Gold Price Forecast – The Reversal From Gold's New High

While the gold hype is impossible to miss as its steep rise brought it above the 2011 all-time highs, how sustainable is it exactly? And what about its short-term prospects?

That's what we'll examine in today's article.

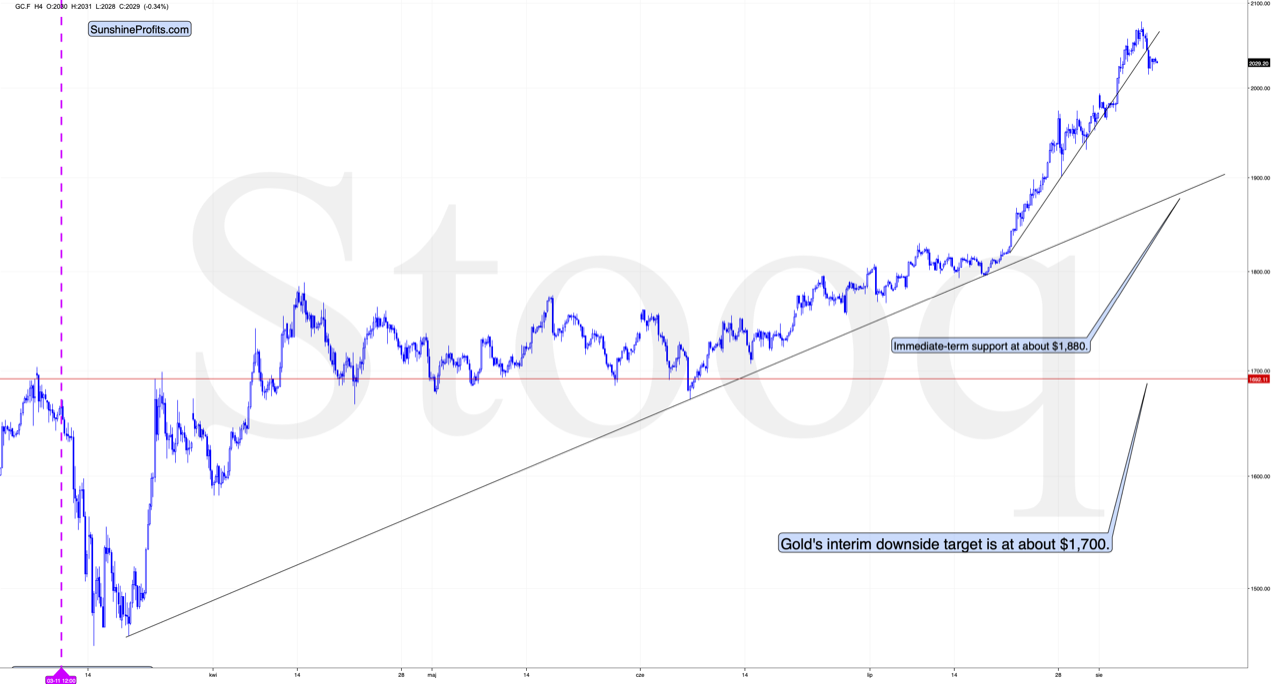

From the short-term point of view, we see that gold finally moved below its rising short-term support line and then it paused a bit. At this time, we can’t rule out another temporary upswing close to the previous highs, where gold could verify the breakdown by moving once again to the rising line that was broken.

Based on the likely double-bottom in the USD Index, it seems that a smaller rally is more likely – similar to the one that we saw in early March shortly after the top and also right before the plunge. Please note that we saw something similar – a small upswing – also after the April top.

The interim downside target is the rising support line, which is at about $1,880 right now, but before gold reaches it, it’s likely to be closer to $1,900.

The next support is at $1,700, which is where – approximately – gold topped and bottomed multiple times earlier this year.

