern (marked with green) was verified. The previous three similar patterns (also marked with green) were followed by huge declines, and I copied the moves to the current situation (marked with dashed lines). This simple analogy tells us that the HUI Index could slide to the 100 – 150 range, meaning that it could even decline to its early 2016 low.

Can it really happen? With the precious metals market as weak as it is right now (from the medium-term point of view, not the long-term one) — of course.

On a short-term note, please take a look at what silver just did.

It broke to new 2021 lows in terms of the closing prices. Indeed, back in August, silver’s intraday low was lower, but it didn’t close as low. That’s a major confirmation of the bearish price forecast for silver.

Thank you for reading our free analysis today. Please note that the above is just a small fraction of today’s all-encompassing Gold & Silver Trading Alert. The latter includes multiple premium details such as the targets for gold and mining stocks that could be reached in the next few weeks. If you’d like to read those premium details, we have good news for you. As soon as you sign up for our free gold newsletter, you’ll get a free 7-day no-obligation trial access to our premium Gold & Silver Trading Alerts. It’s really free – sign up today.

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Sunshine Profits: Effective Investment through Diligence & Care

* * * * *

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be subject to change without notice. Opinions and analyses are based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are deemed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

********

Przemyslaw Radomski,

Przemyslaw Radomski,