Gold Forecast: Cycles Pushing Higher Into November

Recap of Last Week

Recap of Last Week

Last week's action saw the Gold market forming its low for the week in Monday's session, here doing so with the tag of the 1760.30 figure. From there, a sharp rally was seen into later in the week, with the metal running all the way up to a Friday peak of 1815.50 - before backing off the same into the weekly close.

Gold's 4-8 Week Picture

As mentioned in my prior article, the overall cyclic picture had turned back to the upside, with the mid-term waves now projected higher into the month of November:

From last weekend: "due to momentum considerations, the action seen into last week now favors the upward phase of the 72 and 154-day cycles to be back in force. In terms of patterns, the last 72-day trough had to have formed a 'higher-low' - against the August bottom. The fact that this 72-day cycle formed a higher-low on its most recent correction tends to favor the 1836.90 swing top (i.e., the last peak for this component) to eventually be taken out on its current upward phase."

As noted, the combination of the 72 and 154-day cycles had confirmed a turn higher, with that action favoring additional strength in the coming weeks - ideally into the mid-to-late November timeframe. Here again is our smaller 72-day wave:

Short-Term Action a Direct Hit

From last weekend: "with the larger 72 and 154-day cycles now favored to be pointing higher into November or later, the probabilities tend to favor the current smaller-degree correction to end up as a countertrend affair, holding above the 1721.10 swing low. Support to the same looks to be into the 1740-1760 area, thus making this range a key level to watch in the coming days."

As mentioned above, due to the position of the larger 72 and 154-day cycles, the odds favored the most recent correction phase with the short-term cycles to end up as countertrend, with support noted at or into the 1740-1760 region for Gold. Last Monday's decline took the metal right down to the 1760.30 figure - a direct hit - with the metal bottoming there, before turning back to make higher highs into Friday.

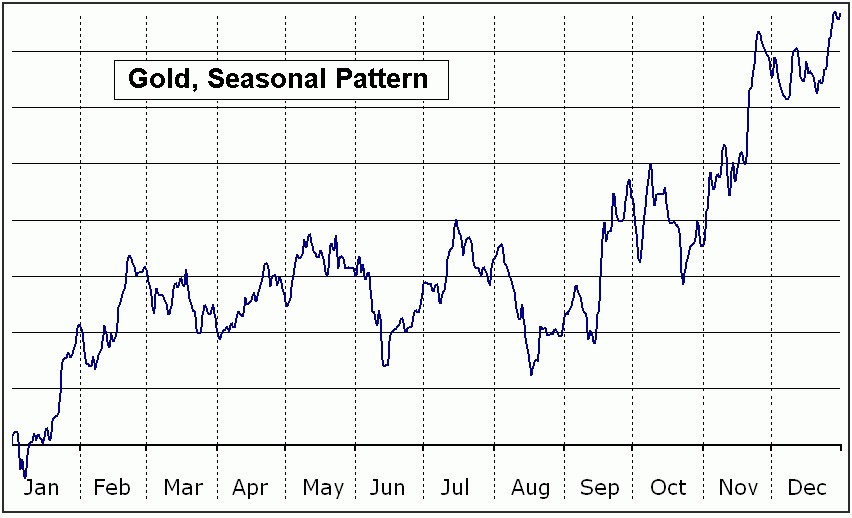

For the near-term view, the ideal path is looking for additional strength then in the coming weeks (i.e., mid-to-late November), before setting up another swing top with the 72-day cycle, which would then be looking for a decent correction into mid-to-late December, which is also a 'mid-point' seasonal bottoming window - within the larger bullish seasonal period for Gold, which lasts into early next year:

In terms of price, with the last correction phase of the 72-day cycle component forming the pattern of a 'higher-low', the probabilities tend to favor a push back above the 1836.90 swing top in the days/weeks ahead, before looking for the next peak with this particular (72-day) wave.

For the bigger picture, however, the current upward phase with the 72-day cycle is favored to end up as a countertrend affair, holding below the June peak of 1923.40. From there, as mentioned, another decline is likely to play out into December - a move which may or may not end up as countertrend to the 1721.80 figure, the prior low for this component. More on that as we continue to move forward.

Jim Curry

The Gold Wave Trader

http://goldwavetrader.com/

http://cyclewave.homestead.com/

********