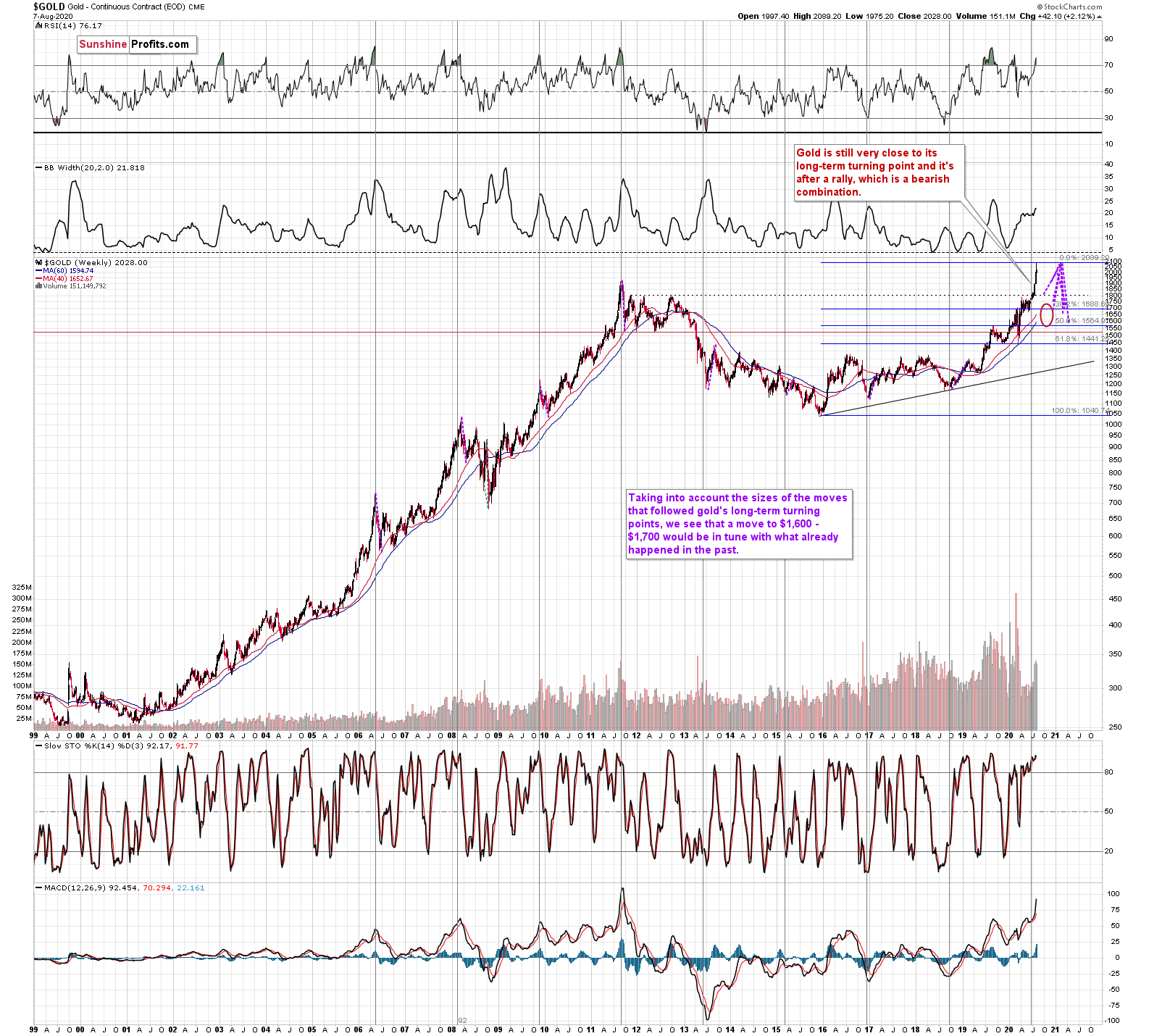

The $1,700 level is additionally confirmed by the 61.8% Fibonaci Retracement based on the entire 2015 – 2020 rally.

There’s also possibility that gold would decline to the $1,500 - $1,600 area or so (50% Fibonacci retracement and the price level to which gold declined initially in 2011), but based on the size of the recent upswing, we no longer think that this scenario is the most likely one.

Gold’s very long-term turning point is here and since the most recent move has definitely been to the upside, its implications are bearish.

We used the purple lines to mark the previous price moves that followed gold's long-term turning points, and we copied them to the current situation. We copied both the rallies and declines, which is why it seems that some moves would suggest that gold moves back in time - the point is to show how important the turning point is in general.

The big change here is that due to gold’s big rally, we moved our downside target for it higher. Based on the information that we have available right now, it seems likely that gold will bottom close to the $1,700 level. That’s very much in tune with how much gold moved after the previous long-term turning points.

Also, while we’re discussing the long-term charts, please note the most important detail that you can see on the gold, silver, and mining stock charts, is hidden in plain sight. Please note how much silver and miners rallied.

The analogy to the price moves after the previous turning points didn’t change, but since the starting point is much higher, the downside target is also higher.

Speaking of upside targets, last week we wrote the following:

Based on gold's Fibonacci extensions and the previous major highs and lows (the 2018 high and late-2019 low along with the 2020 low), we get a nearby upside target of $2085. At the moment of writing these words, gold is trading at $2044. Given this week's volatility, it could even be a matter of hours before gold reaches the above-mentioned target and reverses. Taking closing prices into account, gold is up by $35, so if it reverses significantly, we would be likely to see a powerful weekly reversal candlestick and one that causes gold to decline in the following weeks.

That’s more or less what happened. Gold didn’t erase the entire weekly gain, but most thereof. Gold topped at $2,089.20.

Summary

Despite all the yellow metal excitement, we better not ignore the extended nature of its advance – it's ripe for a reversal. Just recall Friday's move.

The following days are not likely to be pleasant times for anyone who refuses to jump on the bullish bandwagon just because prices moved higher in the previous months. But what’s profitable is rarely the thing that feels good initially. As silver often moves in close relation to the king of metals, forecasting gold’s rally without a bigger decline first is thus likely to be misleading. The times when gold is lastingly trading well above the $3000 level will likely come, but they are unlikely to be seen without being preceded by a sharp drop first.

Naturally, the above is up-to-date at the moment of publishing and the situation may – and is likely to – change in the future. If you’d like to receive follow-ups to the above analysis, we invite you to sign up to our gold newsletter. You’ll receive our articles for free and if you don’t like them, you can unsubscribe in just a few seconds. Sign up today.

Przemyslaw Radomski, CFA

Editor-in-chief, Gold & Silver Fund Manager

Sunshine Profits - Effective Investments through Diligence and Care

* * * * *

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be subject to change without notice. Opinions and analyses are based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are deemed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Przemyslaw Radomski,

Przemyslaw Radomski,