Gold Forecast: Fed Pause Lifts Gold Above $2000, Bullish Breakout?

Gold Miners (GDX) may be forming a head and shoulder bottom.

The FOMC left rates unchanged - the stock market is rebounding.

If the Fed is done hiking, gold may be heading to a November breakout.

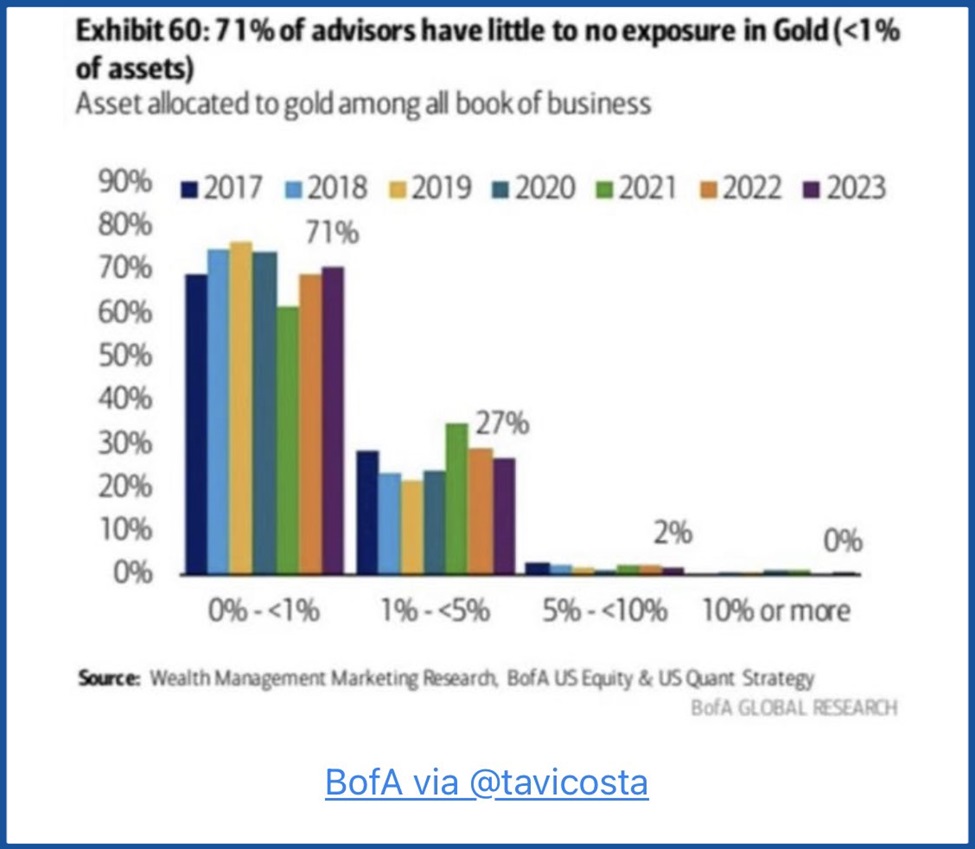

Gold Allocation

Over the last several years, 71% of financial advisors had less than a1% exposure to gold.

I think most advisors recommend between 5% and 10%, correct me if I’m wrong - only 2% are balanced that way.

source: https://twitter.com/VogtAlexander_/status/1719234075968381100/photo/1

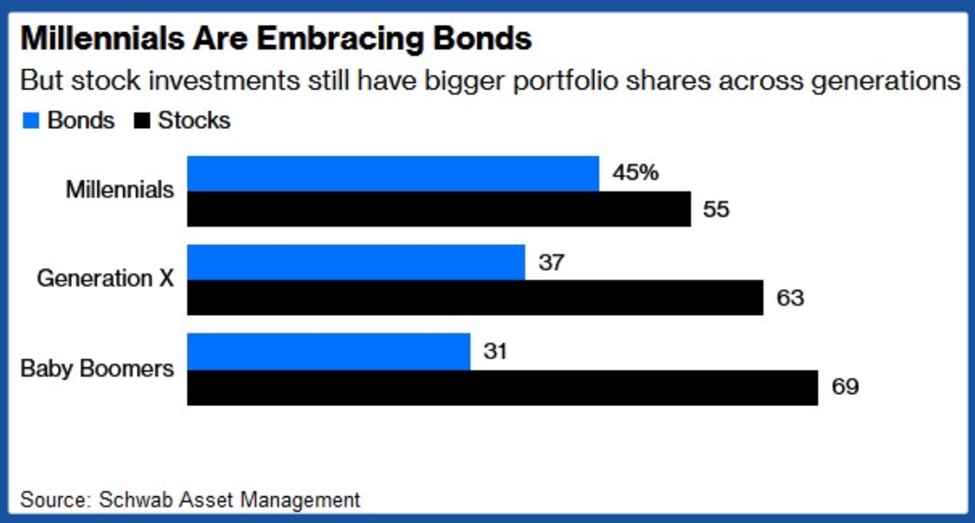

Stock vs. Bonds

The traditional 60/40 portfolio broken down amongst age groups is far from what I expected. According to Schwab, Boomers hold the least amount of bonds with just a 31% weighting. To my surprise, Millennials hold the most. With bond prices in a 3-year bear market and fixed income yielding 5%, I wonder when investors will panic and reallocate.

source: https://twitter.com/jessefelder/status/1719726228792553683/photo/1

Precious Metals Commentary

- I see a potential head and shoulder bottom in miners that could trigger an explosive rally.

- A November breakout is a significant possibility.

GOLD- Gold continues to consolidate just below $2000. A daily close above $2040 in the first half of November would signal a breakout and potential attack on $2090. To the downside, closing below $1960 would sponsor a retest of the October breakout.

SILVER- Silver is consolidating below the 200-day MA. A daily close above $24.00 would signal a breakout. Downside support at $22.00.

PLATINUM- Prices are above the trendline and must close above $950 to promote an attack on $1000. On the downside, platinum must hold $900 to stay constructive.

GDX- Miners are setting up a near repeat of last year's head and shoulder bottom. Note that in 2022, the final low came in the first week of November, followed by an explosive breakout. A close above $30.00 in the coming days would confirm a breakout.

GDXJ- Juniors need progressive closes above the trendline to confirm a breakout.

SILJ- Silver juniors must break decisively above the trendline to support a breakout.

S&P 500- Stocks gapped higher over speculation the Fed is done hiking. Closing below today's 4237 gap would signal a bearish reversal. If this is more than a bounce, I'd need to see progressive closes above the October 4393 high. Otherwise, I think there are too many headwinds for a sustained advance.

BTCUSD- Bitcoin filled the breakdown gap from last year near $36,000. What happens next is crucial. A continued advance above $40,000 would legitimize the recent breakout. Whereas a reversal lower that closes below $31,000 would establish a bull trap and renewed decline.

Conclusion

The October low washout sentiment and gold could reach new highs by year-end. I think we’ll know by mid-November if metals and miners are breaking out.

Click here à to read our article on $10,000 gold and $300 silver.

AG Thorson is a registered CMT and an expert in technical analysis. For regular updates, please visit www.GoldPredict.com.

********